Central banks led by the Fed were convinced for a long time that high inflation was temporary. The ECB was wrong for a long time. The regulator started to talk about the need to raise rates in May. As a result, inflation in the eurozone jumped to an all-time high of 8.1% and the euro plummeted to a 5-year low against the US dollar. Christine Lagarde and her colleagues had to urgently admit their mistakes. However, if they have corrected the situation with the euro rate against the US dollar, it is much more difficult to bring consumer prices under control.

No one argues that the European Central Bank has a much more difficult task than the Fed. Not only is it going to start catching up with inflation later, but it is also in close proximity to the armed conflict zone in Ukraine. In addition, the energy crisis is hitting the eurozone more than the US.

Moreover, it is always easier to manage a single country than a community of different states. For example, France, where CPI is growing at less than 6%, is doing better than Estonia, where consumer prices exceed 20%. We should also add to the significant debts of Italy, Greece, and other countries, and fear that rising rates will increase the cost of servicing them and put a heavy burden on economies. The situation is extremely difficult, and it is interesting for everyone to see how the ECB deals with the problems.

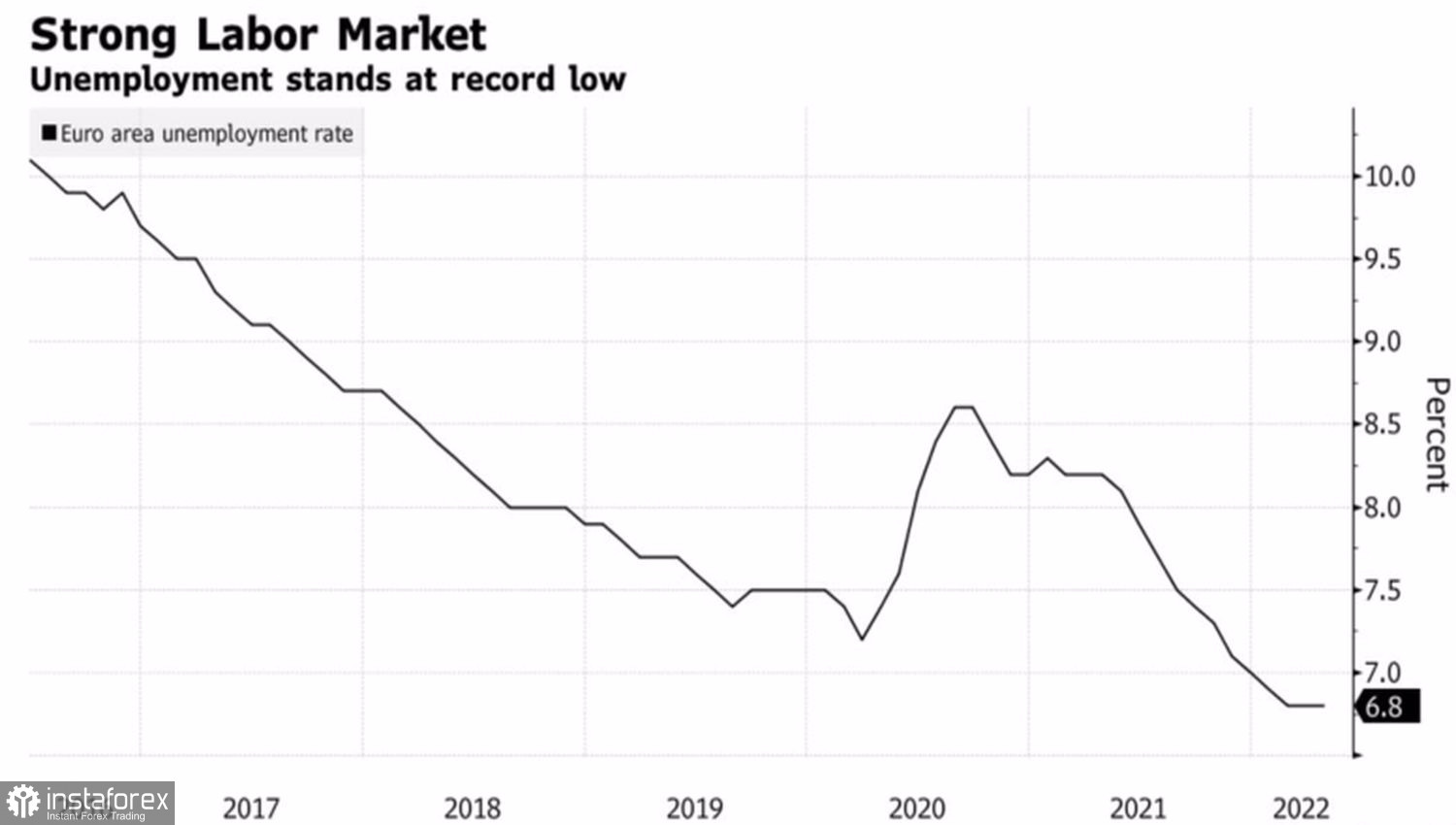

However, despite much talk of stagflation and recession, the European Commission expects eurozone GDP growth of 2.7% in 2022. It is seriously counting on the consumer, who is sitting on sacks of money and has no problems with work. Indeed, the size of the population's excess savings is estimated at €700 billion, and unemployment is at a record low of 6.8%.

