EUR/USD

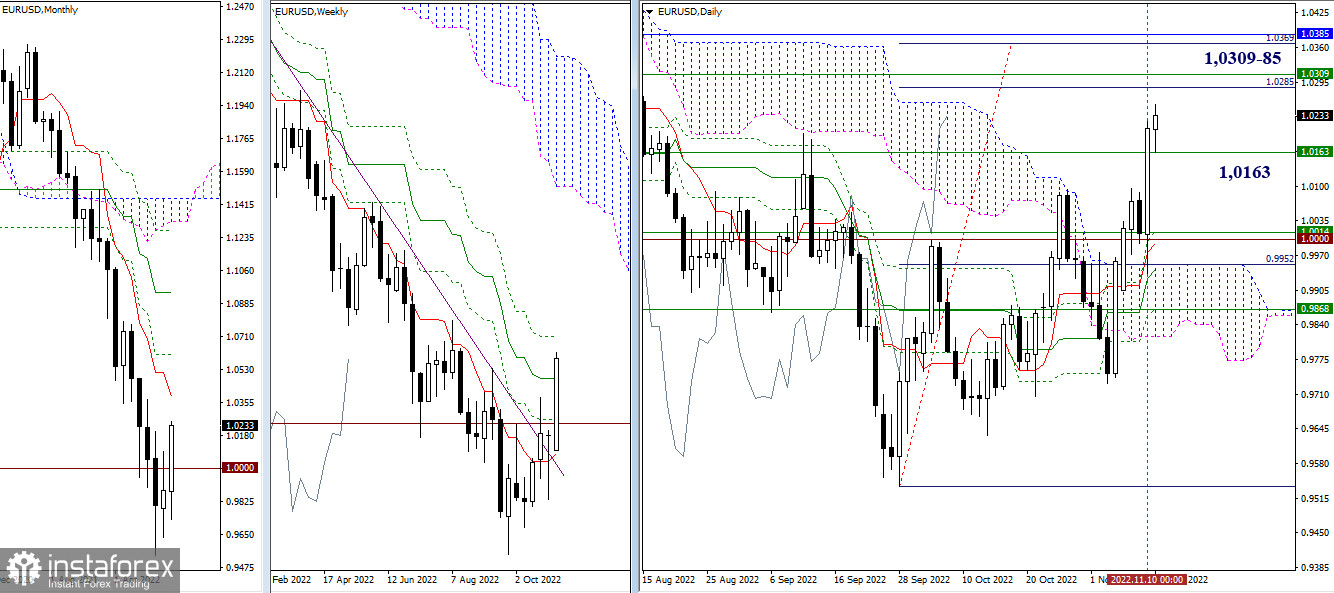

Higher timeframes

After a pause, bulls not only managed to update the high, but realized a large-scale and productive rise, pushing off the levels of 1.0000 – 1.0014 (weekly and psychological level). By now, the weekly medium-term trend (1.0163) has been passed on some timeframes, so this level can now serve as support on these timeframes. The main attention of bulls is now directed to the area where important targets are combined—1.0285 - 1.0309 - 1.0369 - 1.0385 (final levels of the weekly Ichimoku cross + monthly short-term trend + target for the breakdown of the daily cloud).

