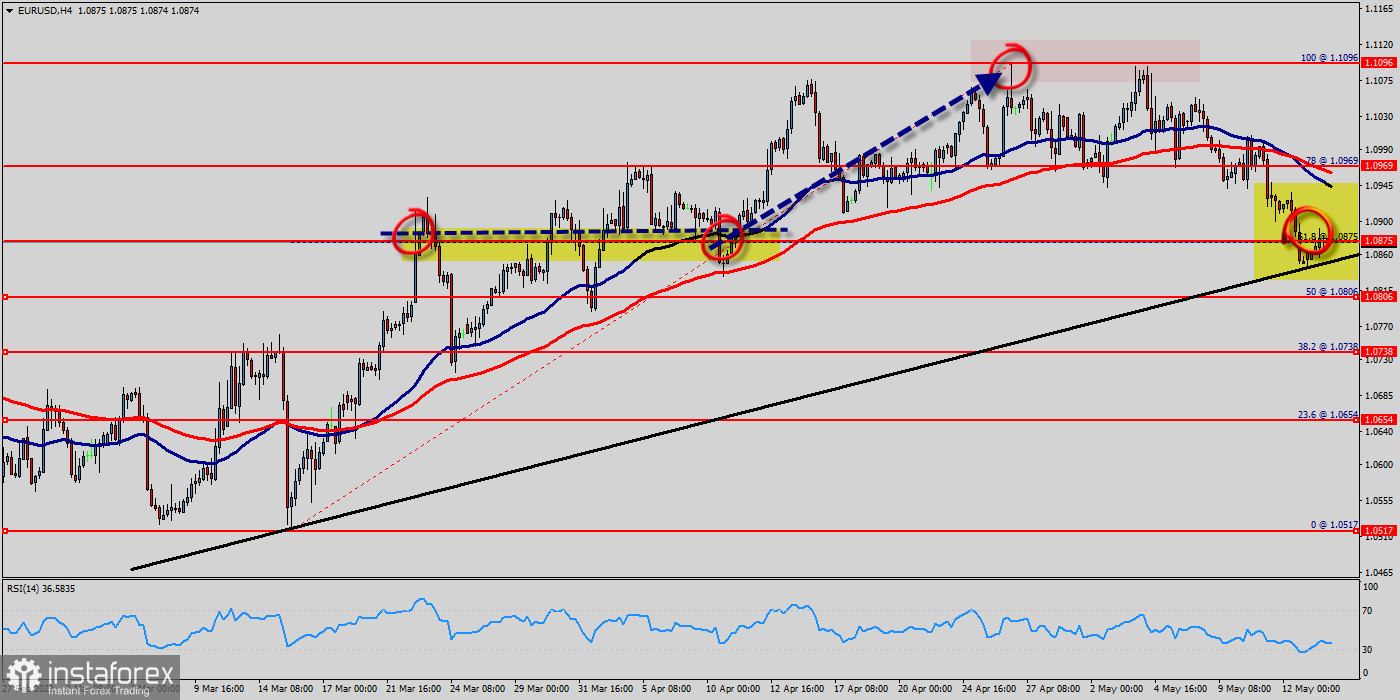

Euro parity still in play ahead of decisive US inflation data, for that common currency came within whisker of 1.1018 this week. Right now, the EUR/USD pair is still moving around the price of 1.1018. The currency pair EUR/USD is trading below the resistance levels of 1.1052 and 1.1092. The euro to US dollar (EUR/USD) rate has risen about 0.25% month-to-date to trade around 1.1018. The raise is comparable to gain last seen for three weeks, when the European Central Bank unleashed its massive stimulus programme. The EUR/USD pair continues to move upwards from the level of 1.1018, which represents the double bottom in the hourly chart. The pair rose from the level of 1.0970 to the top around 1.1018 USD. Today, the first resistance level is seen at 1.1052 followed by 1.1092 and 1.1115, while daily support is seen at the levels of 1.0943 and 1.015. According to the previous events, the EUR/USD pair is still trading between the levels of 1.0943 and 1.1092. Hence, we expect a range of 149 pips in coming hours (1.1092 - 1.0943).

The first resistance stands at the price of 1.0927, therefore if the EUR/USD pair succeeds to break through the resistance level of 1.1092, the market will rise further to 1.1115. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.1092 in order to test the second resistance (1.1115).

The US Dollar and the Euro are two of the most prominent and well-known currencies in the world. The Euro versus US Dollar (EUR/USD) currency pair has the largest global trading volume, meaning it is the world's most-traded currency pair. Whether you find the instrument easy or difficult to trade on, it's not a pair that many traders neglect, due to its daily volatility and price movement.

The market is indicating a bearish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. Today, support is seen at the levels of 1.0943 and 1.0915. So, we expect the price to set above the strong support at the levels of 1.0943 and 1.0915; because the price is in a bullish channel now.

The RSI starts signaling upward trend. Consequently, the market is likely to show signs of a bullish trend. It will be good to buy above the level of 1.1018 with the first target at 1.1092 and further to 1.1115 in order to test the daily resistance. If the EUR/USD pair is able to break out the daily resistance at 1.1055, the market will rise further to 1.1115 to approach support 3 in coming hours or two days. However, the price spot of 1.1115 and 1.1092 remains a significant resistance zone. Therefore, the trend is still bullish as long as the level of 1.0915 is not breached.

After finding bids reach to 1.0943, the EUR/USD pair price recovered above 1.0903 and 1.0943. Initial the EUR/USD pair resistance lies near the 1.1000 level (38.2% of Fibonacci retracement levels). A decent breakout and follow-up move above 1.0903 or/and 1.0943 could open the gate for a push towards the 1.1000 level.

The main support remains near the area of 1.0903 and 1.0943. Also it should be noted that the EUR/USD pair and packets of pairs unite as the bulls gain their momentum. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. The EUR/USD pair increased within an up channel.

Closing above the pivot point (1.0943) could assure that the EUR/USD pair will move higher towards cooling new highs. The bulls must break through 1.0943 in order to resume the up trend.

Trading recommendations :

The trend is still bullish as long as the price of 1.0903 is not broken. Thereupon, it would be wise to buy above the price of at 1.0943 with the primary target at 1.1000. Then, the EUR/USD pair will continue towards the second target at 1.1092 (a new target is around 1.2040 in coming days).

The breakdown of 1.0903 will allow the pair to go further down to the prices of 1.0803 and 1.0732.

An uptrend will start as soon, as the market rises above support level 1.0943, which will be followed by moving up to resistance level 1.1000. Further close above the high end may cause a rally towards 1.1092 and 1.2040. Nonetheless, the weekly resistance level and zone should be considered.

On the downside, the 1.0943 level represents support. The next major support is located near the 1.0903, which the price may drift below towards the 1.0855 support region.

Bahasa Indonesia

Bahasa Indonesia

Русский

Русский English

English Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română