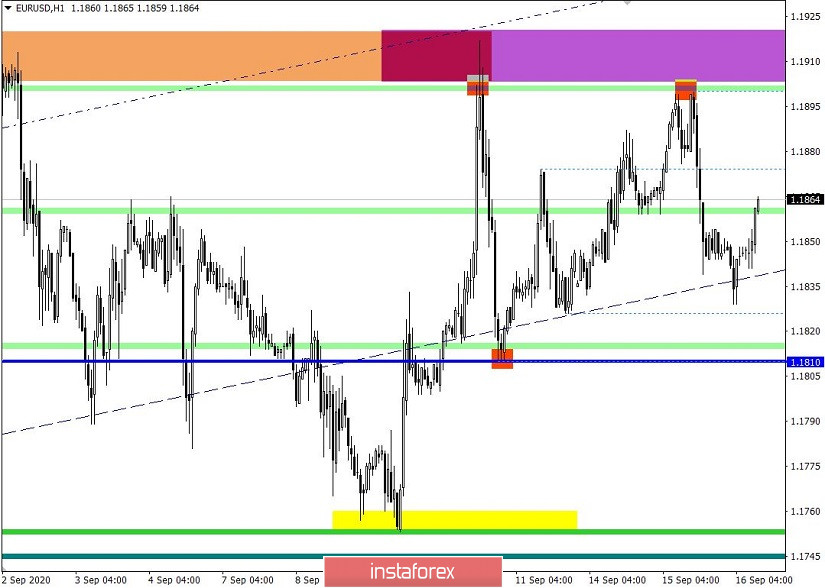

The euro/dollar pair continues to fluctuate in the structure of the side channel from the levels of 1.1700/1.1810/1.1910, where the area of the upper border played the role of resistance once again, slowing down the upward movement and turning it in the opposite direction.

The logical basis associated with price levels (1.1700/1.1810/1.1910) has been going on in the market for more than six weeks, where a slowdown in the upward trend is no longer considered a theory.

Based on the time spent on price deceleration, we can assume that the market is preparing for large changes in the form of an inertial move. In terms of logic, we could say that it all comes down to a change in trend from an upward to a downward one, which, for example, is already happening on the pound/dollar currency pair, but it's not so simple. The emotional background of the market can play a trick with traders, where instead of a targeted movement, a local one will arise, which can become a big delusion and losses on a trading deposit. That is why our strategy is a local approach to trading operations with a 1-2-day perspective, which makes it possible to be not only in tact with the market, but also against its emotional background.

Analyzing the last trading day by the fifteen-minute, we can see that the round of short positions arose from 11:00 and lasted until 14:00 UTC +00, where the period of the start of the US session became the most active part of time.

In terms of daily dynamics, a low indicator of 61 points is recorded, which is 24% below the average level. It is worth considering that when analyzing the hourly chart, inertial fluctuations are stably recorded, formed within the day, which indicates the involvement of speculators in the market.

As discussed in the previous review, traders considered a logical basis associated with price fluctuations in the sideways channel 1.1700/1.1810/1.1910, where the approach to the upper border was seen as a sell signal towards 1.1860 - 1.1810 - 1.1700.

Looking at the trading chart in general terms (daily period), you can see the same six-week slowdown in the medium-term upward trend, which signals a reduction in the volume of long positions.

The news background of the past day contained data on the volume of industrial production in the United States for August. The rate of decline of which accelerated from -7.42% to -7.73% against the forecast of -6.1%. As we can see, not everything is as bad as it might seem, the rate of recovery has been set since April and there is a significant change from -16.5 to -7.73%. The fact that the current forecasts were not confirmed does not negate the fact of gradual stabilization. It is also worth noting that the data for July was revised for the better from -8.18% to -7.42%.

The market reaction to the statistics was in favor of the US dollar.

In terms of the information background, the market continues to feel instability in the Brexit process, which has not yet fully affected the European currency, or rather, it ignores the possible failure of negotiations between England and Brussels, as well as Britain's exit from the EU without a deal at all. The most important thing here is to monitor the Brexit information flow, as the deterioration of the situation will force the euro to decline and quite actively.

In turn, European Central Bank (ECB) board member Fabio Panetta said yesterday that the regulator is not completely satisfied with the effect of its monetary policy.

"The results achieved by the monetary policy measures are remarkable, but they are not yet fully satisfying the ECB, as price pressures and inflationary expectations are expected to remain subdued. In light of the current inflation forecast, we need to remain cautious and carefully assess the information received, including the dynamics of the exchange rate," Fabio Panetta said.

