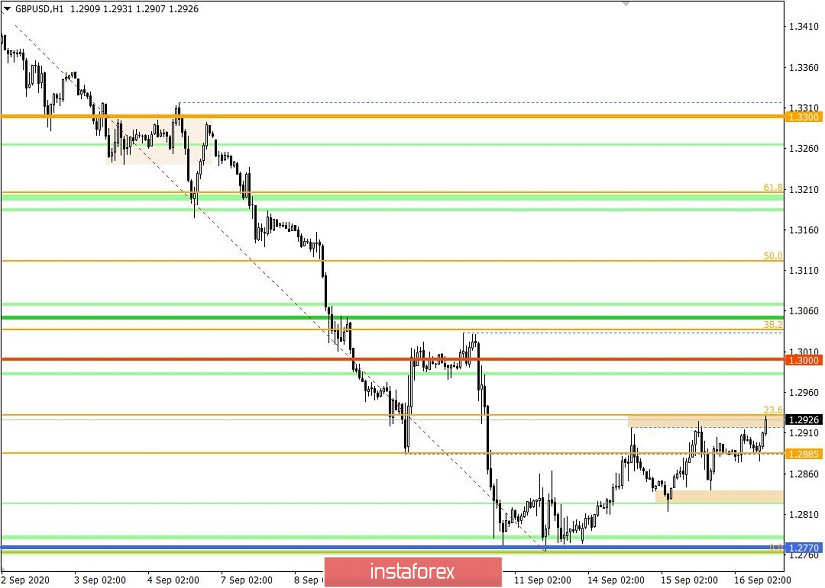

GBP / USD broke out of 1.2885, stretching by as much as 100 points (1.2825 / 1.2930) in the chart. Such a strong movement indicates only one thing: market participants are in a high degree of uncertainty because of current issues around Brexit.

As we all know, the market is now operating in the hands of Brexit. All movements are currently via the influence of progress regarding the issue, thus:

- Any deterioration will lead to the expansion of the current range 1.2825 / 1.2930 to 1.2770.

- An improvement or temporary lull can play into the hands of a correction from 1.2770 towards the level of 1.3000.

So, if we look at the M15 chart to analyze the trades opened yesterday in GBP / USD, we will see that a bullish mood arose during the Asian and European sessions, during which the quote reached a price level of 1.2930. Then, everything changed at the US trading session, when short positions appeared and quickly returned the quote below 1.2885.

Such resulted in a volatility not below 100 points, which indicates high speculative activity in the market.

Most traders did follow the suggestions in the previous review , so no sharp surges were observed, except for local speculations.

Thus, in the daily chart, movement was down since September 1-10, coursing along the direction of 1.2770. The correction was also normal considering such significant price changes.

A number of statistics on the UK economy were published yesterday, one of which is the data on the UK labor market, which revealed that unemployment in the country continues to rise, having reached a rate of 4.1%. In turn, applications for unemployment benefits also rose by about 73.7 thousand.

"This is a difficult time for all of us as the pandemic continues to have a profound impact on jobs and livelihoods. This is why protecting jobs and helping people get back to work continues to be my number one priority, "UK Treasury Secretary Rishi Sunak said.

Meanwhile, investors and traders continue to be concerned about the crumbling negotiations between the UK and the EU, as the controversial bill on the domestic market of Great Britain, which provokes criticism of the European Union and the opposition, could cause a hard Brexit and glum future. The Economists are already sounding the alarm and predicting the worst times for Britain if the Brexit deal fails.

"We are skeptical of the argument that the scale of the economic impact of COVID-19 will obscure the economic impact of the breakdown of Brexit negotiations," Goldman Sachs said in a report.

Today, data on UK inflation was released, and, according to the report, it recorded a decrease from 1.0% to 0.2%.

At the same time, the FOMC held a meeting today, during which the Fed maintained its super-soft monetary policy, which many already expected.

Further development

As we can see on the trading chart, GBP / USD traded within the range 1.2825 / 1.2930, trying to resume the previously set correction from 1.2770. If the quote moves further above 1.2930, the quote will locally go towards 1.3000, after which it will slow down.

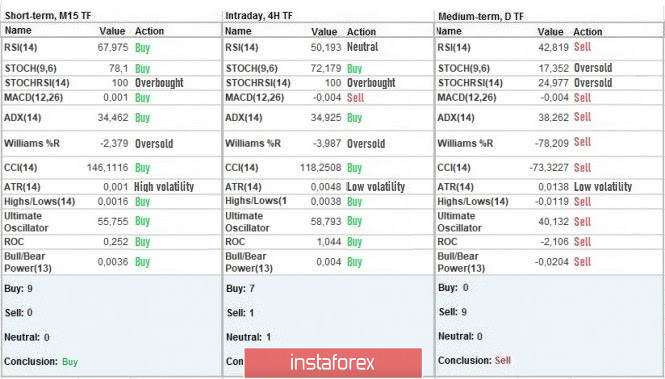

Indicator analysis

Looking at the different time frames (TF), we can see that the indicators on minute and hourly periods signal BUY due to a price consolidation around 1.2930. The daily period, on the other hand, signals SELL, reflecting the downward move from 1.3480.

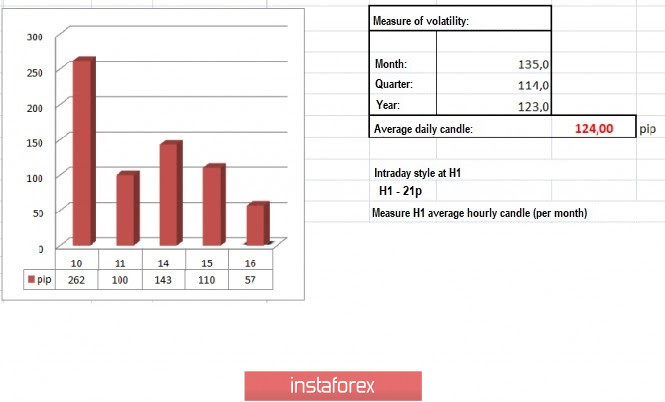

Weekly volatility / Volatility measurement: Month; Quarter; Year

Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year.

(The dynamics for today is calculated, all while taking into account the time this article is published)

Volatility is at 57 points, which is 54% below the average value. Nonetheless, activity is still considered high, at it will continue to be so due to the latest news and speculation within the market.

Key levels

Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support areas: 1.2885 *; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

Also check trading recommendations for the EUR/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română