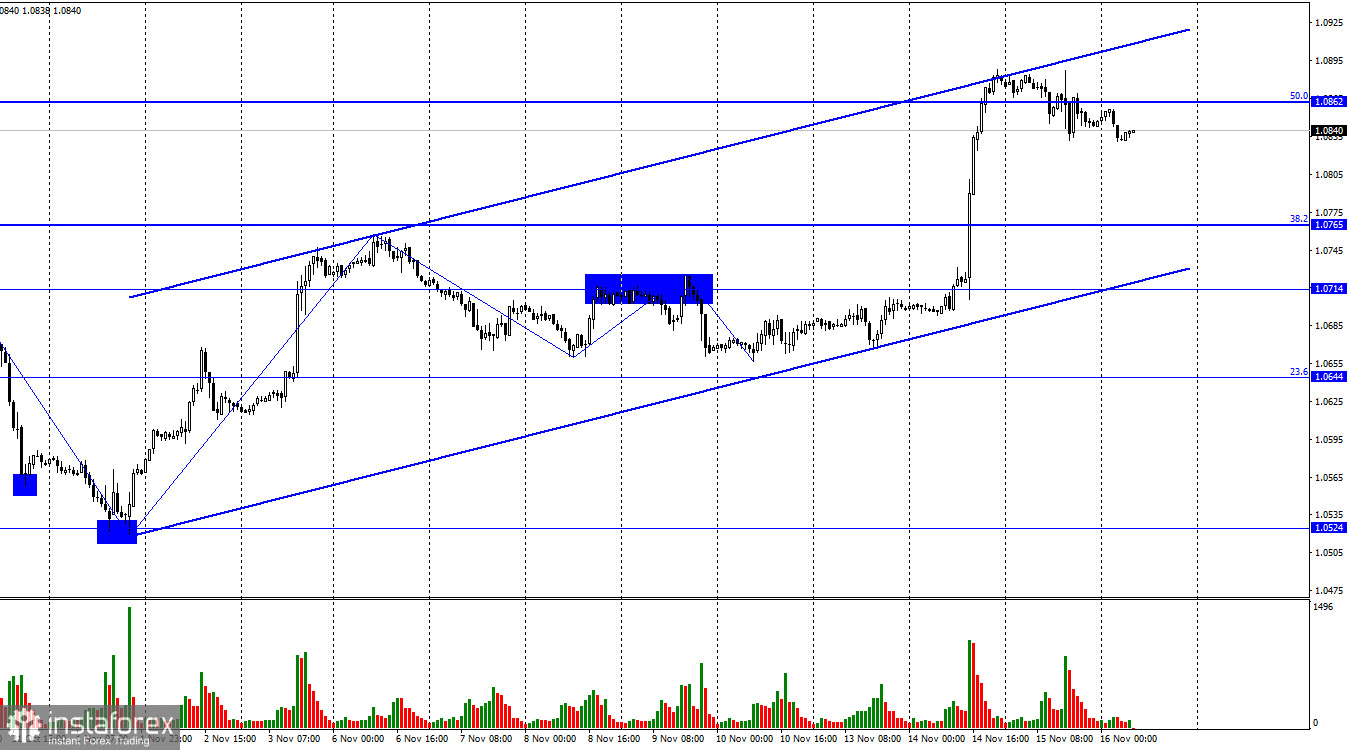

The EUR/USD pair reversed in favor of the US dollar on Wednesday and consolidated below the corrective level of 50.0% (1.0862). The pair also rebounded from the upper line of the ascending trend corridor, which characterizes the current sentiment of traders as "bullish." Thus, two sell signals were received, and the pair began falling towards the Fibonacci level of 38.2%–1.0765. Fixing quotes above the level of 1.0862 will work in favor of the euro and the resumption of growth towards the next corrective level of 61.8% (1.0958).

The wave situation remains ambiguous. We seem to have a clear "bullish" trend, but the waves' sizes and alternation leave many questions unanswered. It is now better to rely on the trend corridor and levels. For the current trend to change to "bullish," the pair needs to fall to 1.0644. This may take several days or even a week.

Yesterday, the European Union released a report on changes in industrial production volumes. Volumes decreased by 6.9% y/y and by 1.1% m/m. Traders expected more optimistic figures, and the euro came under market pressure from the beginning of the day. A little later, one of the members of the ECB Board, Peter Kazimir, spoke, stating that over the next few quarters, the regulator will have to keep interest rates at their peak. There is no talk of rate cuts in the first half of next year. Also, Kazimir noted that it is still too early to declare victory over inflation, and the process of tightening monetary policy cannot be considered complete. The risks of inflation acceleration still exist, and the ECB may need to intervene again. Kazimir states a new rate hike is possible if economic data necessitate it.

