The dollar is ready to retreat, as it is well aware that many "bullish" trump cards are already embedded in its course. Another thing is that the euro is too weak to take advantage of a great opportunity for a counterattack. Under such conditions, the market reaction to the results of the May meeting of the Fed promises to be too nervous to rush headlong into the pool and open positions on a breakout. Most likely, we will face a roller coaster – multidirectional movements of EURUSD.

For the first time since 2000, the Fed is ready to raise rates by 50 basis points at once. FOMC officials unanimously claim that they intend to bring it to a neutral level as soon as possible. In fact, a neutral rate is a very vague concept. It was previously assumed that it is at around 2.5%, but given the highest inflation in four decades, it could be higher. In any case, if the central bank adopts market pricing and raises borrowing costs by 50 bp at the next three meetings and by 25 bp for the rest of 2022, the rate will increase to 2.75%.

At the same time, the Fed intends to announce the beginning of a balance sheet reduction of $95 billion a month. All this allows us to talk about the most aggressive monetary restriction since at least 1994. Unfortunately for the EURUSD bears, it is already included in the pair's quotes. Alas, their opponents cannot take full advantage of this.

On the one hand, for the first time since 2015, German 10-year bond yields exceeding 1% mark is good news for the euro. Nevertheless, debt obligations on the periphery are being sold faster. As a result, the rate spread on Italian and German debt, a key indicator of economic and political risks in the eurozone, widens, putting pressure on the EURUSD.

Dynamics of the Italian and German bond yield differential

Indeed, with the EU ready to join the Russian oil embargo, the specter of a recession begins to haunt the continent. Yes, oil from the Russian Federation, which in 2021 accounted for a quarter of the region's imports of this type of energy, can be tried to be replaced, but along with this will come additional costs and logistical difficulties, as a result of which Brent will continue to grow. According to the IMF, without Russian oil and gas, the economy of the currency bloc will miss 3% in 2023. The Bundesbank says that German GDP will shrink by 2% already in 2022.

Thus, the willingness of US dollar buyers to take profits following the FOMC meeting may result in EURUSD growth, however, there are many who want to sell the pair more expensive, which suggests its limited potential.

