From inflation to recession and back. The markets are stormy, and very much so. Investors rush from one extreme to another, which is reflected in the dynamics of various assets. The only safe bet seems to be the US dollar. If US consumer prices do not slow down, the Fed will continue to tighten monetary policy aggressively. If the global economy faces a recession, the US dollar will win as a safe-haven currency. Is parity in EURUSD inevitable?

Judging by the minutes of the June FOMC meeting, the central bank is so scared of keeping inflation at an elevated level that it is ready to sacrifice the economy to return PCE to the target. Jerome Powell and his team are determined to bring the rate not only to the neutral level, but also to raise it even higher. As a result, borrowing costs were raised by 75 bps in June and are likely to rise by the same amount in July. If the Fed does not show determination, it is unlikely that it will be possible to break the upward trend in inflation expectations.

At the same time, aggressive monetary restrictions also have a downside—recession. Weak statistics in the US reinforce fears about its imminent approach, contributing to a decrease in the yield of treasury bonds, which, it would seem, should weaken the US dollar. In fact, the US data has been pleasing to the eye lately. The number of vacancies decreased slightly, but it turned out to be better than the forecast of Bloomberg experts. It is hard to imagine that with such a strong labor market, the economy is in for a recession.

Dynamics of the number of vacancies in the USA

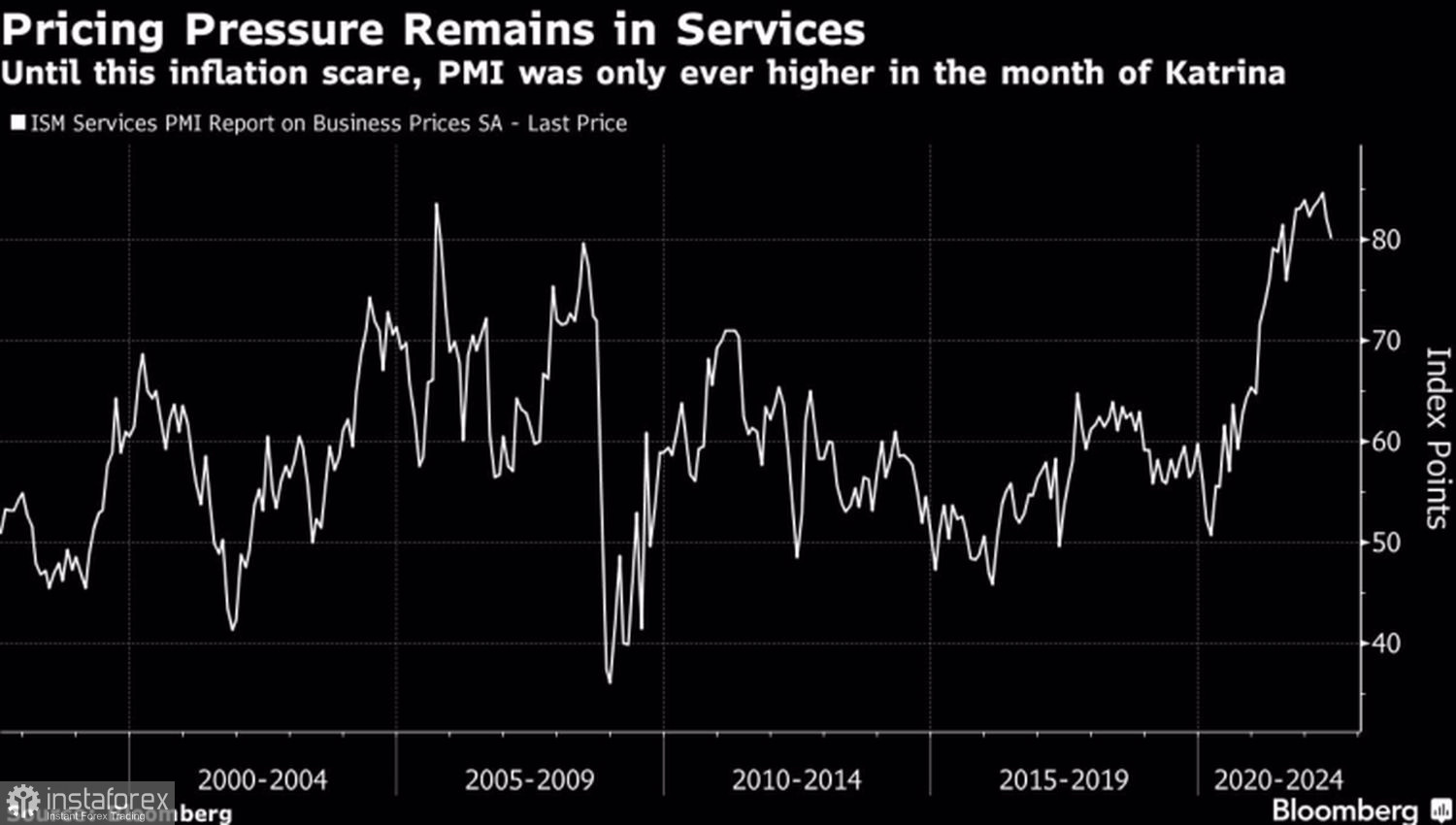

The final value of the purchasing managers' index in the service sector also came out better than expected. An important point: respondents to the ISM survey predict a slowdown in producer prices, which gives hope that the Fed will still be able to achieve a soft landing for US GDP. The recovery of the sector after the pandemic is going well: is it worth worrying about the recession?