Perhaps, today is the most important day in terms of the economic calendar. The results of the FOMC meeting will be released, where changes in interest rates are not expected, but clarifications about the strategy and operations of the regulator in the future are expected. Bloomberg, referring to anonymous sources, writes that the Fed will maintain interest rates until 2023. If this is confirmed during a press conference by Jerome Powell, the US dollar will be under strong pressure, under sales. But it should be understood that rumors are not a fact, and it is very likely that Powell will not name any terms for containing the rate, and his rhetoric will always be smeared with words about economic recovery and external risks.

Thus, if there is not something extraordinary in Powell's words, then the market will not react much at the time of the meeting's results, and it will take time to comprehend the speech of the FRS head, which will result in movement on the market already on Thursday.

USA 18:00 Universal time - Results of the Fed meeting

USA 18:30 Universal time - Press conference

In terms of statistical data, we have retail sales figures in the United States (12:30 Universal time), where they are expected to slow down from 2.7% to 2.5%.

Further development

Analyzing the current trading chart, you can see that the quote is still in the upper part of the side channel 1.1810/1.1910, where about 18 points were missing before reaching the average level. The price fluctuation at the given levels will remain on the market for some time, where it is necessary to see clear consolidations relative to 1.1810/1.1910 for significant changes, which may lead to a local growth towards a breakdown.

Based on the above information, we will display trading recommendations:

- Buying a pair is considered at a price above 1.1925, with the prospect of moving to 1.1950-1.1990.

- Selling a pair is considered at a price below 1.1800, with the prospect of moving to 1.1755-1.1700.

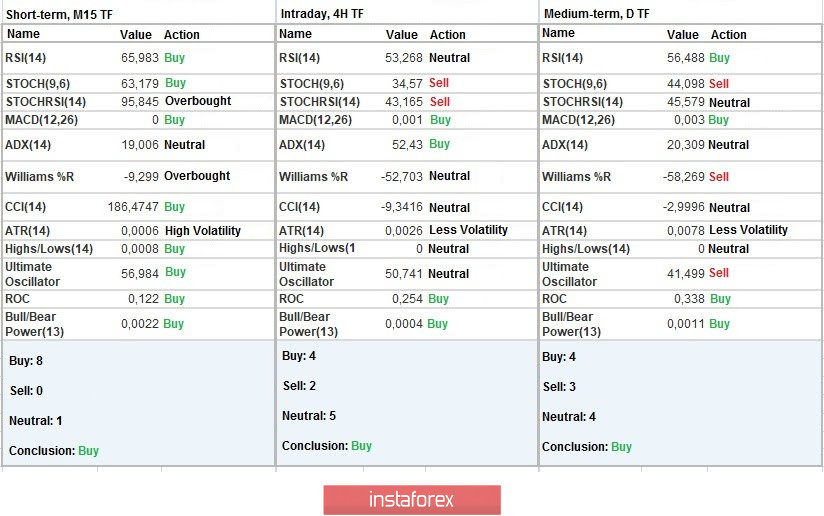

Indicator analysis

Analyzing different sectors of time frames (TF), we see that indicators of technical instruments on hourly and daily intervals have a buy signal, but based on general consideration, the signal should be regarded as neutral.

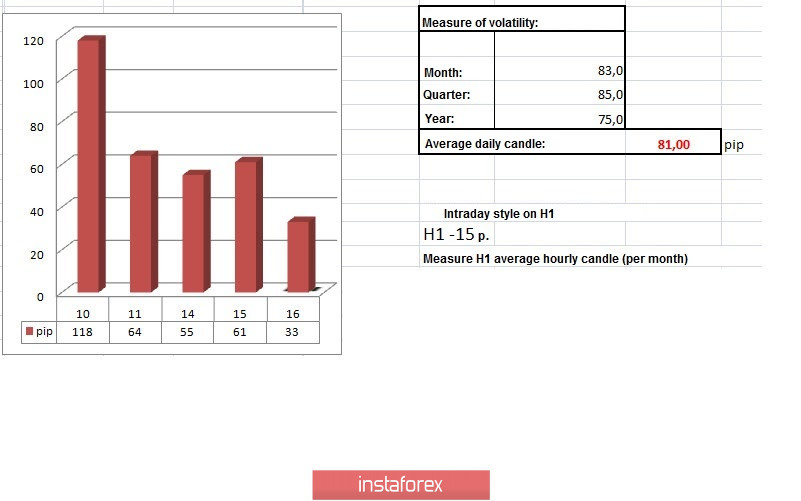

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month / Quarter / Year.

(September 16 was built taking into account the publication time of the article)

The volatility of the current time is 33 points, which is 59% below the average. It can be assumed that there is a chance of acceleration due to speculation amid the results of the Fed meeting and emotions associated with Brexit.

Key levels

Resistance zones: 1.1910 **; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825.

Support zones: 1.1800; 1.1650 *; 1.1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***.

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română