Unemployment rate in eurozone

Thus, the ECB should not be afraid that the economy of the EU will not withstand a rate hike. The latest macrostatistics prove its stability, which is showing strong numbers.

Christine Lagarde and her colleagues will do what they are supposed to do at the June 9 meeting: announce a deposit rate hike in July with the prospect of more steps later and the end of QE. If inflation keeps surging, that is definitely good news for the EUR/USD pair but we have to understand that bears are unlikely to act in the same way as they did at the end of May. They are much stronger now. The market has stopped speculating about a pause in the Federal Reserve's tightening of monetary policy, which has boosted bond yields and returned interest in the US dollar.

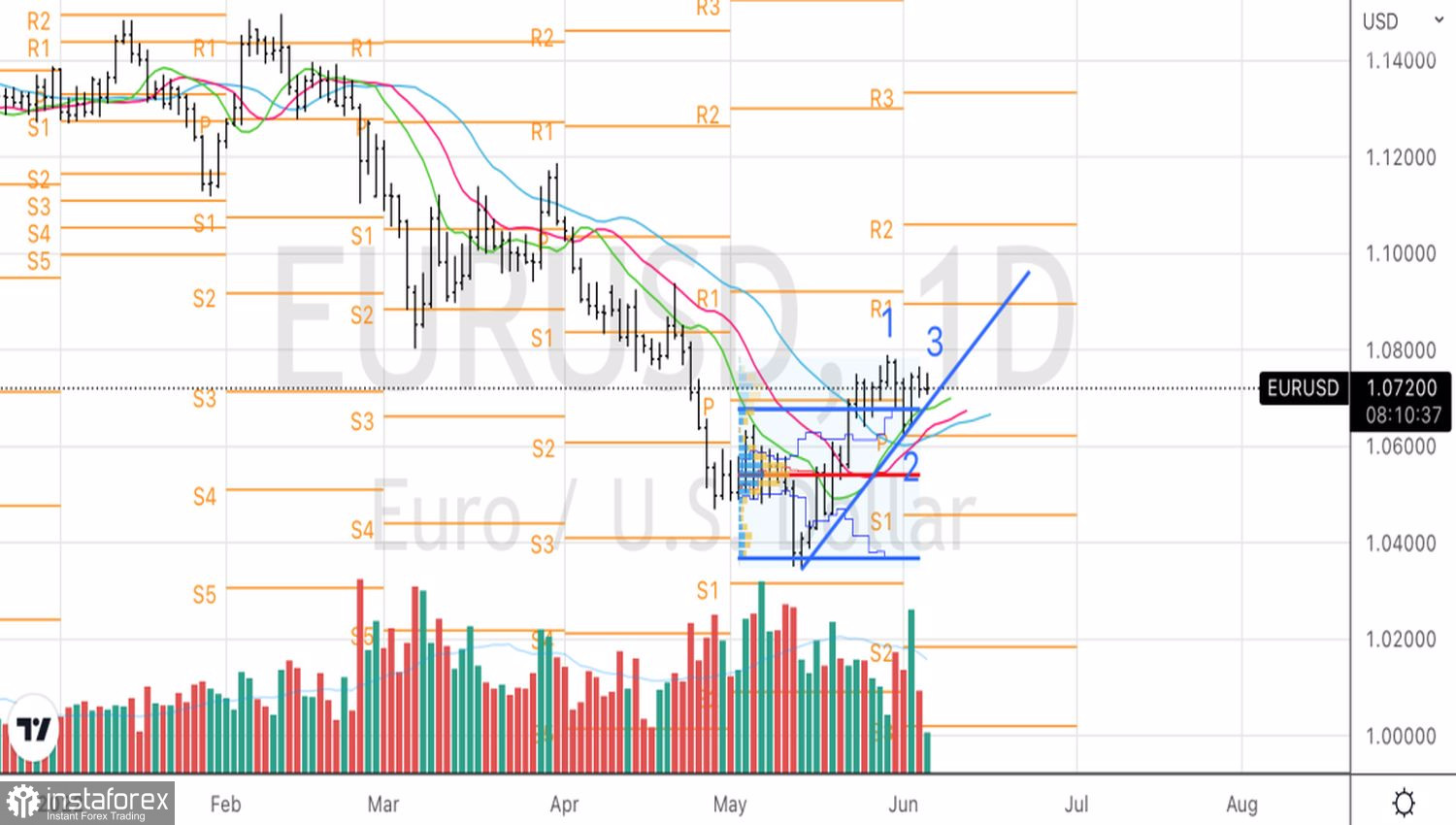

EUR/USD, daily chart

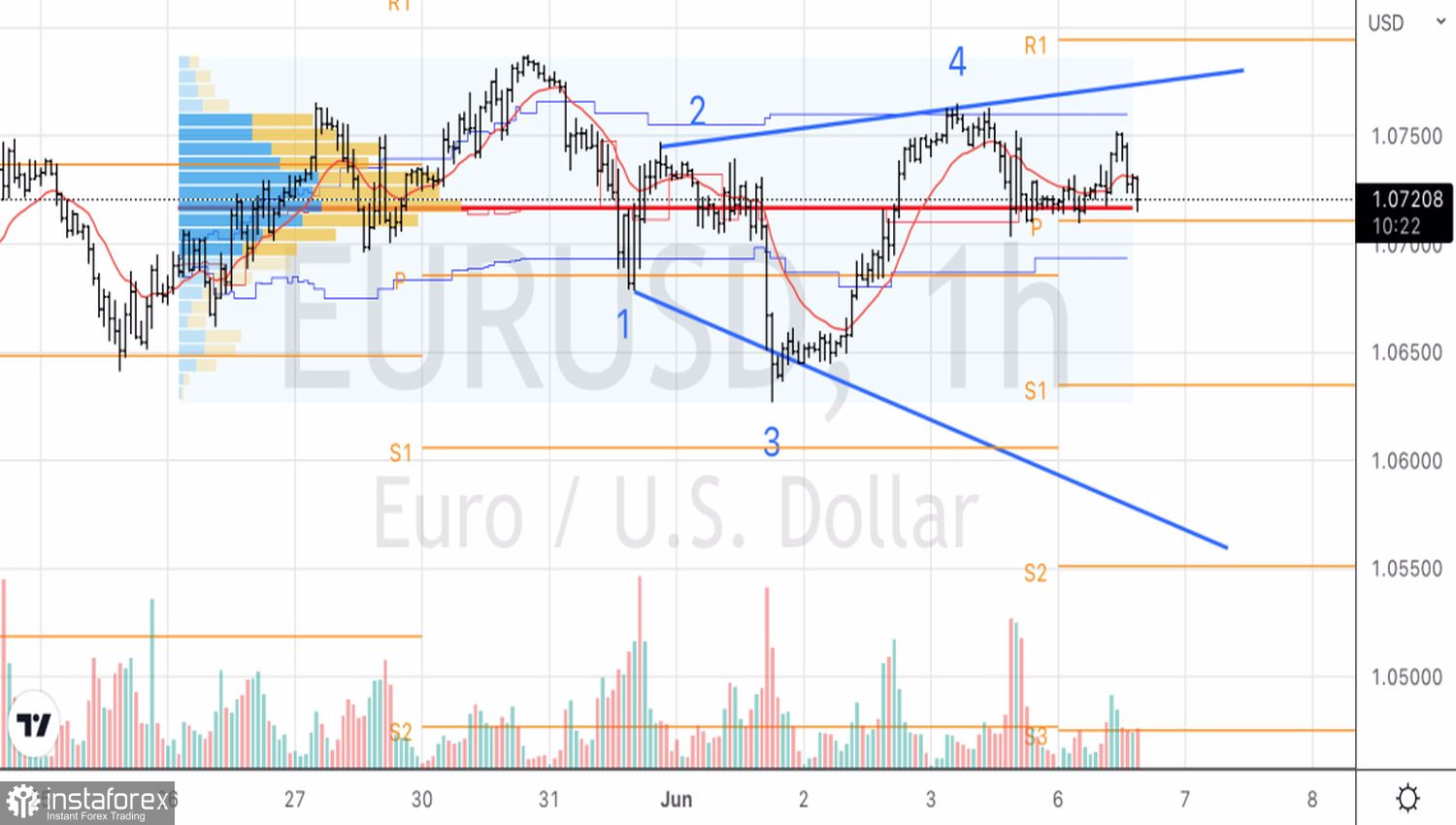

EUR/USD, hourly chart

Technically, a 1-2-3 pattern was formed on the EURUSD daily chart. Falling below the support at 1.07 and the upper boundary of the fair value at 1.068 is a reason to sell the euro. On the hourly time frame, there is a chance of formation of the Expanding Wedge pattern. This requires a successful test of the pivot level at 1.063.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română