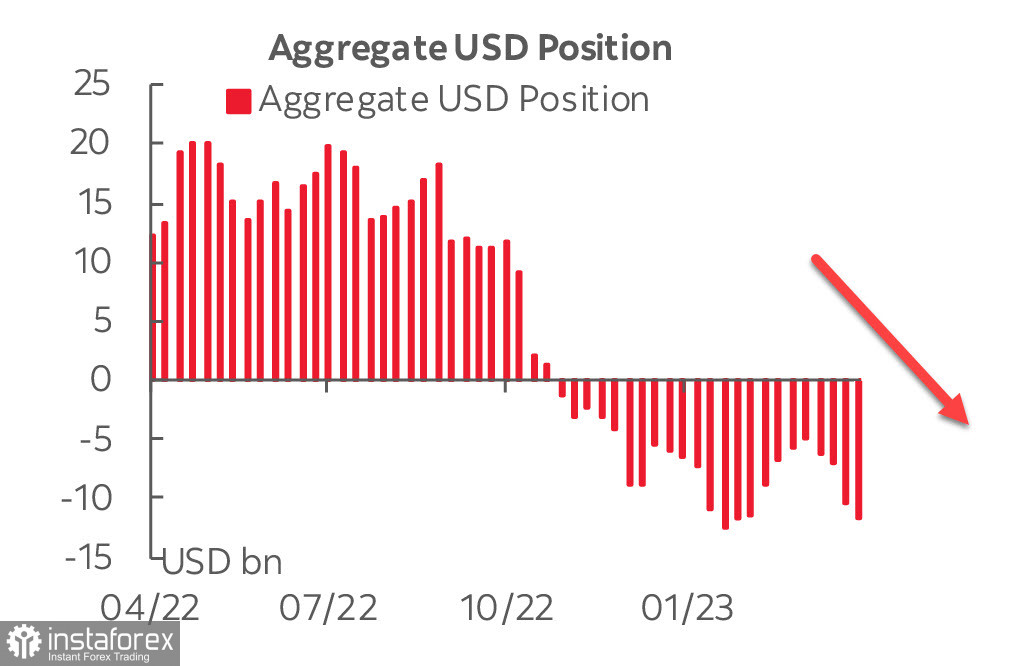

Posisi pendek bersih pada dolar AS meningkat sebesar 1,225 miliar menjadi -11,7 miliar untuk minggu pelaporan. Data menunjukkan bahwa permintaan untuk dolar menurun, dengan agregat net short spekulatif dalam dolar menjadi yang terbesar sejak pertengahan Februari, dengan akun uang riil meningkatkan net short position mereka ke tertinggi sejak pertengahan 2021. Akun dengan leverage menjual dolar kurang aktif, tetapi trennya sama.

PMI AS dan Eropa melampaui ekspektasi, terutama karena kinerja yang kuat di sektor jasa. Indeks komposit zona euro berdiri di 54,4 versus 53,7, jasa di 56,6 versus 54,5 yang diharapkan, dan manufaktur di 45,5 versus 48,0 yang diharapkan. Indeks Komposit AS adalah 53,5 versus 51,2 yang diharapkan, jasa pada 53,7 versus 51,5 yang diharapkan, dan sektor manufaktur pada 50,4 versus 49,0 yang diharapkan.

Ketegangan dalam laporan PMI disebabkan oleh faktor inflasi yang semakin meningkat. Laporan PMI AS menyatakan: "Harga output keseluruhan naik pada laju tercepat selama tujuh bulan. Perusahaan menyatakan bahwa kondisi permintaan yang lebih akomodatif memungkinkan mereka untuk terus melewati suku bunga yang lebih tinggi, gaji staf, tagihan listrik dan biaya material kepada klien." Kondisi permintaan yang membaik mendukung pertumbuhan yang lebih cepat di bulan April, tetapi juga menyebabkan kebangkitan momentum inflasi.

Laporan PMI menunjukkan hal berikut. Meskipun pengetatan moneter yang agresif di kedua sisi Atlantik, sejumlah faktor negatif telah hilang - krisis energi Eropa dan kembalinya China ke pertumbuhan aktif. Tekanan inflasi tetap tinggi, terutama mengingat laju pertumbuhan upah yang cepat. Semua ini tidak memungkinkan kemenangan cepat atas inflasi.

