Speculative activity arose at yesterday's trading, during which the quote managed to move closer to the high reached on July 9 (1.1370), locally breaking through it with the shadows of 1.1370 -> 1.1374. The pattern of the technical analysis, or rather its psychological part, played a major role in the movement, at which long positions declined sharply, and a pullback occurred in the market, returning the quote below the level of 1.1350. But no matter how hard the bulls tried to change the trend, they still weren't able to succeed, and the market continued to concentrate in the variable range 1.1180 / 1.1350. It seems that the quotes will hang there for a long time, but there are theories that the upper limit of 1.1350 will soon expand to 1.1400 / 1.1440. Nevertheless, the recurring fluctuation will continue to transpire in the market.

For major changes, there are two points needed to be broken through in the market. The first one is the level of 1.1440 / 1.1500, a breakout from which will lead to a change in the market tact of the medium-term downward trend. The second point, meanwhile, is the area of 1.1165 / 1.1180 / 1.1190, a breakout from which will lead to changes in the structure of the flat and to the subsequent recovery relative to the earlier movement on May 18.

Analyzing yesterday's trading in detail, we can see that a round of long positions arose around noon, but the main surge of activity appeared from 14:00 until 17:00, during which the quotes hit the high reached on July 9. After that, they underwent a pullback and stagnation within the level of 1.1350.

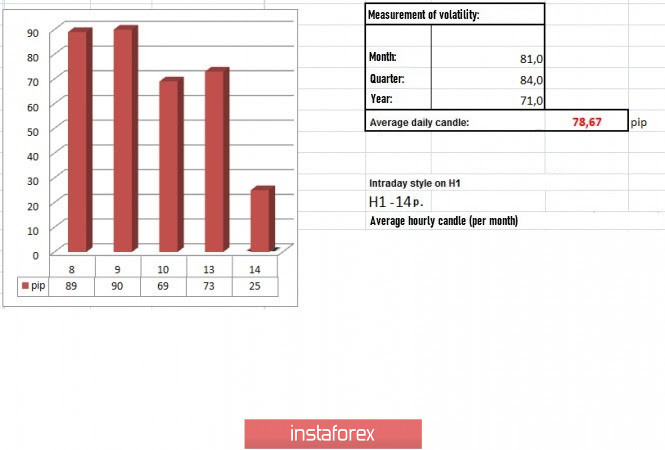

Thus, for volatility, a gradual acceleration from 69 to 73 points was recorded, but it is still below the average daily level of 78 points. Nevertheless, relative to the minute and hour intervals, acceleration was still observed, which embodies the speculative mood of the market.

As discussed in the previous review , traders planned to open short positions if the quotes consolidated below the level of 1.1300. However, it did not happen, so they resorted to speculative activity which made it possible to earn profit on local long operations in the direction of 1.1300-1.1370.

Analyzing the trading chart in general terms (the daily period), we can see that over the past week, the quote has been concentrated in the upper part of the side channel, where, based on the laws of technical analysis, there is a chance of a reversal, in which the concentration of trading forces will take place in the area of 1.1180 / 1.1250.

As for news, the reports published yesterday did not contain important macroeconomic statistics for Europe and the United States. Hence, speculative activity remained at a high level, which dominated the market sentiment.

The news yesterday was all about the coronavirus, Brexit, and the weak recovery of the world economy.

One example is the speech of Dallas Fed President Robert Kaplan which warned that the incentive measures given by the Fed will not last forever and will be curtailed after the US economy returns to normal.

"I think it would be wise if we give a signal that as soon as the state of the economy improves, it will be right for us to limit and curtail some of these programs. Incentive measures were needed, but how long should this last? I am sure that we need to return to a market that functions without the help and without the intervention of the Fed, " Kaplan said.

Today, the data on industrial production in Europe will come out, where, based on forecasts, the rate of decline should slow down from -28.0% to -20.2%. The factor is positive and reflects the slow recovery of the EU economy.

In the afternoon, the final data on inflation in the United States will be published, where they expect growth from 0.1% to 0.5-0.6%. However, based on recent indicators, the data may not coincide with the forecast, which will lead to a sharp weakening of the US dollar. In addition, low inflation may result to the expansion of the Fed's quantitative easing program, which scares investors.

13:30 (UTC + 1) - publication of the data on US inflation

Further development

Analyzing the current trading chart, we can see that the pair underwent a rollback, in which the quotes concentrated just below the level of 1.1350. A number of trading signals indicated it, and if we use technical analysis, we can see that a rebound is possible from the upper region of the flat, in the direction of 1.1300 - 1.1250 - 1.1190. The upcoming data on US inflation will play an integral role in the current movement, at which if the data coincides with the forecast, activity will increase, which will lead the quotes to the values 1.1300 - 1.1250 - 1.1190. But if the data turns out negative, the dollar will undergo large sell-offs which will expand the flat from 1.1180 // 1.1250 // 1.1350 to 1.1400 / 1.1420.

Thus, based on the above information, we present these trading recommendations:

- Sell positions lower than 1.1325, in the direction of 1.1300 - 1.1250 - 1.1190.

- Buy positions higher than 1.1350, towards 1.1370. Buy again if the quotes reach higher than 1.1375, towards 1.1400 / 1.1420.

Indicator analysis

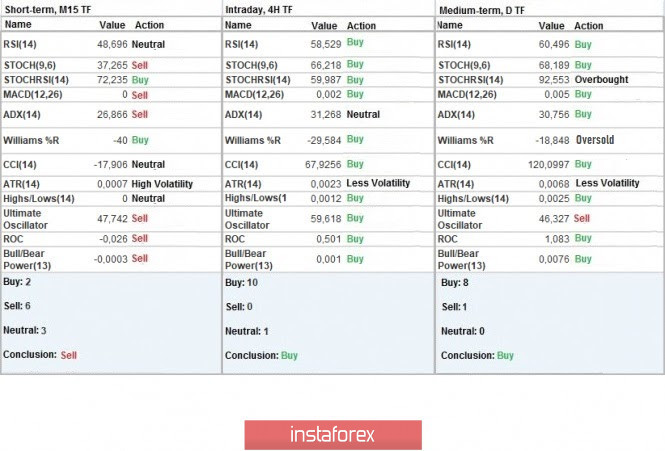

Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments in the hourly and daily periods signal "buy" due to a speculative jump in quotes yesterday. Meanwhile, the minute intervals signal "sell" due to a rollback and consolidation below the level of 1.1350.

Volatility per week / Measurement of volatility: Month; Quarter Year

The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year.

(July 14 was built, taking into account the time the article is published)

The volatility at this current time is 25 points, which is 67% lower than the daily average. But due to the upcoming news, it is expected to increase significantly.

Key levels

Resistance Zones: 1.1350; 1.1440 / 1.1500; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100

Support areas: 1.1250 *; 1.1180 **; 1.1080; 1,1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***.

* Periodic level

** Range Level

*** Psychological level

Also check the hot forecast and trading recommendations for the GBP/USD pair here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română