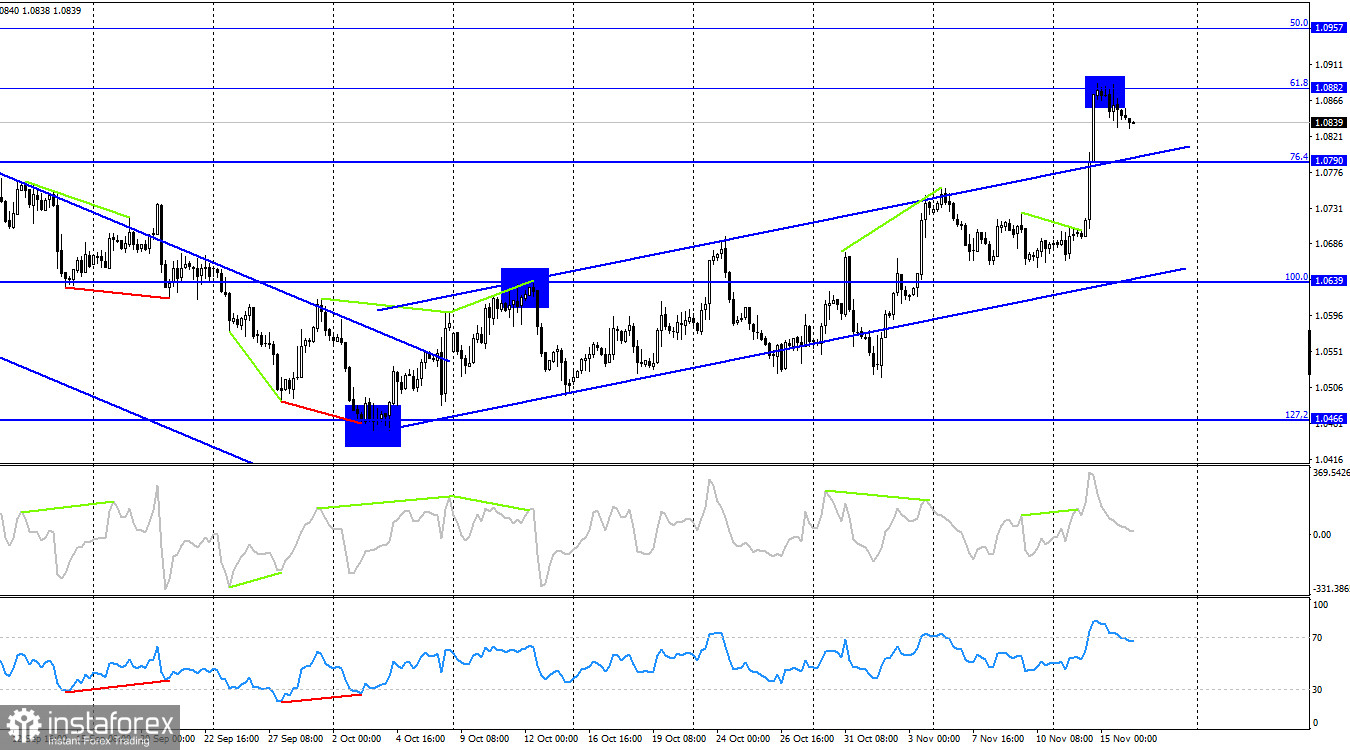

On the 4-hour chart, the pair rose to the corrective level of 61.8% (1.0882). The rebound of quotes from this level favored the US currency, and the pair began to fall toward the corrective level of 76.4% (1.0790). There are no impending divergences from any of the indicators today. Closing above the level of 1.0882 will further increase the probability of further growth towards the next Fibonacci level of 50.0%–1.0957.

