At the start of a new trading week in Germany, reports from the IFO Institute were published. The indicators came out in the "red zone." The July result was de facto weaker than weak expectations. German business sentiment fell to 88 points against the forecast decline to 90. This is a two-year low: the last time the indicator was at such a low level was two years ago, during the coronavirus crisis.

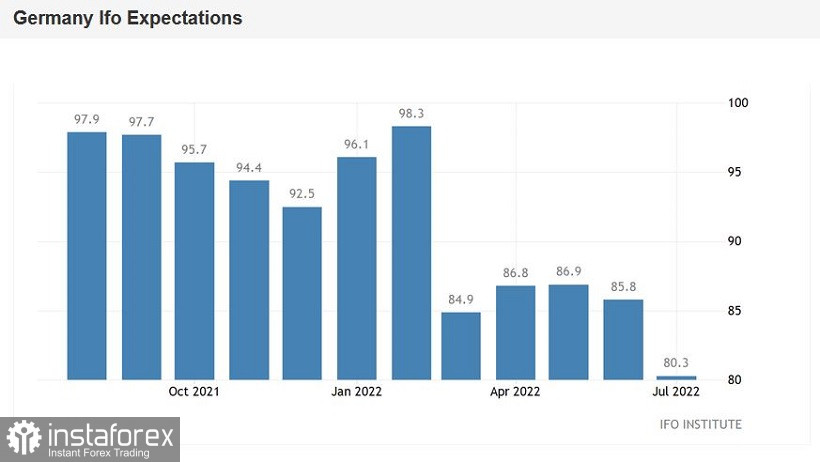

The German indicator of economic expectations was also disappointing, which collapsed to 80 points: this is the weakest result since April 2020. Commenting on the published figures, the institute's economist said that representatives of the surveyed companies expect "a significant deterioration in business activity in the coming months." The IFO also warned that Germany is on the verge of a recession: the rise in the energy prices and gas shortage are putting significant pressure on the country's economy.

German reports from the IFO are consistent with the PMI indices published last Friday. In France and Germany, almost all indicators fell below the key 50-point value. The deterioration of the situation was recorded both in the provision of services and in the production sector. The pan-European PMI indices repeated the trajectory of the French and German indicators, showing negative dynamics.

The euro-dollar pair reacted to today's release with a decline to 1.0180. But the bears failed to develop a downward momentum. The hawkish comments of the ECB representative and Latvian central bank governor Martins Kazaks helped the euro to regain its position, after which the buyers of EUR/USD turned the situation in their favor by organizing a corrective pullback. Kazaks said that the September increase in the interest rate "should be very significant." He clarfied that the European Central Bank may raise the rate by 50 basis points again in early autumn. Such a hawkish signal allowed EUR/USD buyers to neutralize the negative from the data and make up for losses.

In general, the pair continues to trade in the range of 1.0130–1.0270, that is, in fact, within the wide-range flat. For the development of the upward movement, buyers of EUR/USD need to gain a foothold in the area of the third figure. It will be possible to talk about the resumption of the downward trend only after the decline below 1.0100. To date, neither bulls nor bears are at risk of opening large positions, especially on the eve of the July meeting of the Fed. The results of the July meeting will be announced this Wednesday, so the market is actually frozen in anticipation.

The US dollar index continues to slide down rather due to the inertia of Friday trading. Representatives of the Federal Reserve observe a silence regime (a 10-day period before the meeting of the Central Bank). Therefore, the created information vacuum is filled by numerous experts who conduct an absentee discussion regarding the possible outcome of the July meeting. Some analysts (in particular, Nomura Securities International and Citigroup) continue to insist that the option of a 100-point rate hike cannot be ruled out. Arguing their position, they point to a record increase in the consumer price index, which in June exceeded the 9 percent mark (for the first time since February 1982).

However, most experts are still confident that the regulator will increase the interest rate by 75 points in July, having implemented, so to speak, the "baseline" scenario. It is noteworthy that a few weeks ago, Chairman Jerome Powell said that the Fed, in July, will make a choice between increasing rates by 50 or 75 points. At that time, the 75-point option was considered a hawkish scenario. However, after the publication of the latest report on the growth of the US CPI, as well as after the July meeting of the Bank of Canada (which nevertheless decided on a 100-point increase), the market mood has noticeably changed. Therefore, the prevailing market confidence that the Fed will raise rates by 75 points the day after tomorrow does not strengthen the position of the greenback. On the contrary, all doubts about the 100-point scenario are interpreted by traders against the US currency. For this reason, the dollar is under background pressure, and not only paired with the euro.

And yet, in my opinion, it is risky to open trading positions against the greenback today. First of all, because of risk aversion against the backdrop of increased anti-risk sentiment. In particular, the market is discussing the possible consequences of the visit of US House of Representatives Speaker Nancy Pelosi to Taiwan (in August). According to the Financial Times, China's non-public rhetoric has become much tougher around this issue—they even allowed a military response.

Also, today it became known that China has stepped up mass testing for coronavirus in Shanghai and Tianjin. Based on this testing, about 25 million people in Shianghai may again be quarantined. In other words, the current news background does not contribute to the growth of EUR/USD.

Thus, a stalemate has developed for the pair: weak European reports do not allow buyers to form an upward offensive, while growing doubts about the "ultra-hawkish" mood of the Fed members do not allow sellers to seize the initiative. In my opinion, the pair will trade in the range of 1.0130-1.0270, within which it has been trading throughout the past week. Before the announcement of the results of the July meeting of the Fed, traders are unlikely to decide on more active actions. Therefore, at the peak of the upward pullbacks, it is advisable to open short positions with the main targets of 1.0200 and 1.0150.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română