Overview:

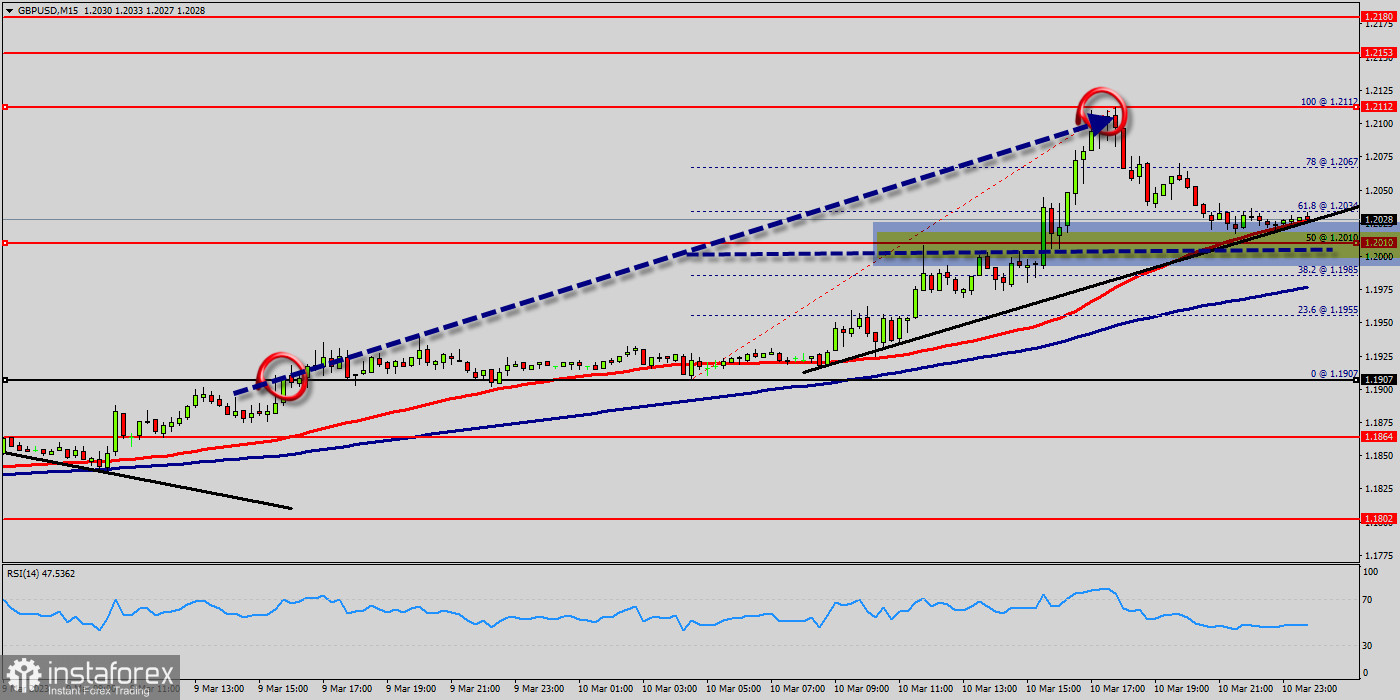

The bullish trend is currently very strong on The GBP/USD pair. As long as the price remains above the support levels of 1.2010, you could try to benefit from the growth. The first bullish objective is located at the price of 1.2035.

The bullish momentum would be boosted by a break in this resistance (1.2035). The hourly chart is currently still bullish. At the same time, some stabilization tendencies are visible between 1.2010 and 1.2112.

Together with the relatively large distance to the fast-rising 100-day moving average (1.2035), there are some arguments for a relief rally in coming months on the table.

The GBP/USD pair is at highest against the dollar around the spot of 1.2035 since last week. The GBP/USD pair is inside in upward channel. For some weeks the GBP/USD pair decreased within an up channel, for that the GBP/USD pair its new highest 1.2067.

Consequently, the first support is set at the level of 1.2010. Hence, the market is likely to show signs of a bullish trend around the area of 1.2010 and 1.2035.

RSI is seeing major support above 40% and a bullish divergence vs price also signals that a reversal is impending.

According to the previous events the price is expected to remain between 1.2010 and 1.2112 levels.

Buyers would then use the next resistance located at 1.2067 as an objective. Crossing it would then enable buyers to target 1.2112 (the double top - last bullish week).

Be careful, given the powerful bullish rally underway, excesses could lead to a possible correction in the short term. If this is the case, remember that trading against the trend may be riskier. It would seem more appropriate to wait for a signal indicating reversal of the trend.

The GBP/USD pair has plunged up for a fresh two weeks high. Prices pushed above a key retracement from a Fibonacci setup that spans from the lowest price of 1.2010 (50% of Fibonacci on the hourly chart), for that buyer pulled the bid back-above that level by the end of the week.

This week, the GBP/USD pair traded up and closed the day in the red area near the price of 1.2028. Today it rose a little, rising above 1.2010. If the pair succeeds in passing through the level of 1.2035, the market will indicate the bullish opportunity above the level of 1.2035 in order to reach the second target at 1.2112.

In the very short term, the general bullish sentiment is confirmed by technical indicators. Therefore, a small upwards rebound in the very short term could occur in case of excessive bearish movements.

The trend is still bullish as long as the price of 1.2010 is not broken. Thereupon, it would be wise to re-buy above the price of at 1.2010 with the objective of 1.2035. We should see the pair climbing towards the next target of 1.2067. The pair will move upwards continuing the development of the bullish trend to the level 1.2112 in coming days.

Bahasa Indonesia

Bahasa Indonesia

Русский

Русский English

English Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română