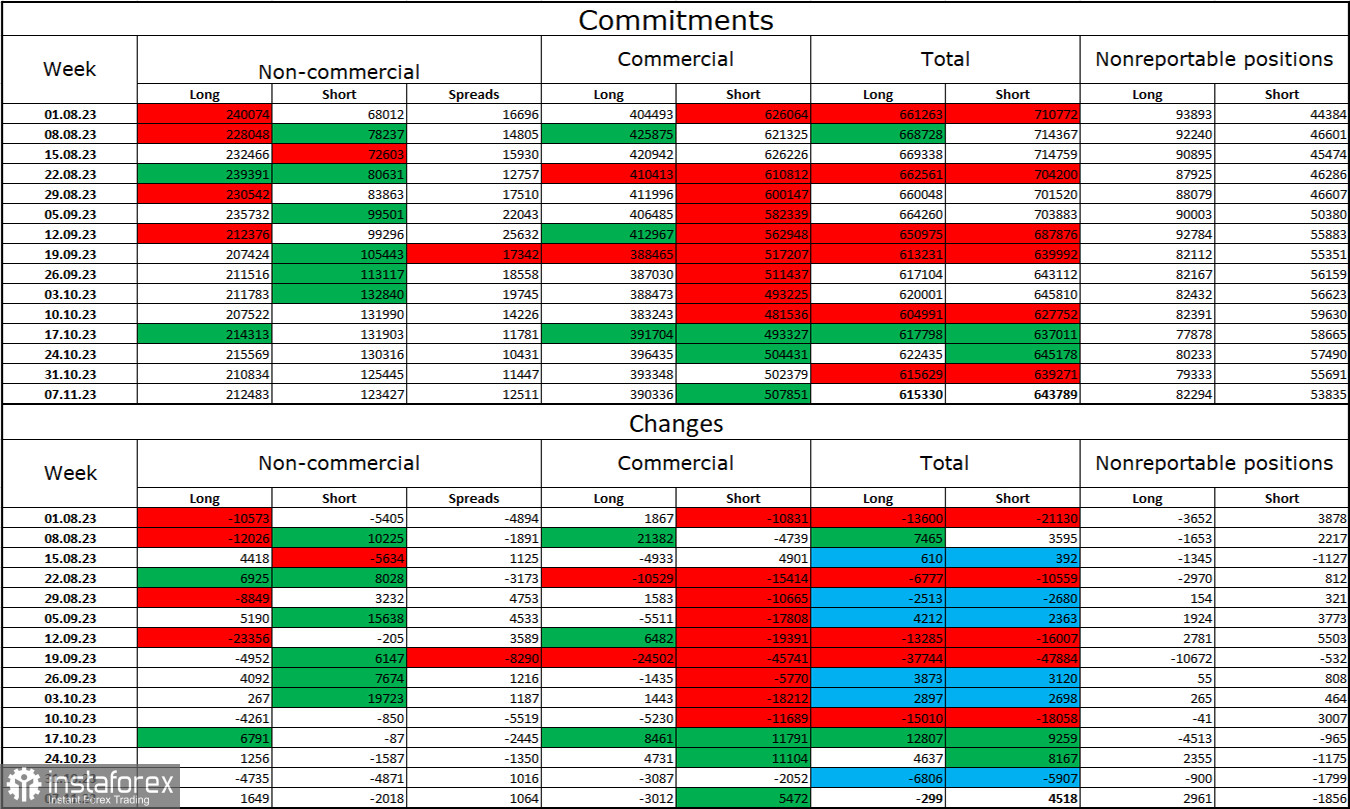

Laporan Komitmen Trader (COT):

Pada pekan laporan terakhir, para spekulan membuka 1.649 kontrak beli dan menutup 2.018 kontrak jual. Sentimen para trader utama tetap "bullish", tetapi telah melemah dalam beberapa pekan dan bulan terakhir. Jumlah total kontrak beli yang terkonsentrasi di tangan para spekulan saat ini adalah 212.000 dan kontrak jualnya adalah 123.000. Perbedaannya sekarang kurang dari dua kali lipat, meskipun beberapa bulan yang lalu, selisihnya tiga kali lipat. Situasi ini akan terus berubah untuk mendukung bears. Bulls telah mendominasi pasar terlalu lama. Sekarang mereka membutuhkan informasi yang kuat untuk memulai tren "bullish" yang baru. Tidak ada latar belakang seperti itu sekarang. Para trader profesional mungkin akan segera menutup posisi beli. Angka-angka saat ini memungkinkan kelanjutan penurunan euro dalam beberapa bulan mendatang.

Kalender berita untuk AS dan Uni Eropa:

AS - Indeks Manufaktur Fed Philadelphia (13:30 WIB).

AS - Klaim Pengangguran Awal (13:30 WIB).

AS - Produksi Industri (14:15 UTC).

Pada tanggal 16 November, kalender peristiwa ekonomi berisi tiga entri urutan kedua.

Dampak latar belakang informasi pada sentimen trader pada hari Kamis mungkin lemah.

Perkiraan untuk EUR/USD dan rekomendasi trader:

Saya masih tidak menyarankan untuk mempertimbangkan membeli pasangan mata uang ini saat ini. Jika kuotasi yang terkonsolidasi di atas level 1,0862 dengan target yang berada di level 1,0958, harus dipahami bahwa setelah kenaikan 200 poin, probabilitas pergerakan seperti itu rendah. Saya merekomendasikan penjualan kemarin saat menutup di bawah level 1,0862 pada grafik per jam dengan target yang berada di level 1,0765. Transaksi ini dapat tetap dibuka sekarang.

Bahasa Indonesia

Bahasa Indonesia

Русский

Русский English

English Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română