According to popular bitcoin analyst Bitcoin Jack, the main cryptocurrency could be a "good bet" for investors if the Fed does its best to keep the U.S. economy afloat from looming recession risks.

The independent market analyst compared bitcoin, often referred to by enthusiasts as "digital gold," with the prospects for further quantitative easing by the U.S. Federal Reserve.

He noted that the ongoing military standoff between Ukraine and Russia has strangled the supply chain for essential commodities such as oil and wheat, which could lead to higher global inflation.

Where does the demand for Bitcoin come from

The appetite for safe-haven assets was also the reason for the increase in demand for bitcoin earlier this week. On February 28, the price of BTC rose by just over 14.50% on the day, recording the biggest one-day gain in a year.

The Arcane Research report claims that Ukrainians looking for "powerful fundraising tools" and Russians trying to bypass "the strictest capital controls in decades" were behind the BTC price spike.

"This speculation may have contributed to the 15% increase in the bitcoin price over the past seven days," Arcane Research wrote on March 1, adding that BTCUSD could rise to $47,000 next time.

Likewise, investment vehicles based on the main cryptocurrency saw $195 million in capital inflows from the beginning of the month to February 25, according to the latest report from CoinShares.

The other side of the coin: the risk of a recession

However, recession risks continued to overshadow Bitcoin's upside potential. For example, Brian Coulton, chief economist at Fitch Ratings, predicted that core inflation would remain high throughout 2022, especially as the Ukrainian-Russian crisis exacerbated the risks of global price shocks.

"If core inflation remains high and inflation expectations rise the Fed, and the BOE could be left with no choice but to quickly move rates to neutral or restrictive levels," he wrote, adding that the Fed rate could reach 3% by end of 2022.

Bet on resistance

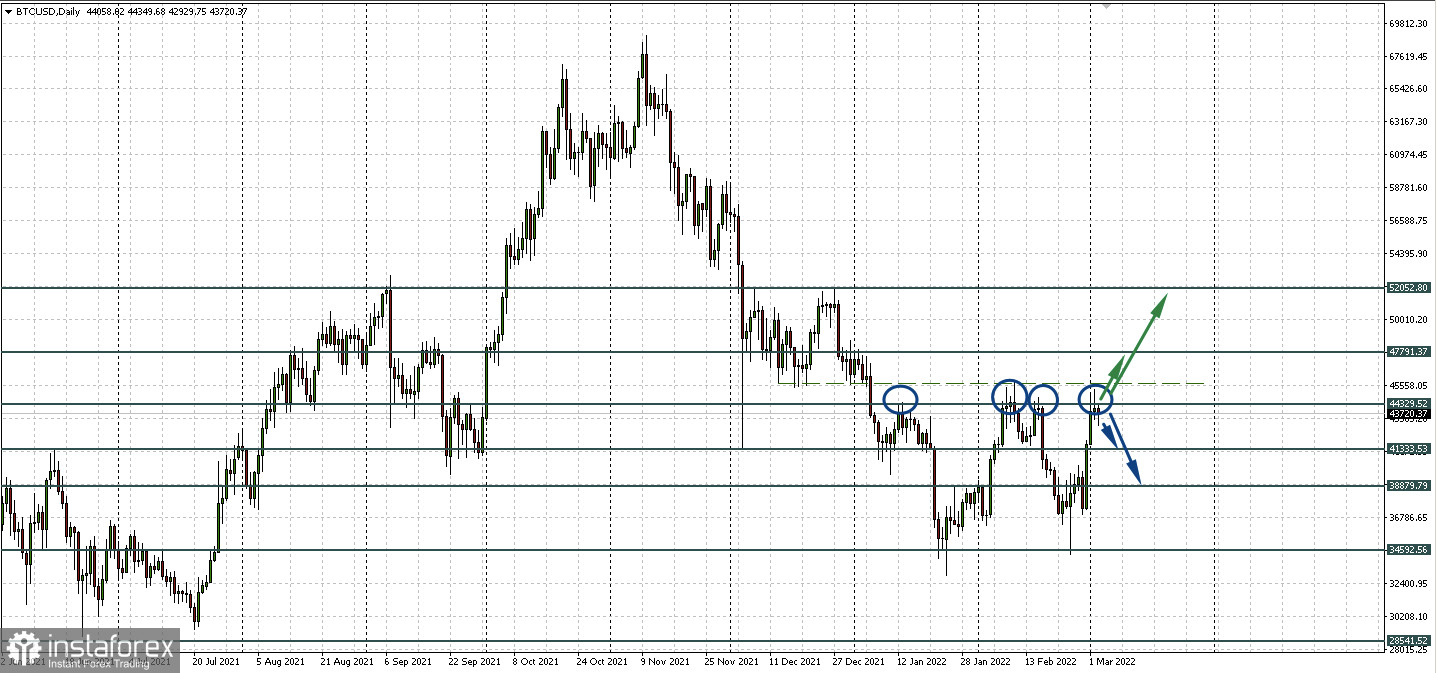

Now the horizontal 44,329.52 remains a strong resistance level for BTCUSD. On the daily chart, we see several bounces down from it.

It is worth noting that the double bottom reversal pattern, which was mentioned in yesterday's review, has the other side of the coin. A third bottom can be drawn from it. A triple bottom, by the way, is also a reversal signal.

An upward price impulse is possible after a clear breakdown of the resistance level of 44,329.52 and consolidation above it.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română