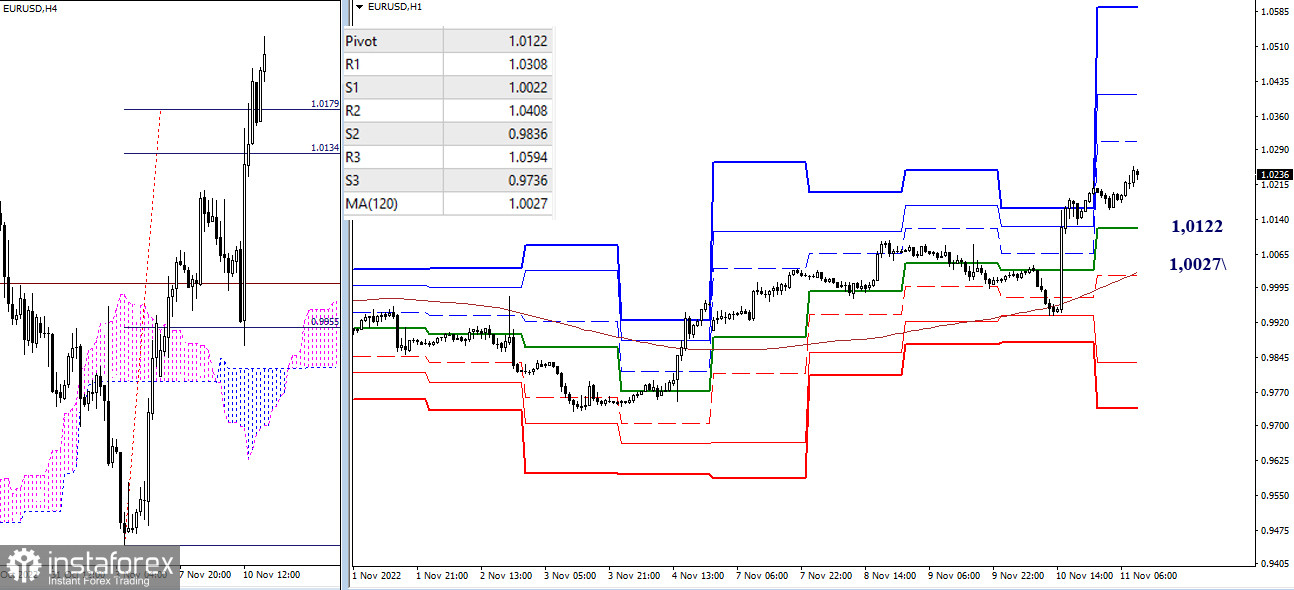

H4 – H1

The weekly long-term trend yesterday managed to bail out bulls, defending their interests and keeping their main advantage. Thanks to the support of the moving average, continued upward movement was observed. The upward benchmarks within the day today can be noted at the boundaries of 1.0308 - 1.0408 - 1.0594 (resistance of the classic pivot points). The key levels of the lower timeframes today retain the role of supports and are located at 1.0122 (central pivot point of the day) and 1.0027 (weekly long-term trend). Their breakdown can change the current balance of power.

