Analýza piatkových obchodov:

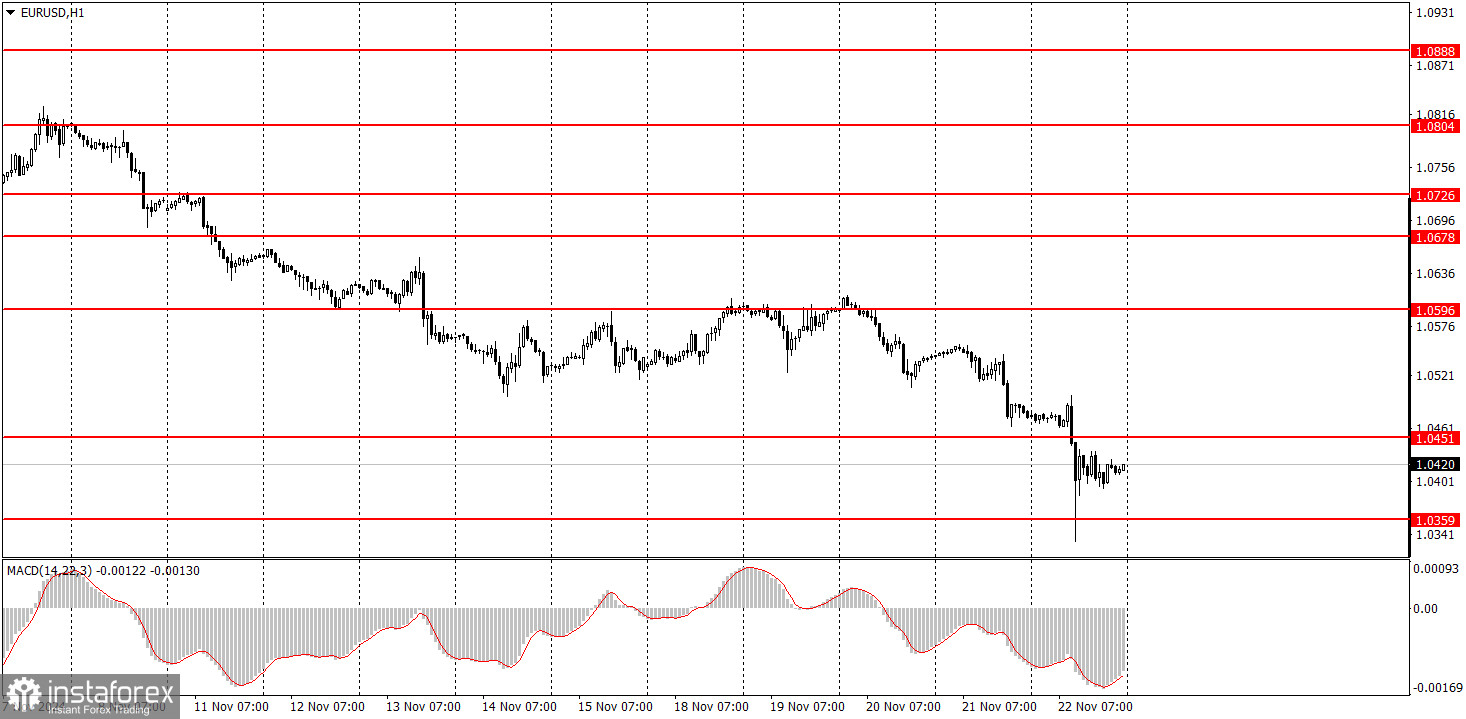

1-hodinový graf páru EUR/USD

Pár EUR/USD zaznamenal v piatok ďalší prudký pokles, pričom len za niekoľko hodín klesol o 150 pipov. Pre začínajúcich obchodníkov je dôležité poznamenať, že takýto výrazný pohyb v takom krátkom časovom rámci je pre euro zriedkavý. K takejto reakcii trhu zvyčajne nedochádza, a to ani po zasadnutiach centrálnych bánk. Piatkový prepad eura, ktorý vyvolalo zverejnenie údajov o PMI z eurozóny a Nemecka, je odrazom panického správania trhu, signalizujúceho útek od eura.

