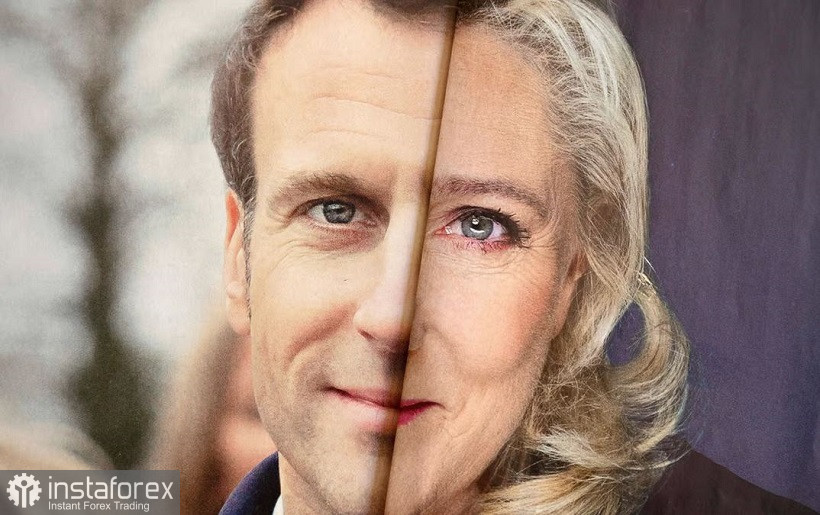

Emmanuel Macron's nominal victory in the first round of the French presidential election helped EUR/USD buyers start the trading week from the upward gap, in the area of the 9th figure. However, this fundamental factor will not be a reliable help to the single currency. Firstly, we are talking only about the first round, and secondly, it is difficult to call Macron's victory "convincing." Rather, on the contrary, his rival – Marine Le Pen – for the first time in many years had a really real opportunity to take the presidency.

Therefore, buyers of EUR/USD should not build false illusions: in the medium term, they will not be able to reverse the downward trend. So, it is still advisable to use any corrective pullbacks to open short positions.

According to the results of processing 100% of the protocols, Emmanuel Macron scored 27.6% of the votes. Marine Le Pen came in second with 23.41% and Jean-Luc Melenchon was in third garnering 21.95%. According to most political experts, despite the nominal victory of Macron, now we can talk more about the success of Le Pen. Also, we should not forget that on the eve of the first round, the rating of the incumbent president was actively declining, and the rating of Marine Le Pen, on the contrary, was increasing. Therefore, according to most forecasts, the struggle between them will be more stubborn than five years ago. And the result of the second round cannot be called a foregone conclusion: many representatives of the left electorate can vote for Le Pen thanks to her social slogans.

The prospects of a possible victory for Le Pen in the second round will put background pressure on the euro. On the one hand, she is no longer in favor of abandoning the euro and France's withdrawal from the European Union, as it was five years ago, during the previous presidential campaign. However, Eurosceptic sentiments still dominate her rhetoric and program. She has repeatedly stated that she wants to turn the European Union into a Union of Nations that will not be bound by the common laws of the European Union. If the next opinion polls do not indicate a confident separation of Macron from his rival in the second round, the EUR/USD pair will be under significant pressure.

In addition, other fundamental factors speak in favor of the downward scenario. For example, "hawkish expectations" regarding the Fed's next steps are increasing. The Reuters news agency at the weekend interviewed more than a hundred leading economists about the prospects for tightening the Fed's monetary policy. 85 of them said that the US regulator will raise the interest rate by 50 basis points at the May meeting. Moreover, 56 respondents also added that the Fed will raise the rate by the same amount following the results of the June meeting.

Here we can recall the minutes of the Fed's March meeting, where the Committee members did not rule out such a scenario. Over the past two weeks, many representatives of the Federal Reserve have "directly" advocated a more aggressive pace of monetary policy tightening. While representatives of the European Central Bank are taking a much softer position, despite the record increase in inflation in the eurozone. Currency strategists of conglomerates such as Goldman Sachs and Morgan Stanley suggest that the ECB will decide on the first rate hike only in December. However, the members of the European regulator for the most part do not voice such scenarios. The divergence of ECB and Fed positions also puts pressure on EUR/USD.

Geopolitics is also an ally of the greenback. There is growing concern in the market about the prospects of the negotiation process between Russia and Ukraine, which has clearly stalled. After the "Istanbul meeting," the parties hold talks via video link, but to date, there are no prerequisites for concluding any comprehensive agreement. And in this case, time is playing on the side of the dollar. The information vacuum strengthens the anti-risk mood in the market, allowing a safe greenback to feel comfortable in the main dollar pairs.

Thus, many fundamental factors speak in favor of a further decline in EUR/USD. This includes the political situation in France, the divergence of the monetary policy of the Federal Reserve and the European Central Bank, and the geopolitical situation in Eastern Europe. Therefore, the upward pullbacks of EUR/USD should be treated with great caution. The downward trend is still in force, so it is advisable to use corrective waves to open short positions.

From a technical point of view, the pair is located under all the lines of the Ichimoku indicator on the daily chart, which shows a bearish parade of line signal. Also, the price is located between the middle and lower lines of the Bollinger Bands indicator. The first target is the lower line of this indicator, which corresponds to the 1.0850 mark. If sellers push through this target, then the next level of support will be the psychologically important mark of 1.0805 – this is the price minimum of this year.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română