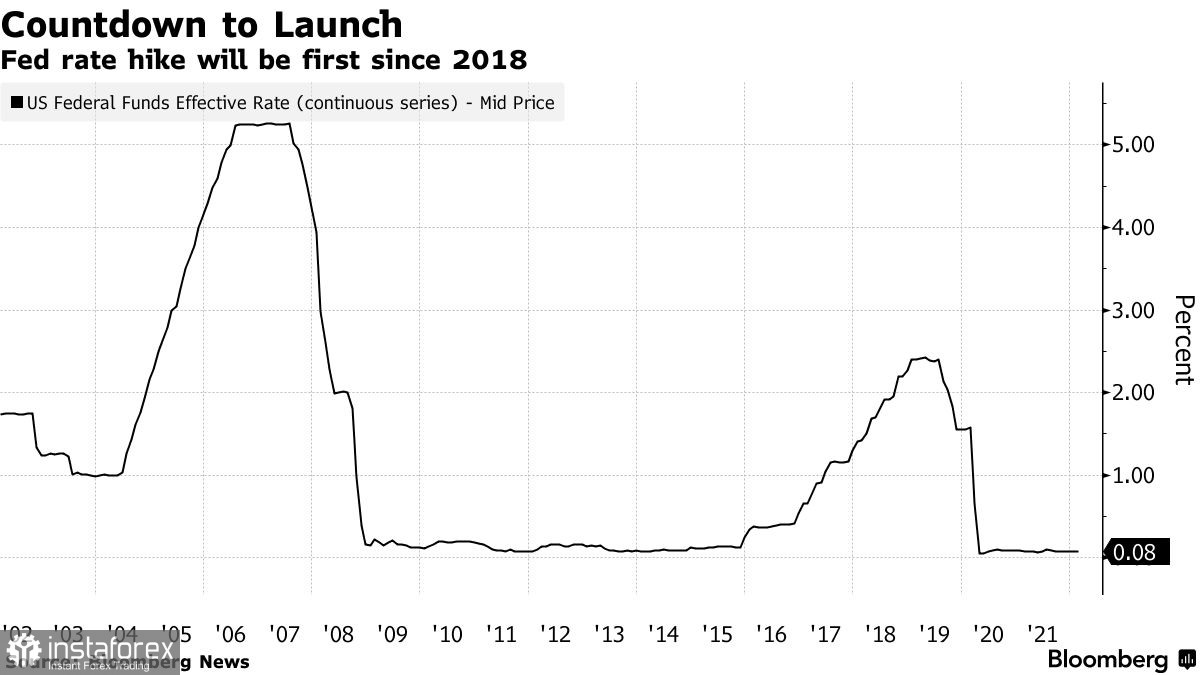

The Federal Reserve is sure to raise interest rates today for the first time since 2018. However, this is not news for investors. Most likely, they will focus on how aggressive the central bank plans to be in the fight against the highest inflation in four decades. The Federal Open Market Committee is expected to raise rates by a quarter of a percentage point at the end of its two-day monetary policy meeting. Immediately after that, Chairman Jerome Powell will speak, and that's where the "heat" really begins. Earlier this month, Powell told lawmakers that he supports raising rates, but the whole question is whether the Fed will start acting more aggressively. The volatility of the markets will depend on this decision.

Traders expect at least that the committee will make a statement in which it will try to send an encouraging signal about the ability to ease inflationary pressure. Many also talk about more serious changes in the Fed's policy and its program. It is also expected to publish forecasts that can be used for making decisions in the future for medium-term investors and traders. Achieving macroeconomic stability while raising interest rates just for the sake of fighting inflation is not the right way - especially in the current difficult geopolitical conditions.

According to several economists, the latest FOMC forecasts are likely to provide for at least four interest rate hikes in 2022 and three in 2023. This will be more than the three increases this year noted at the December meeting. However, there is some uncertainty about the committee's further thoughts. Some market participants are already planning for seven rate hikes in 2022 - one at each meeting.

Expectations for 2024 regarding interest rates will also be very important. It will be clear from the data whether the committee expects to raise the Fed's base interest rate above its neutral level to curb inflation in this way. If so, there will be many reasons for panic, since it is obvious that everything is not as calm in the central bank as they want to present it. The neutral level, which does not accelerate or slow down the economy, is 2.5%. If inflation continues to rise in the future, and many expected that February was the peak month, followed by a recession, it will be necessary to act more harshly, which will negatively affect stock markets but will support the US dollar, which is already pretty overbought against several risky assets, including the euro foot. This is far from contributing to the development of the American economy due to the sharp rise in the cost of exports. Considering what is happening now with prices in the United States, especially for fuel, food, and utility bills, it is obvious that the February jump in the consumer price index is far from the last and it is still very far from the peak. All this will slow down the economy, gradually pushing it into recession. If oil prices remain above $ 100, you will not have to wait long for this event.

As for the geopolitical situation. Demilitarization of Ukraine according to the Austrian or Swedish version with the preservation of its army, but without the presence of foreign military bases is being discussed at the negotiations of the delegations of Moscow and Kyiv and can be considered as a compromise option, Kremlin spokesman Dmitry Peskov said. In an interview, Peskov declined to provide details.

As for the technical picture of the EURUSD pair

Euro bulls, though, returned to resistance around 1.1000, which keeps the demand for the trading instrument. Geopolitical tensions around Russia and Ukraine have eased slightly, but the focus is now on the Federal Reserve meeting. Euro buyers need to consolidate above 1.1040, which will allow the correction to continue to the highs: 1.1100 and 1.1160. The decline of the trading instrument will be met with active purchases around 1.0930. However, the key support level remains the 1.0810 area.

As for the technical picture of the GBPUSD pair

The buyers of the pound have shown themselves after the recent major fall of the pair, and are now focused on the resistance of 1.3080. The return to control of this range will allow us to count on a more powerful correction of the pair in the area of 1.3140 and 1.3190. However, the growth prospects are overshadowed by the upcoming meeting of the Federal Reserve System and the Bank of England. How the market will behave in this situation is a complete mystery, so I recommend taking a wait-and-see attitude and sitting out all the volatility and uncertainty expected in the coming days. If we go below 1.3030, then the pressure on the trading instrument will increase. In this case, we can expect a fall to 1.2930 and the exit of the trading instrument to new lows: 1.2850 and 1.2790.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română