Euro sa môže mierne odraziť alebo sa pokúsiť o korekciu, ale všeobecný sentiment zostáva medvedí. Ak trh pri správach mierneho významu klesne v priebehu dvoch hodín o 150 pipov, jasne to svedčí o silnej tendencii predávať euro. Varovali sme pred tým počas celého roka 2024 a súčasný vývoj je v súlade s našimi očakávaniami. Prvý cieľ na úrovni 1,0451, ktorý sme už spomínali, bol dosiahnutý. Domnievame sa, že euro by mohlo klesnúť ešte viac.

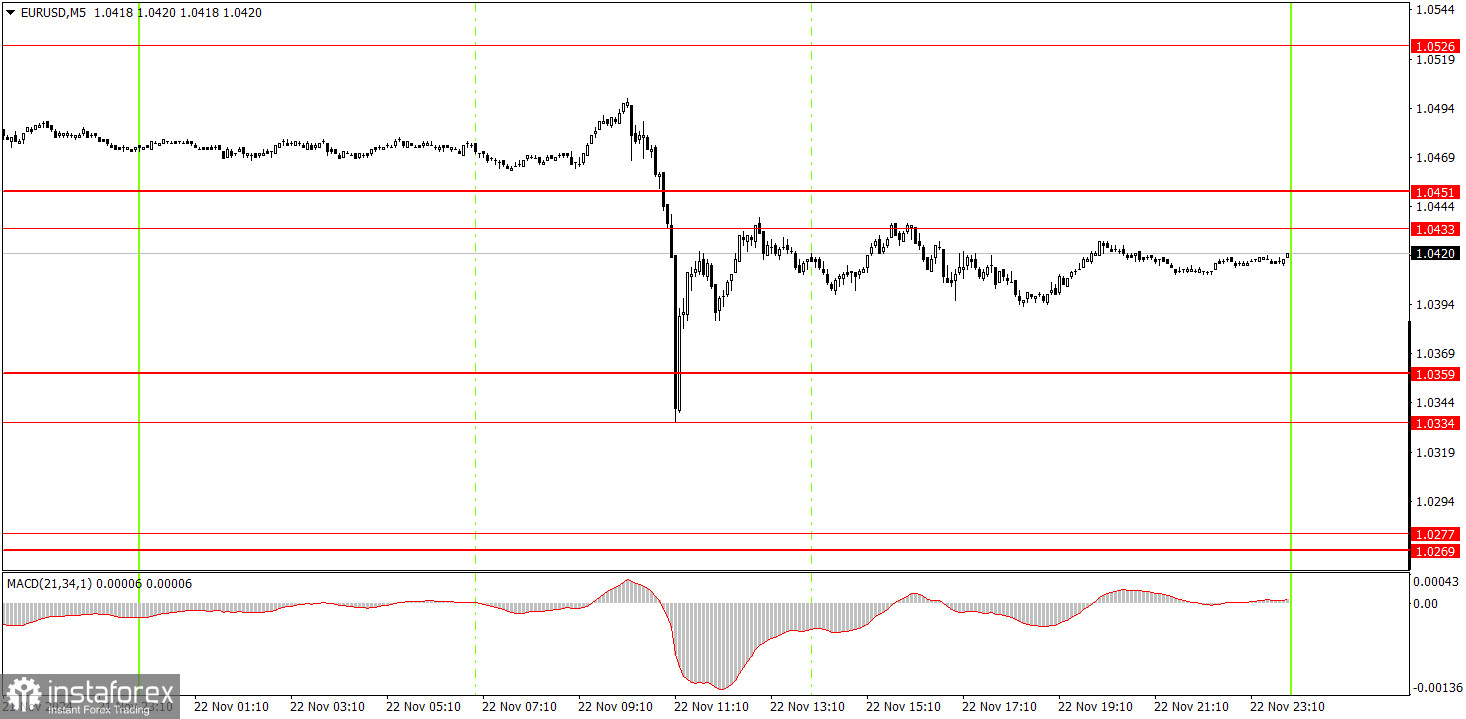

5-minútový graf páru EUR/USD

V piatok sa na 5-minútovom grafe vytvorilo niekoľko obchodných signálov, ale predpovedať takýto prudký pokles bolo takmer nemožné. Obchodníci mohli po prelomení zóny 1,0433 ‒ 1,0451 vstúpiť do krátkych pozícií, pričom prvý cieľ na úrovni 1,0359 bol dosiahnutý rýchlo. Obchodovanie pri odraze od tejto úrovne by sme však vzhľadom na rýchlosť odrazu neodporúčali (aj keď cieľové úrovne boli v tomto prípade dosiahnuté).

