While the Fed has made its decisions, the ECB has an important choice to make at its March 10 meeting. Dependent on energy supplies from Russia, the Eurozone economy is suffering more losses than its American counterpart. And the fact that the war in Ukraine is unlikely to end quickly will continue to faithfully serve safe-haven assets. The "bears" on EURUSD have plenty of trump cards to push quotes down. Which they do.

U.S. Federal Reserve Chairman Jerome Powell painted a rather transparent picture during his testimony before the U.S. Congress. He will propose to raise the federal funds rate in March, after which the rate of monetary restriction may be increased in the event of a further acceleration of inflation or its being at high levels for longer than the Central Bank expects. The latter scenario looks very likely in light of the impact of events in Eastern Europe on the commodity market.

The ECB has not yet made its choice, and it will not be easy to do so. Even financial markets have difficulty making decisions. Eurozone bond yields have fallen, signaling a bleak outlook for the currency bloc's economy. At the same time, inflation expectations jumped well above the 2% target. If ECB President Christine Lagarde and her colleagues turn a blind eye to this, a self-fulfilling prognosis awaits them: when consumers expect high prices in the future, consumers buy goods, which leads to a further acceleration of inflation. Something needs to be done. As an option, taper QE earlier than currently expected.

Thus, the Fed has outlined the trajectory of tightening monetary policy, the ECB has yet to do this, but it is obvious that we will talk about different speeds. As a result, rate-sensitive derivatives are signaling that the EURUSD pair may fall to 1.08.

Dynamics of EURUSD and currency swap spreads

The close dependence of Europe on Russian gas supplies leads to the fact that, in the conditions of their limitation, the prices for blue fuel in the euro area grow much faster than in the Americas. Europeans spend more money on electricity bills than Americans. That is, they have less for consumption, which determines the rate of GDP growth. For sure, because of the war in Ukraine, the eurozone economy will expand more slowly than its U.S. counterpart.

If we add to the divergence in monetary policy and in economic growth the high demand for safe-haven assets in the face of uncertainty due to the military conflict in Eastern Europe and the overwhelming interest in dollar financing, then the picture will definitely develop in favor of the "bears" on EURUSD. A strong report on the U.S. labor market may add fuel to the fire, however, I personally would not be surprised by some pullback of the pair due to partial profit-taking by short speculators.

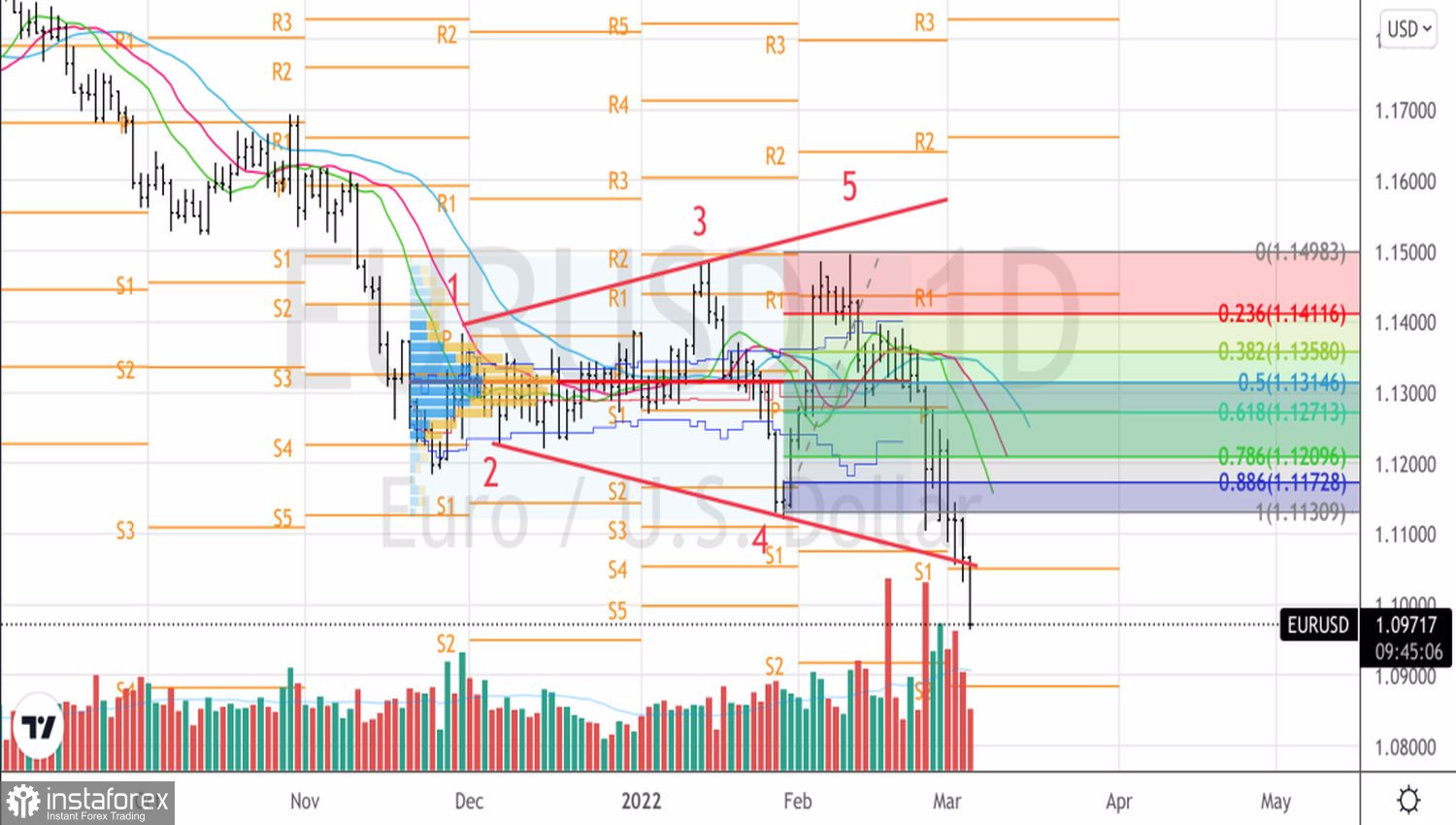

Technically, on the daily chart, EURUSD continues to work out the Broadening Wedge pattern. Short positions formed from levels 1.126, 1.117, and 1.111 turned out to be a good decision. Now traders should use pullbacks to build them up. Pivot points 1.092 and 1.088 act as targets for the downward movement.

EURUSD, Daily chart

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română