***

GBP/USD

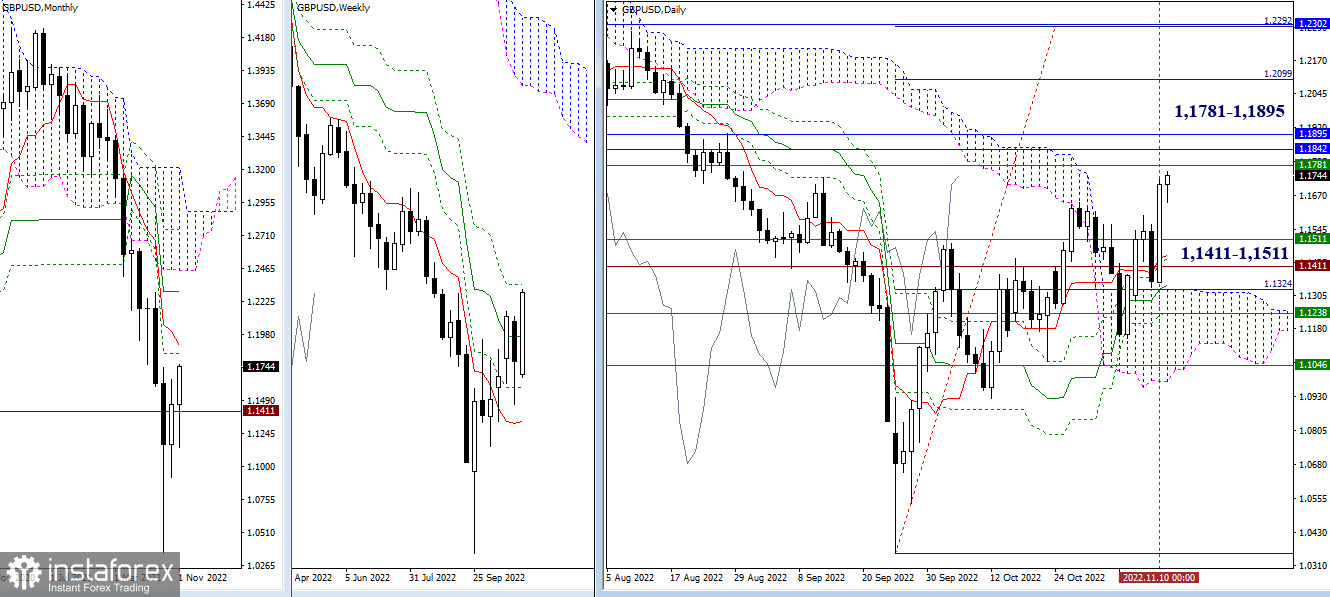

Higher timeframes

The pause and deceleration in the area of 1.1411 - 1.1511 could not change the main thing. Bulls bounced off the levels and continued to rise yesterday. As a result, now the pair has approached the zone of monthly and weekly resistances (1.1781 – 1.1842 – 1.1895). The outcome of the interaction will determine the further development of the situation.

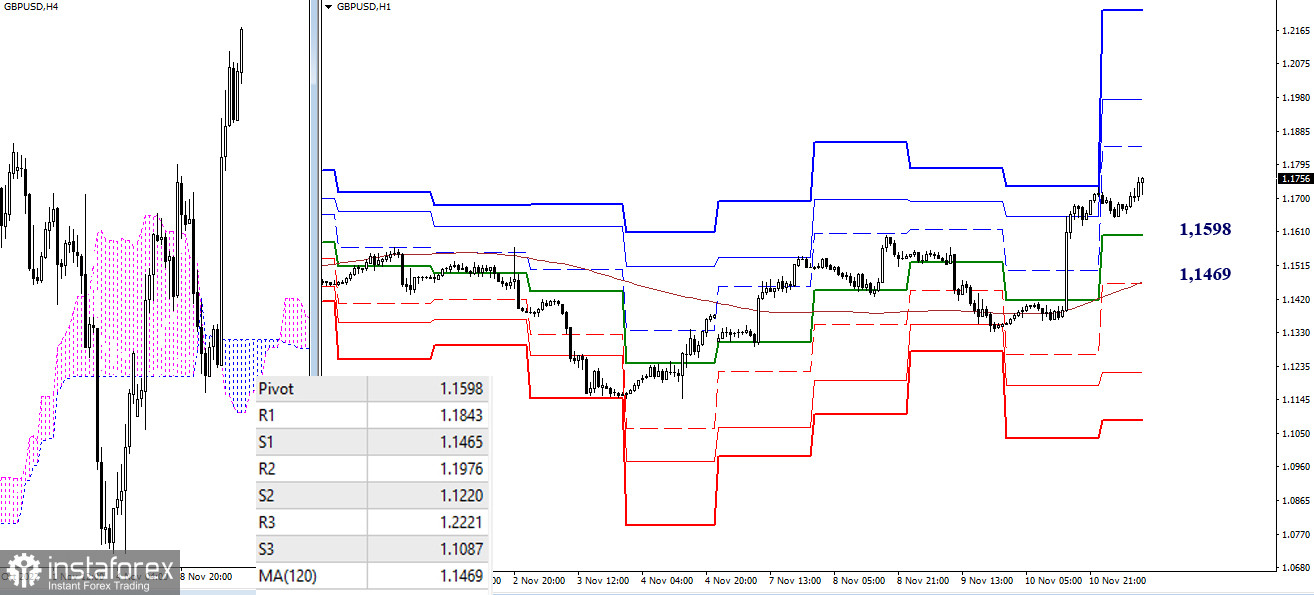

H4 – H1

On the eve of the weekly long-term trend, with its attraction and strength of support, it was able to hold the situation, keeping the advantage on the bulls' side. Today, bulls continue to develop the rise. The benchmarks within the day are the resistance of the classical pivot points (1.1843 – 1.1976 – 1.1221). The key levels of the lower timeframes retain their role as supports, which today are at the levels of 1.1598 (central pivot point of the day) and 1.1469 (weekly long-term trend).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

Português

Português

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română