At the start of the new trading week, the EUR/USD pair shows an upward trend, trying to get closer to the boundaries of the 6th figure. This dynamic is explained by the weakening of the greenback (and not the strengthening of the euro): the US dollar index declined to the middle of the 103rd figure, updating the one-and-a-half-week low.

The fundamental picture that is negative for the US currency has developed against the background of rebalancing by large investors of their portfolios at the end of the month and the second quarter. Stock markets are showing a slight increase, while the greenback was under pressure in almost all dollar pairs, including the pair with the euro.

EUR/USD buyers are testing the resistance level of 1.0580 (the average line of the Bollinger Bands indicator on the daily chart), thereby continuing Friday's trends. Last week, traders were unable to develop an upward trend: as soon as the price crossed the boundaries of the 6th figure, sellers became active on the pair, which extinguished the upward impulse. Today we are witnessing another attempt of the upward offensive against the background of a changed fundamental picture.

However, most experts do not expect a significant correction in the markets due to the rebalancing of investment portfolios. Stocks may show a slight increase, the dollar may show temporary weakness. But in the context of the EUR/USD pair, macroeconomic reports will play the role of the first violin. First of all, of an inflationary nature.

In my opinion, the most important macroeconomic release of the week will be published on Thursday, June 30th. On that day, the US Personal Consumption Expenditures (PCE) benchmark price index will be released. As you know, this inflation indicator is monitored by the Fed most carefully, so it can provoke increased volatility for the EUR/USD pair.

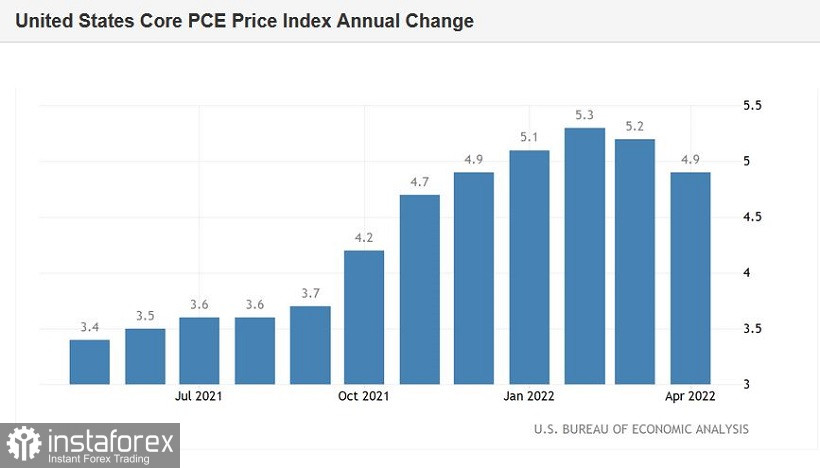

Here it is necessary to dwell on the background of the issue. Recall that in the spring of this year, Fed Chairman Jerome Powell said that US inflation in the second quarter would "gradually level off." At the same time, he noted that the base PCE, in his opinion, "is reaching or has already reached its peak." A similar trend, according to Powell, will be demonstrated by other inflation indicators. Arguing his position, the head of the Fed pointed to the dynamics of the consumer price index and PCE. The CPI at that time really interrupted its consecutive multi-month growth. The April release was interpreted as the first sign of stabilization (or slowdown in growth) of inflation. The same dynamics was demonstrated by the basic PCE, as if confirming Powell's words.

However, the May report on the growth of the consumer price index eloquently refuted the assumptions of the head of the Fed: the US continued to go up, updating more and more new horizons. Note that the general CPI in annual terms jumped to 8.6% (the maximum value of the indicator since February 1982), while the core index rose to 6% with a growth forecast of up to 5.8%. That is, contrary to Powell's expectations, as well as many of his colleagues, inflation in May did not maintain its deceleration trend, but, on the contrary, set a new long-term record. In fact, after this release of the CPI, the regulator decided on a 75-point increase in the rate, while previously only the option of a 50-point increase was discussed.

Now it's the turn of PCE. If the core PCE price index also "raises its head," the dollar could receive significant support. Note that this inflation indicator, like the CPI, has been demonstrating a slowdown in its growth for two months. The March result of 5.3% turned out to be the peak, after which the indicator began to slowly slide down, reaching 4.9% in May. According to the forecasts of most experts, the core PCE will come out at 4.8% in June, confirming the slowdown in growth. If, contrary to experts' forecasts, the indicator shows an upward trend, the greenback can count on significant support.

The growth of PCE will play an important role, especially against the background of Powell's hesitations, who recently announced that at its July meeting, the Fed will decide whether to raise the rate by 50 points or increase it again by 75 basis points.

Among the main macroeconomic reports of this week, we can also highlight the release of data on orders for durable goods (published today), consumer confidence in the US (Tuesday), a report on the growth of German inflation (Wednesday), retail sales data in Germany (Thursday) and eurozone inflation data (Friday). However, the key release of the week is a report on the growth of the price index for personal consumption expenditures in the US.

From a technical point of view, the pair is currently trying to consolidate above the resistance level of 1.0580 (the middle line of the Bollinger Bands indicator on the daily chart) in order to storm the next price line at 1.0600 (the upper line of the Bollinger Bands on the four-hour chart). All previous attempts ended in failure, so longs can be considered only after fixing in the area of the 6th figure. Short positions at the moment look quite risky, given the downward dynamics of the US dollar index.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română