Dynamics of prices expected by purchasing managers

Europe is in a much worse state. The next round of the energy crisis is bringing a recession in the eurozone economy, and the political crisis in Britain adds fuel to the fire of sales of most currencies of the euro area. Against this background, the WHO statement that Europe is currently the epicenter of the pandemic looks like something insignificant. According to the organization, the infection rate has increased by 30% in the past two weeks. However, Omicron is considered less dangerous than previous strains, and humanity has learned how to deal with COVID-19. So is it worth remembering?

The positions of the euro look vulnerable, including because of the ECB, which does not yet have a clear plan for how to beat inflation and at the same time prevent fragmentation of the eurozone.

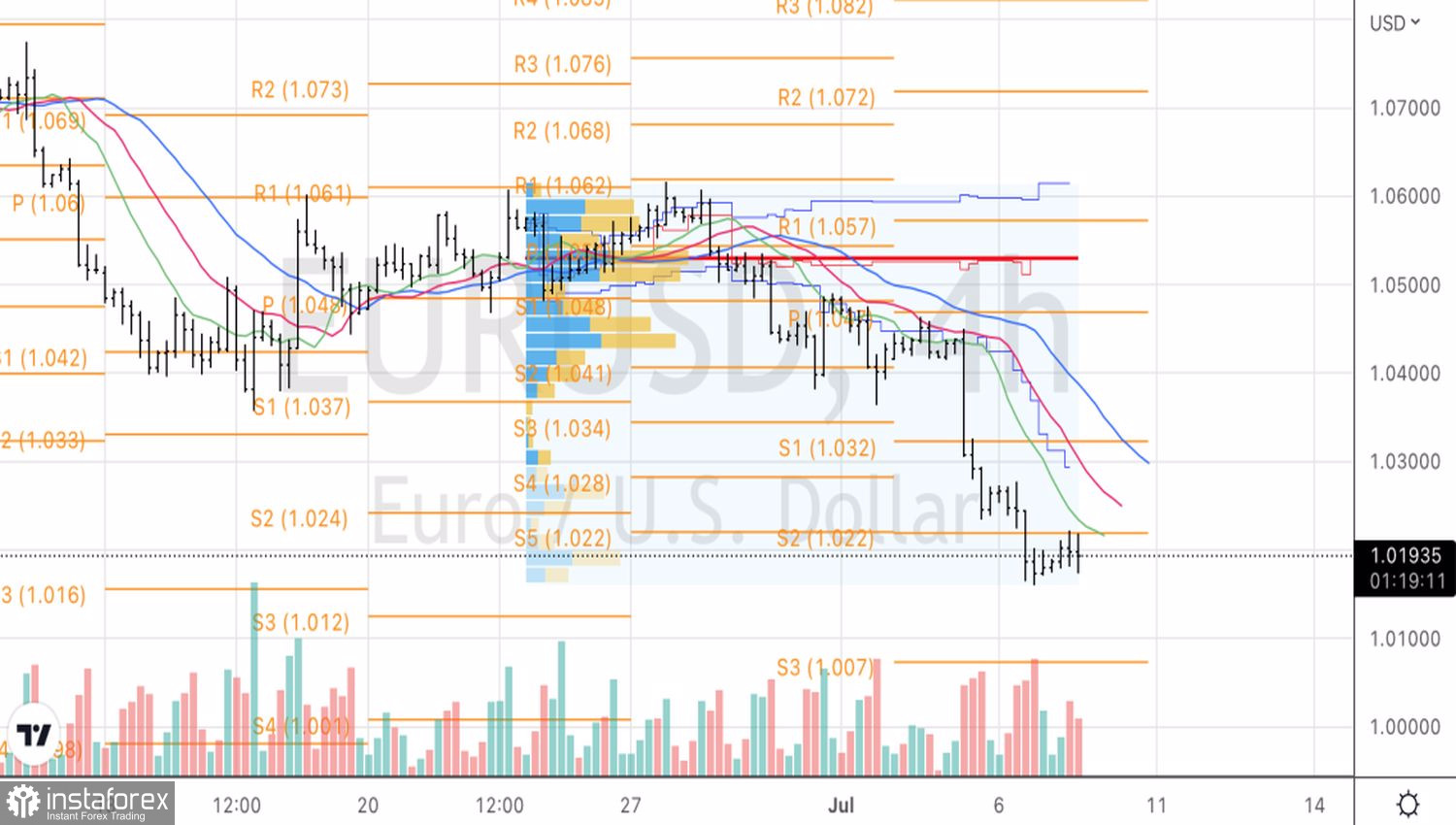

Technically, on the EURUSD 4-hour chart, the inability of the bulls to return above the cluster of pivot points near 1.022 indicates their weakness. This circumstance allows us to recommend selling the main currency pair on a break of support at 1.016.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română