Minggu ini, banyak laporan penting keluar dari AS (pesanan barang tahan lama, PDB, pengeluaran konsumsi pribadi), sehingga volatilitas dapat meningkat. Pergerakan yang kurang lebih kuat hanya mungkin terjadi dalam kasus penilaian ulang prospek suku bunga Fed, yang tidak mungkin terjadi.

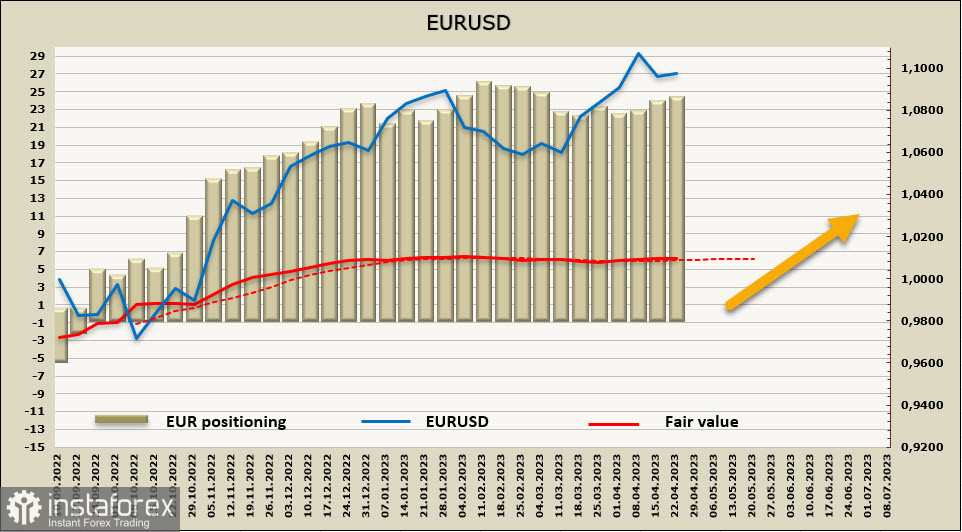

EURUSD

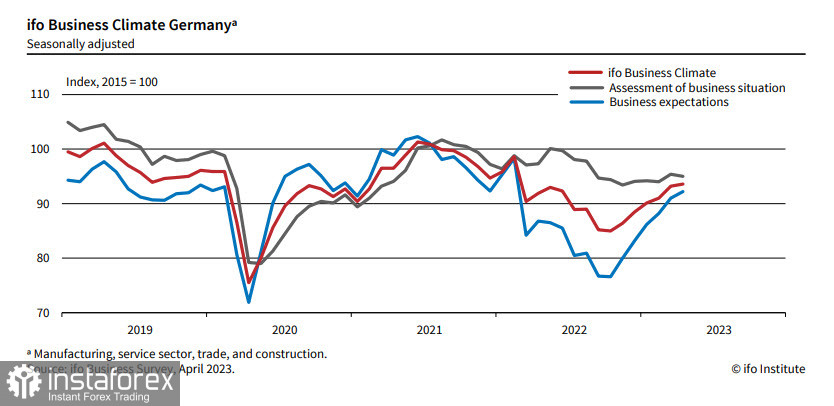

Sentimen dalam bisnis Jerman sedikit membaik. Indeks iklim bisnis Ifo naik menjadi 93,6 poin di bulan April dibandingkan dengan 93,2 poin di bulan Maret. Hal ini disebabkan ekspektasi perusahaan yang membaik. Namun, perusahaan menilai situasi mereka saat ini agak lebih buruk. Kekhawatiran bisnis Jerman melemah, tetapi ekonomi masih kurang dinamis. Momentum keseluruhan jelas telah melambat, dan dorongan positif yang terkait dengan pencabutan pembatasan COVID dan mitigasi krisis energi hampir selesai.

