EUR/USD

Higher Timeframes

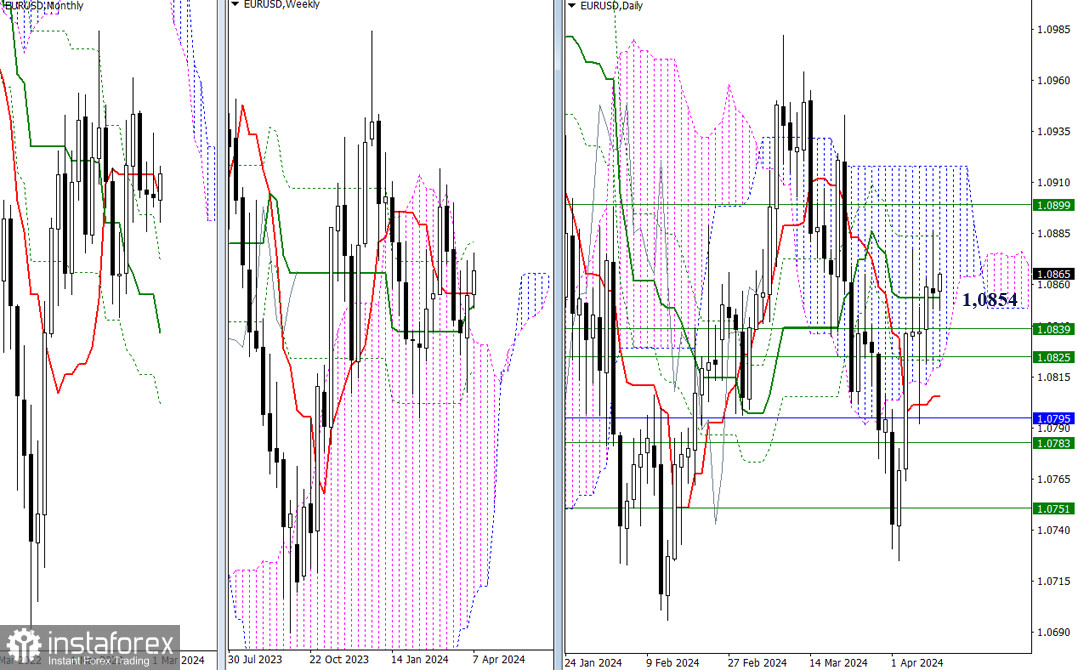

Yesterday, the nearest resistance was tested (1.0884), but by the end of the day, the pair returned again to the support of the daily medium-term trend (1.0854). As a result, there were no significant changes in the main conclusions and expectations. The positions of the upward targets remained unchanged at 1.0884 - 1.0899 - 1.0918. Supports today also remain at the levels of previous days at 1.0825-39 (weekly Ichimoku cross).

H4 - H1

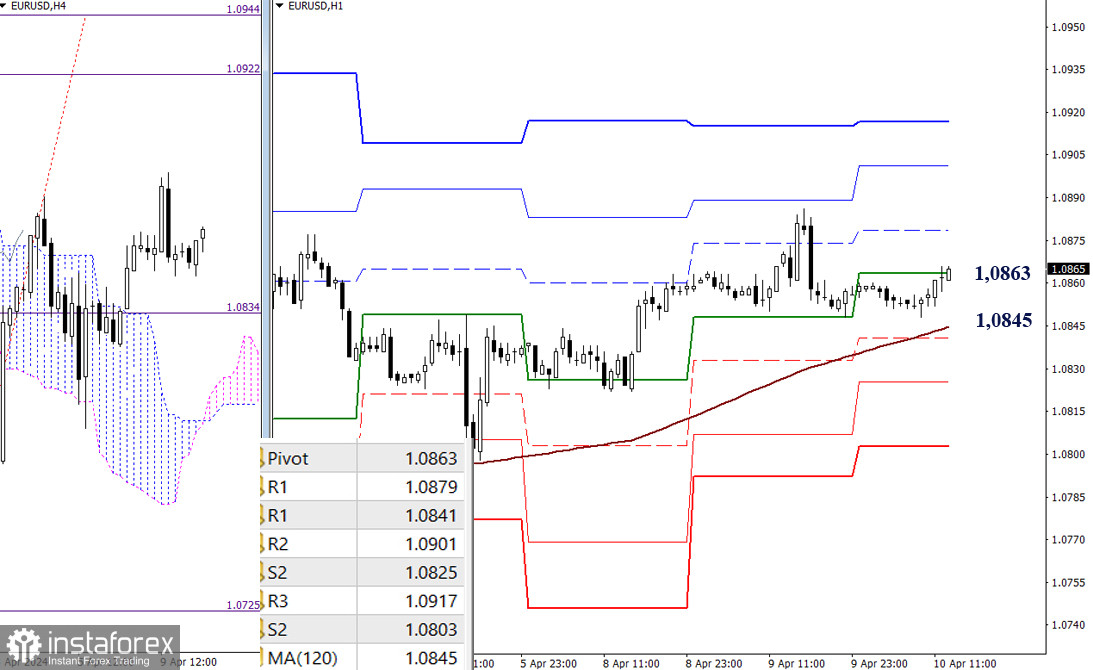

The pair is trading in the correction zone, but the main advantage remains on the bulls' side. Upon resumption of the ascent, bulls will focus on the resistances of the classic pivot points (1.0879 - 1.0901 - 1.0917) and achieving the target for breaking the H4 cloud (1.0922 - 1.0944). If the key level—the weekly long-term trend (1.0845)—is breached, there will be another shift in the current balance of power on the lower timeframes, with the interests of the bears including the testing and breaking of the supports of the classic pivot points (1.0841 - 1.0825 - 1.0803).