Obchodné tipy na pondelok:

Na hodinovom grafe pár EUR/USD nevykazuje žiadnu výraznejšiu korekciu, keďže trh zrejme nie je ochotný nakupovať euro. Hoci je možné, že dôjde k menšiemu ústupu smerom nahor (keďže na týždennom grafe cena dosiahla spodnú hranicu pásma, o ktorom sme predtým hovorili), nezaručuje to začiatok korekcie.Domnievame sa, že pokles by v pondelok mohol pokračovať v oblasti úrovní 1,0433 ‒ 1,0451, keďže trh naďalej signalizuje silný medvedí sentiment.

Kľúčové úrovne na 5-minútovom grafe sú 1,0269 ‒ 1,0277, 1,0334 ‒ 1,0359,1,0433 ‒ 1,0451, 1,0526, 1,0596, 1,0678, 1,0726 ‒ 1,0733, 1,0797 ‒ 1,0804, 1,0845 ‒ 1,0851, 1,0888 ‒ 1,0896. Na pondelok nie je v eurozóne ani v USA naplánované zverejnenie žiadnych dôležitých správ, takže piatkový prudký pokles by sa mohol zastaviť. Odporúčame sa zamerať predovšetkým na predajné signály.

Základné pravidlá obchodovania:

1. Sila signálu: čím kratší čas trvá, kým sa vytvorí signál (odraz alebo prelomenie), tým je signál silnejší.

2. Falošné signály: ak sa na základe falošných signálov otvoria na určitej úrovni dva alebo viac obchodov, následné signály z tejto úrovne by sa nemali brať do úvahy.

3. Trh bez trendu: na trhu bez jednoznačného trendu môže akýkoľvek menový pár vytvoriť viacero falošných signálov alebo žiadny signál. Je lepšie prestať obchodovať pri prvých náznakoch trhu bez trendu.

4. Obchodné hodiny: obchodné aktivity sa vykonávajú od začiatku európskej seansy do polovice americkej seansy, po ktorej by sa mali všetky otvorené obchody ručne zavrieť.

5. Signály MACD: na hodinovom grafe obchodujte na základe signálov MACD len v obdobiach dobrej volatility a jasného trendu, ktorý je potvrdený trendovými čiarami alebo trendovými kanálmi.

6. Blízke úrovne: ak dve úrovne ležia tesne vedľa seba (v rozmedzí 5 až 20 pipov), mali by sa považovať za zónu podpory alebo rezistencie.

7. Stop loss: po pohybe o 20 pipov v predpokladanom smere by mal byť stop loss nastavený na bod vstupu na trh.

Kľúčové prvky grafu:

Cenové úrovne podpory a rezistencie: môžu slúžiť ako ciele pri nákupe alebo predaji a do ich blízkosti môžete umiestniť úrovne take profit.

Červené čiary: predstavujú kanály alebo trendové čiary, ktoré znázorňujú aktuálny trend na trhu a naznačujú očakávaný smer obchodovania.

Indikátor MACD (14,22,3): histogram aj signálna čiara, ktorú možno použiť ako pomocný zdroj signálov.

Dôležité prejavy a správy: zaznamenané v kalendári správ - môžu zásadne ovplyvniť dynamiku cien. Počas ich zverejnenia by ste mali zvýšiť opatrnosť alebo opustiť trh, aby sa zabránilo náhlym cenovým obratom.

Začiatočníci by mali mať vždy na pamäti, že nie každý obchod prinesie zisk. Základom trvalého obchodného úspechu je stanovenie jasnej stratégie spolu s rozumným riadením peňazí.

Slovenský

Slovenský

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română