The US macro data published on Monday turned out to be not very positive for the dollar. The index of business activity in the US manufacturing sector came out with a value worse than forecast (in April it fell to 55.4 from 57.1 in March and against the forecast of 57.6), and the employment index (from ISM) in the US manufacturing sector in April fell to 50.9 from 56.3 in March, which also turned out to be worse than the forecast of a decline to 54.7.

After the US annual GDP released last Thursday with a negative value (-1.4%), this is new data that indicates a slowdown in the US economy. If GDP also declines in the next 2nd quarter, it will be possible to talk about the beginning of a recession in the US economy, as some economists warned.

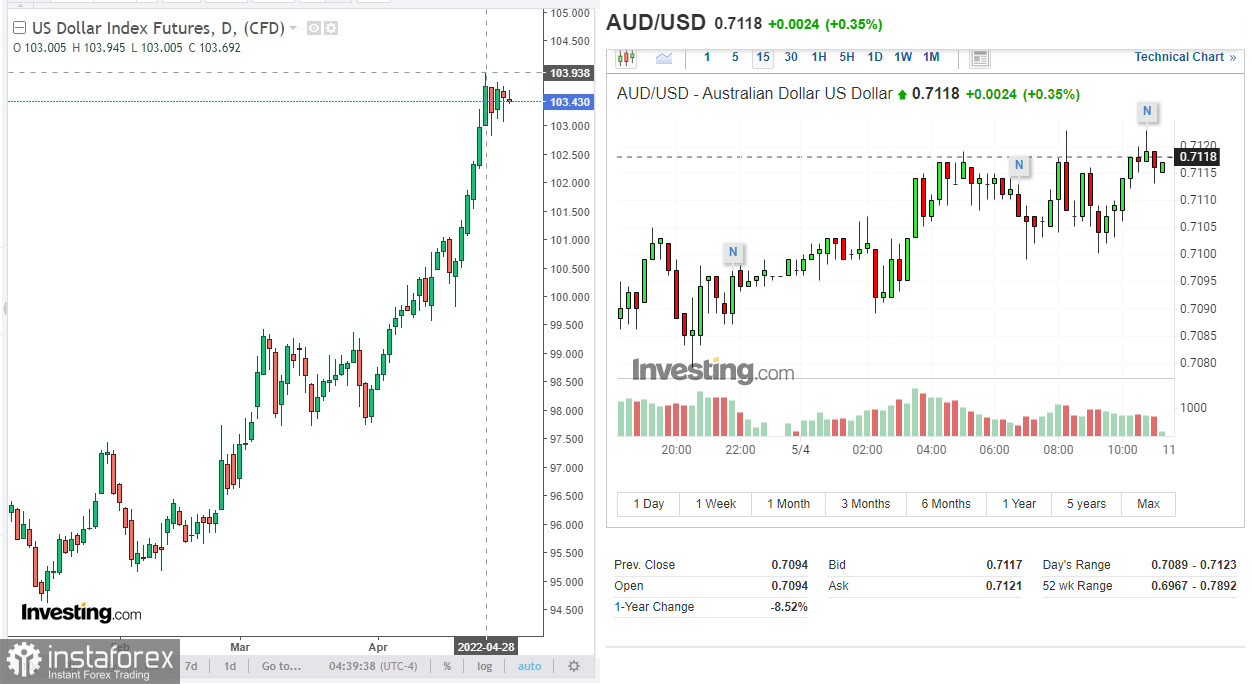

One way or another, due to these reasons, or others, the dollar is weakening today, and the dollar index (DXY) is declining. At the time of writing, the DXY index was near the 103.43 mark, 51 points below the local 2-year high of 103.94 reached last week, and 6 points below the closing price of the previous day.

And yet we can say that this is only a minor correction of the dollar so far. Most likely, it will continue to grow, especially if today the Federal Reserve announces a tougher stance on the monetary policy.

As you know, the Fed's interest rate decision will be published today at 18:00 GMT, and this is the key event of today. It is widely expected that the rate will be raised immediately by 0.50%, to 1.00%. Market participants are also waiting for the Fed to announce a quantitative tightening program and determine the timing of the start of reducing its balance sheet, which is approximately $9 trillion.

At the same time, the expected increase in the interest rate by 0.50% today has already been taken into account in prices. Market participants betting on further dollar growth expect to hear tough signals from the Fed confirming its intentions to accelerate interest rate hikes. Investors are already considering an increase in the Fed's key rate by another 2% over the next four months.

In the meantime, the US dollar is declining. Its downward dynamics (which we attribute to a correction so far) is particularly noticeable in relation to the raw Canadian and Australian dollars, which, in turn, receive strong support from rising energy prices.

During its meeting on Tuesday, the Reserve Bank of Australia raised the interest rate for the first time since November 2010. In order to contain inflation, which has reached its highest in 20 years (in the 1st quarter, the total annual consumer price inflation in Australia was 5.1%, and core inflation was 3.7%), the rate was increased by 0.25%, to 0.35%, which also exceeded the forecast of an increase of 0.15%. In addition, the RBA signaled the likelihood of further increases in the coming months. Now market participants take into account in prices the increase in the RBA interest rate to 2.5% by the end of this year.

"The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time," said RBA Governor Philip Lowe. "This will require a further lift in interest rates over the period ahead."

According to the RBA forecast, in 2022, overall inflation will be at the level of 6%, and the base will accelerate to 4.75%. At the same time, the unemployment rate may drop to 50-year lows next year.

Economists now expect that the RBA will raise the key rate to 2.6% by December 2022 from the current level of 0.35% and will keep it at this level next year.

Thus, the Australian dollar received an upward momentum yesterday. If paired with the US dollar, its strengthening is not so noticeable, then in the main cross-pairs, the Australian dollar is strengthening with more confidence.

As for the AUD/USD pair, as of this writing, it is trading near the 0.7115 mark, moving towards the first important resistance level of 0.7154, the breakdown of which will be the first signal to consider the possibility of entering long positions. In the meantime, it is premature to talk about breaking the bearish trend of AUD/USD. It is also worth recalling that today, after 18:00 GMT, a significant increase in volatility in the financial market is expected.

In quotes of the US dollar, it will also rise earlier, at the beginning of the US trading session, when the next ADP report on the level of employment in the private sector will be released at 12:15 GMT, and at 14:00 GMT – the PMI of business activity (from ISM) in the services sector of the US economy.

Although the ADP report does not have a direct correlation with the official data of the US Department of Labor on the labor market, which will be published on Friday, it is often a harbinger of them, having a noticeable impact on the market. A relative increase in the indicator may have a positive effect on dollar quotes, and a relative decrease in the indicator may have a negative effect. The market reaction may be negative, and the dollar will decline if the data also turns out to be worse than the forecast (395,000 against an increase of 455,000 in March, 475,000 in February, 509,000 in January 2022).

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română