***

GBP/USD

Higher Timeframes

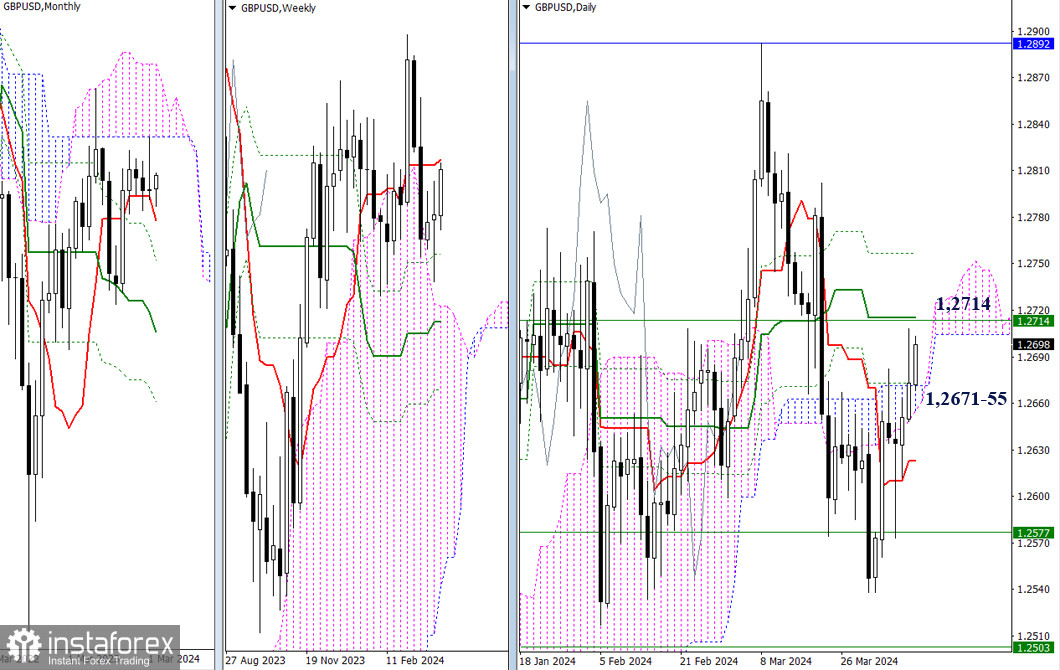

The bulls do not give up and continue the ascent. Their immediate tasks include returning to their side the support of the weekly short-term trend (1.2714) and eliminating the death cross of the daily Ichimoku cloud (1.2715 - 1.2757). In case of failure, the market could quickly find itself in the bearish zone relative to the daily cloud (1.2671 - 1.2655), with the next downward targets being 1.2623 (daily short-term trend) and 1.2577 (weekly Fibonacci Kijun).

H4 - H1

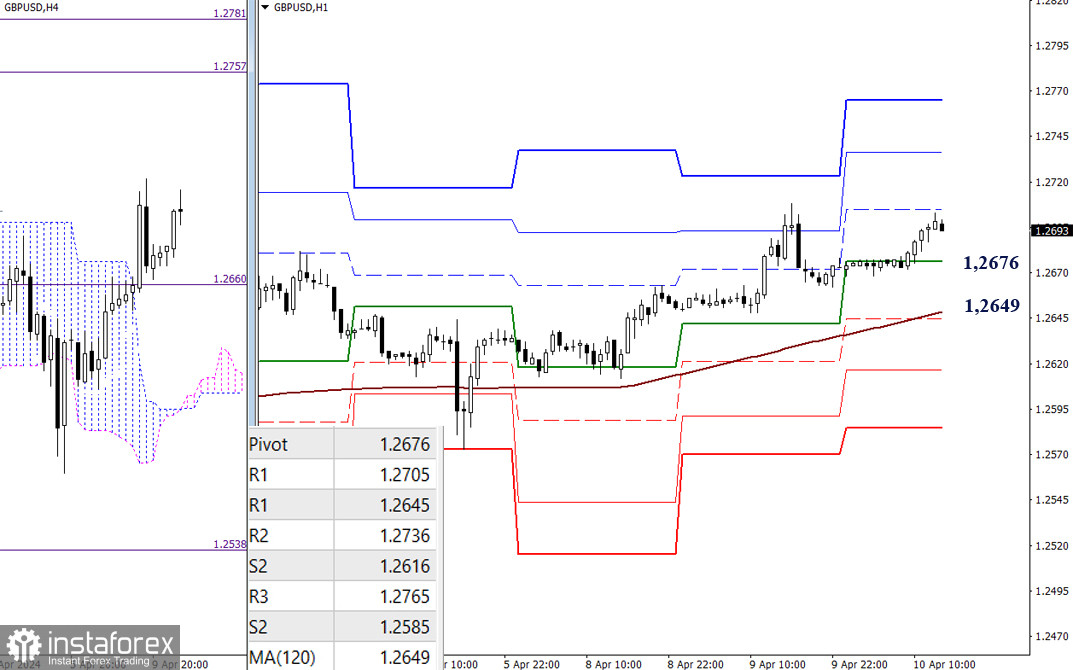

On lower timeframes, the main advantage remains on the bulls' side. The targets for the development of bullish sentiments today are located at 1.2705 - 1.2736 - 1.2765 (classic pivot points) and 1.2757-81 (central pivot point + weekly long-term trend). Key levels will be involved in the event of a decrease at 1.2676 - 1.2649 (central pivot point + weekly long-term trend). If they are broken, the current balance of power may shift in favor of strengthening bearish sentiments. The next downward targets will be the supports of the classic pivot points (1.2645 - 1.2616 - 1.2585).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

Bahasa Indonesia

Bahasa Indonesia

Русский

Русский English

English Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română