The European Central Bank is entering a silent mode before the meeting on May 4th. It is expected that the ECB will raise rates in May, but the size of the hike is unclear, as the market forecast gives a 20% probability of a 50 bps hike and 80% for a 25 bps hike. The further dynamics of EURUSD depend on the ECB's actions. A 25 bps hike may lead to a corrective decline in the euro, while a 50 bps hike, on the contrary, will result in a strong bullish momentum.

The net long position in the euro increased by $263 million to $22.542 billion over the reporting week. The increase is small, but the clearly expressed bullish bias remains, and there are no reasons to expect a downward reversal of the euro yet. The calculated price, following the stability in the futures, is also stable, slightly above the long-term average. The momentum is weak, but there is no sign of a reversal trend.

A week earlier, we saw targets of 1.1180 and 1.1270 for EURUSD, and as the pair spent the last few days in consolidation mode, these targets remain relevant. The latest macro data, primarily inflation reports, have barely changed expectations for the future actions of the Fed and ECB. At the moment, the ECB's position looks more hawkish, meaning the yield differential will change in favor of the euro.

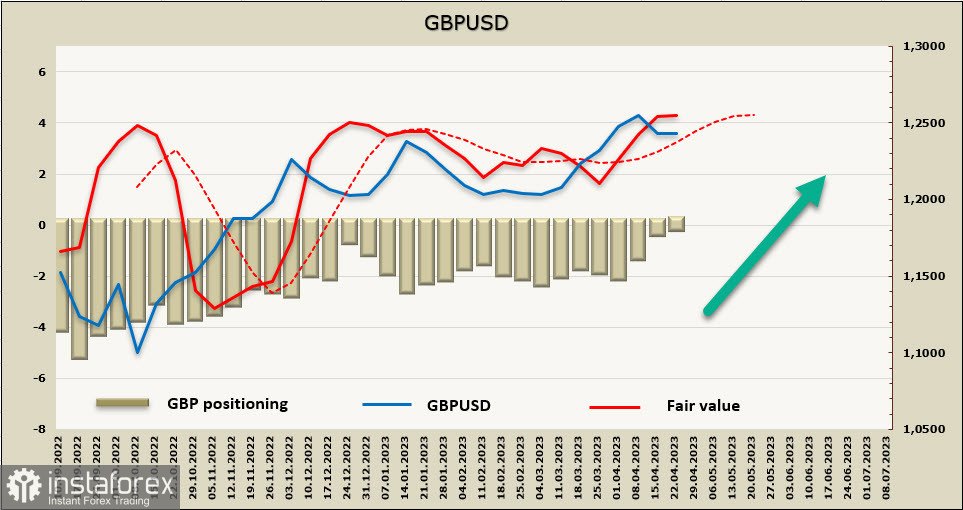

GBPUSD

Core retail sales data in the UK were weak, coming in at -1.0% MoM against an expected -0.6%, although they were revised upwards. The statistical service blamed this on poor weather. Meanwhile, a separate survey showed that consumer confidence in the UK rose to its highest level in a year. The April PMI for the service sector was 54.9, higher than the 52.9 forecast, and the same effect is observed in the US and eurozone countries – inflationary pressure remains too high to hope for a quick decline.

In February, inflation growth slowed from 10.4% to 10.1%, significantly higher than forecasts. The NIESR Institute has traditionally prepared three scenarios for the development of inflationary pressure, called "medium," "high," and "very high." A low inflation scenario is not even considered, meaning the choice is between bad and very bad scenarios. The option of a slow slowdown in price growth is still considered as the base case, but it is noted that the likely increase in geopolitical tensions between Russia and NATO, as well as between the US and China, will quickly worsen the overall picture to levels far exceeding those in 2022.

A long position of $101 million has finally been formed for the pound, with an insignificant bias and a weekly change of +$287 million. The calculated price is above the long-term average and is heading upwards.

As expected, the pound has stayed above the support at 1.2340, and consolidation is observed. The likelihood of resuming growth is still higher, so we expect that after the consolidation is completed, the pound has a good chance of resuming growth. The nearest target is the local high of 1.2545, with a medium-term target of 1.2750.

Bahasa Indonesia

Bahasa Indonesia

Русский

Русский English

English Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română