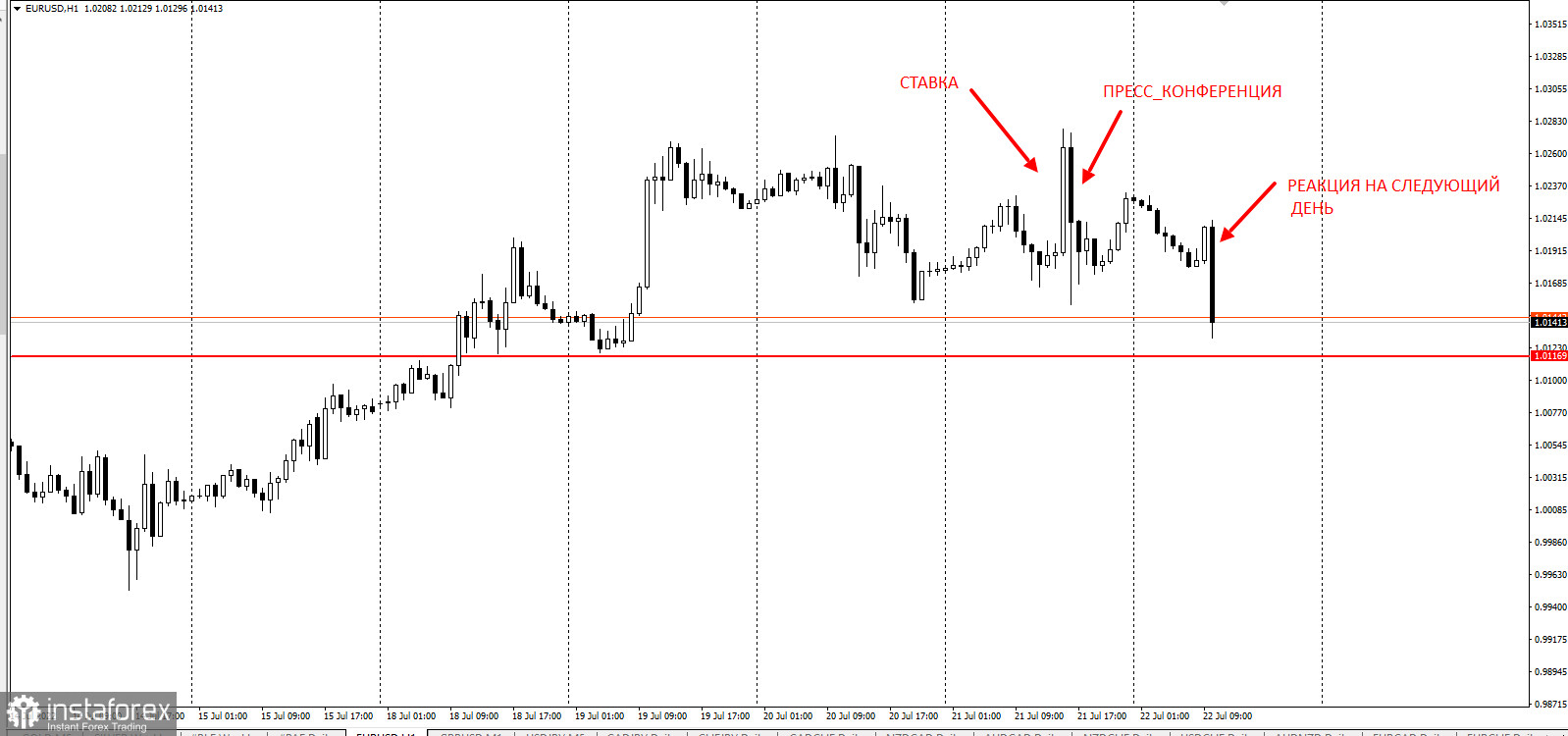

The European Central Bank raised its key interest rate by 50 basis points, the first time in 11 years and the biggest since 2000. It also announced a tool that could prevent uncontrolled expansion of borrowing costs, which happened in 2012, when the very existence of euro was called into question.

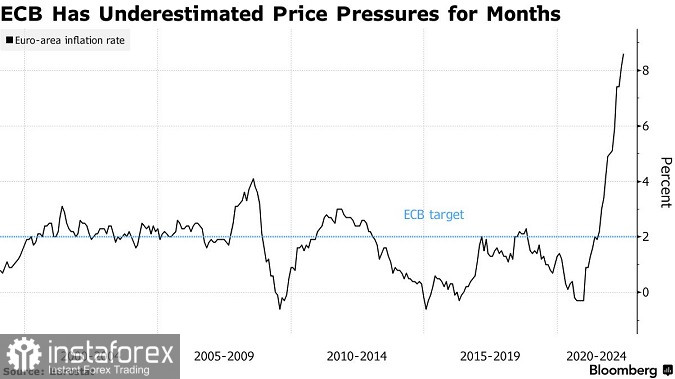

Lagarde said price pressures are spreading across sectors because it is exacerbated by the weaker euro. She added that most core inflation indicators have risen even more, and they expect inflation to remain high for a longer time.

The rate hike aligns the ECB with the global push for tightening, and ends an eight-year experiment with low borrowing costs. The ECB said the normalization of rates would be appropriate in upcoming meetings, prompting traders to increase bets on the pace of tightening. As mentioned above, it also unveiled a new tool that will counteract the erratic market dynamics.

In terms of deposit rates, it was brought to zero, which is twice what was reported just a few days ago.

Now, the ECB is with other 80 banks, including the US Federal Reserve, which have already raised rates this year to fight sky-high inflation.

But it faces more difficult tasks than most because in addition to setting monetary policy for 19 economies, they have to deal with the growing threat of recession.

The ECB last raised rates in 2008 and 2011, but had to resort to this again because economic growth is slowing sharply.

Raising rates show that the Board of Governors is acting on repeated promises to set policy based on incoming economic data. Since the last rate meeting in June, inflation has continued to outperform expectations. Now, it is approaching 10%, and officials have to fight to bring it back to the target in the medium term.

Obviously, banks are moving away from negative rates to boost their profitability. The remaining countries with negative policies are Japan, Switzerland and Denmark.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română