The hype by the West, or rather the United States, of the alleged Russian invasion of Ukraine has dominated the financial markets for the past week, making investors nervous.

Everything that happens on the markets, unfortunately, is currently under the complete negative influence of the theme of "aggressive Russia, which is eager to attack Ukraine." Geopolitical confrontation is not the only reason that puts pressure on global financial markets. To this should be added some rather tough statements by some members of the Fed, who talk about the need for a tighter monetary rate.

Chicago Federal Reserve Bank President Charles Evans and St. Louis Fed President James Bullard support this idea.

But the Fed itself does not yet have an unequivocal consensus on this issue. For example, New York Fed President and influential FOMC member John Williams said on Friday that "inflation is way too high right now, but there are some reasons for optimism that it will come down." It is likely that the markets are also assessing the overall picture of inflation in the U.S., which leads to the absence of unambiguous movements in the currency markets, where there is a very volatile range trading. The ICE dollar index has been moving in a narrow range all last week, rotating near the 96.00 point mark.

A similar picture is also shown by the yields of U.S. Treasuries. The yield on the policy-sensitive two-year Treasury note is "spinning" around the 1.5% mark, while the yield of the benchmark 10-year Treasury is again trading below the 2.0% mark this Monday.

All this indicates that investors are confused. On the one hand, they are frightened by "aggressive Russia," but, on the other hand, they do not see that nothing is happening, which means that there are doubts that the various dates of the Russian attack promised by the media are at least strange.

But the news that appeared today that Russian President Vladimir Putin and U.S. President Joe Biden may meet may become a catalyst for the growth of positive sentiment in the markets. The news about the meeting between the leaders of the Russian Federation and the United States reduces geopolitical tensions and will undoubtedly lead to an increase in demand for risky assets in the markets. Already this morning, before the opening of trading in Europe, there is a strong increase in futures for European and American stock indices, which may signal an increase in stock indices in Europe at the opening. The same picture with a high degree of probability can be observed at the beginning of trading in America.

Watching everything that is happening, we believe that today the dollar will be under pressure on the Forex market, while at the same time the shares of companies that nervously twitched up and down all last week may receive significant support.

Forecast:

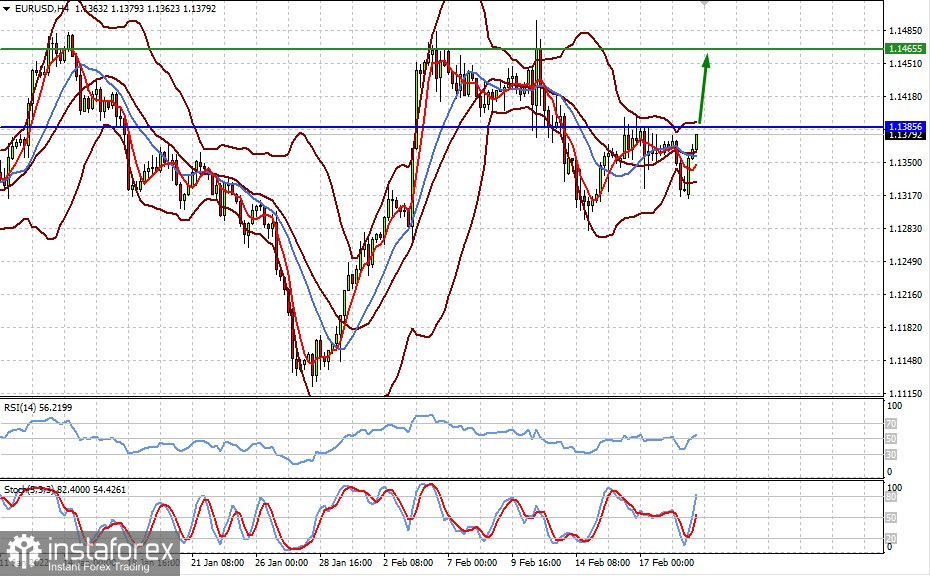

The EURUSD pair may break the 1.1385 mark and grow to 1.1465. The reasons for this growth may be the publication of data on the growth of inflation in Germany, which will push the ECB to consider raising rates in the near future, as well as the demand for risky assets, which traditionally supports the pair.

The USDJPY pair may receive support as geopolitical tensions ease in the markets, which could result in a limited uptick towards 115.70.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română