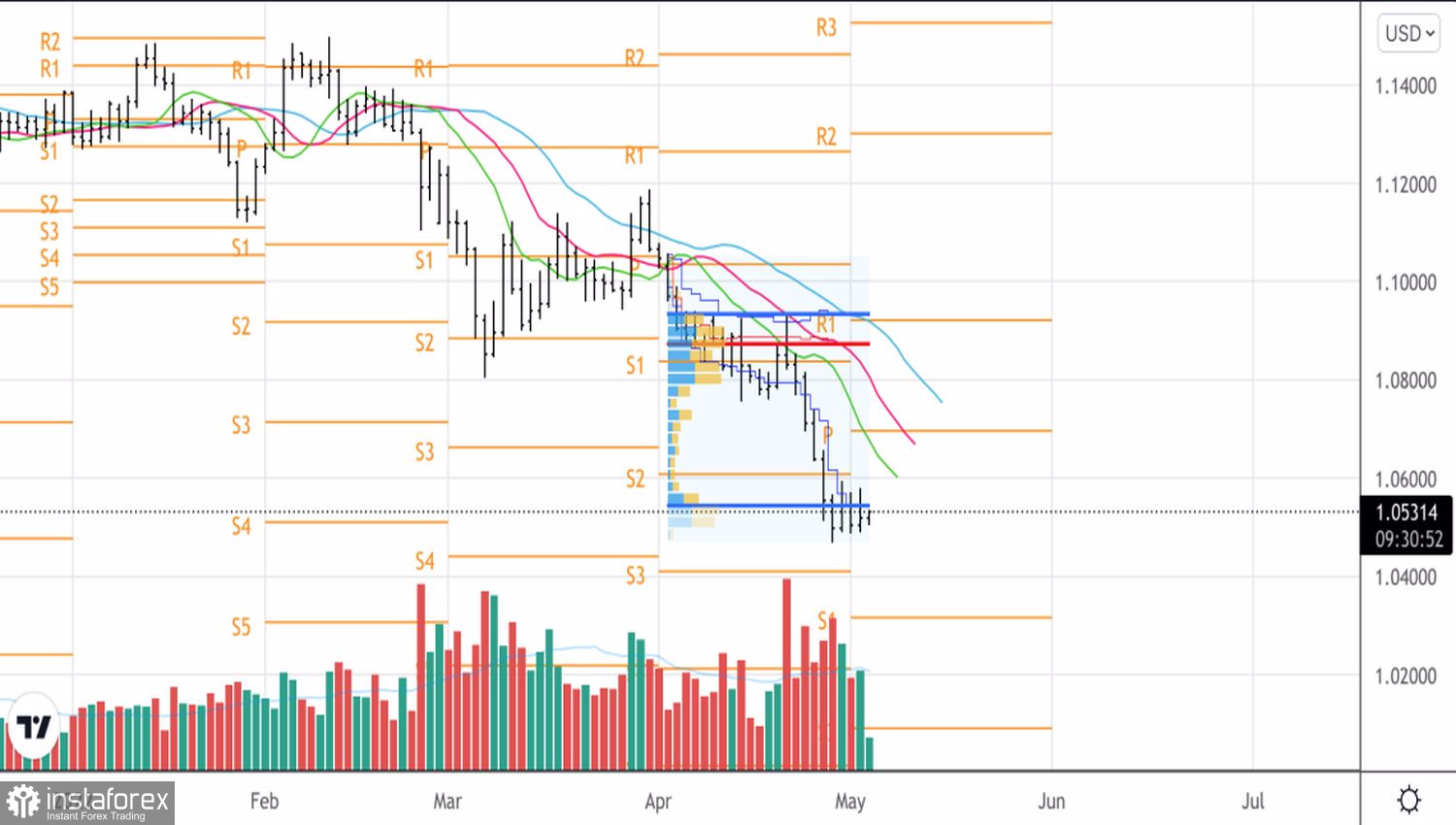

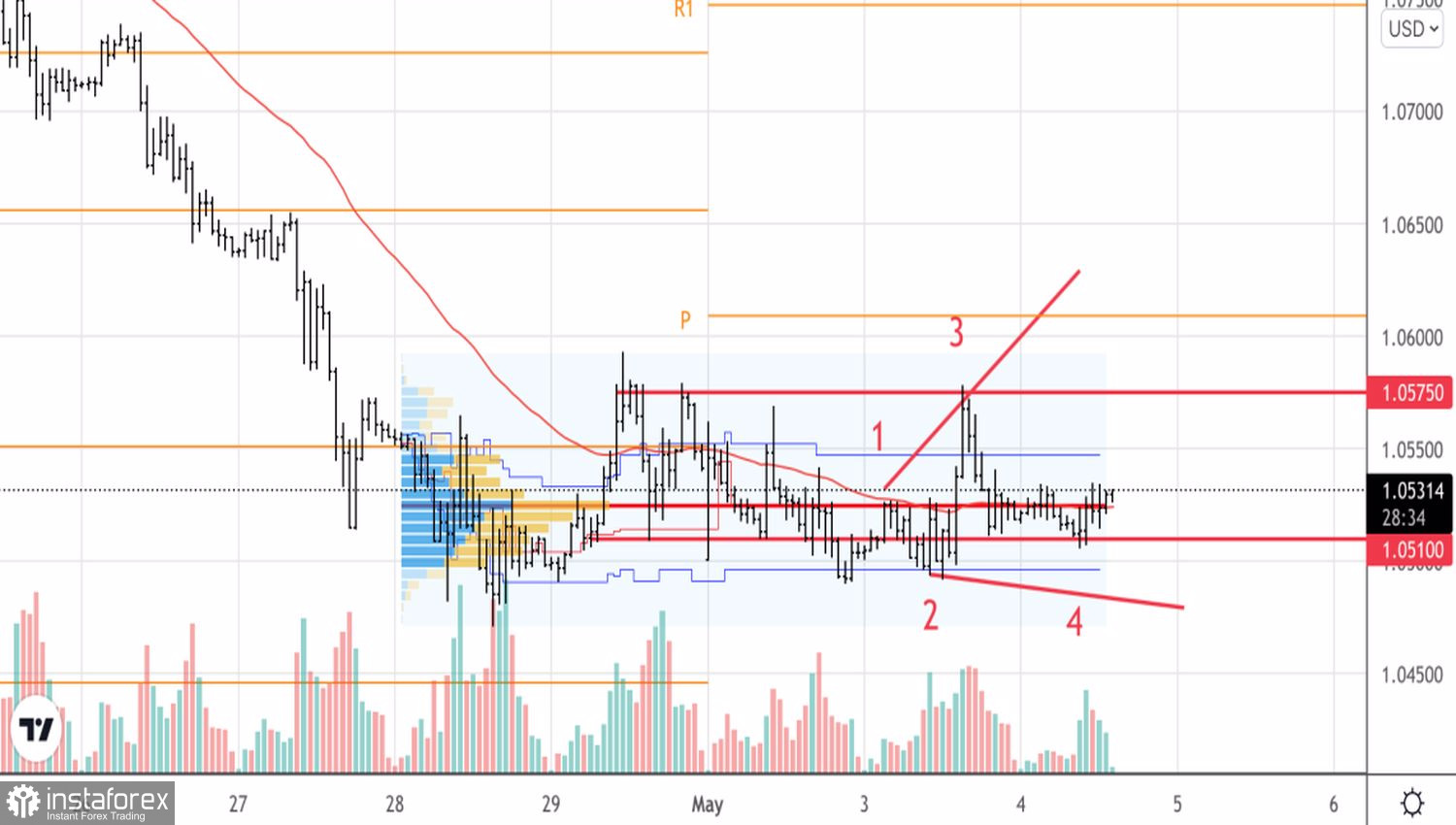

Technically, there is a consolidation in the range of 1.049–1.058 on the EURUSD daily chart. Breakouts of the fair value at 1.0545 and the upper limit of the trading channel near 1.058 may become the basis for opening longs, but it is not certain that the bulls will storm 1.0605. On the hourly time frame, the failure of the bears to hold the 1.049 level after falling below it is fraught with the formation of a Broadening Wedge pattern. The recommendation is to exit the market.

EURUSD, Daily chart

EURUSD, Hourly chart

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română