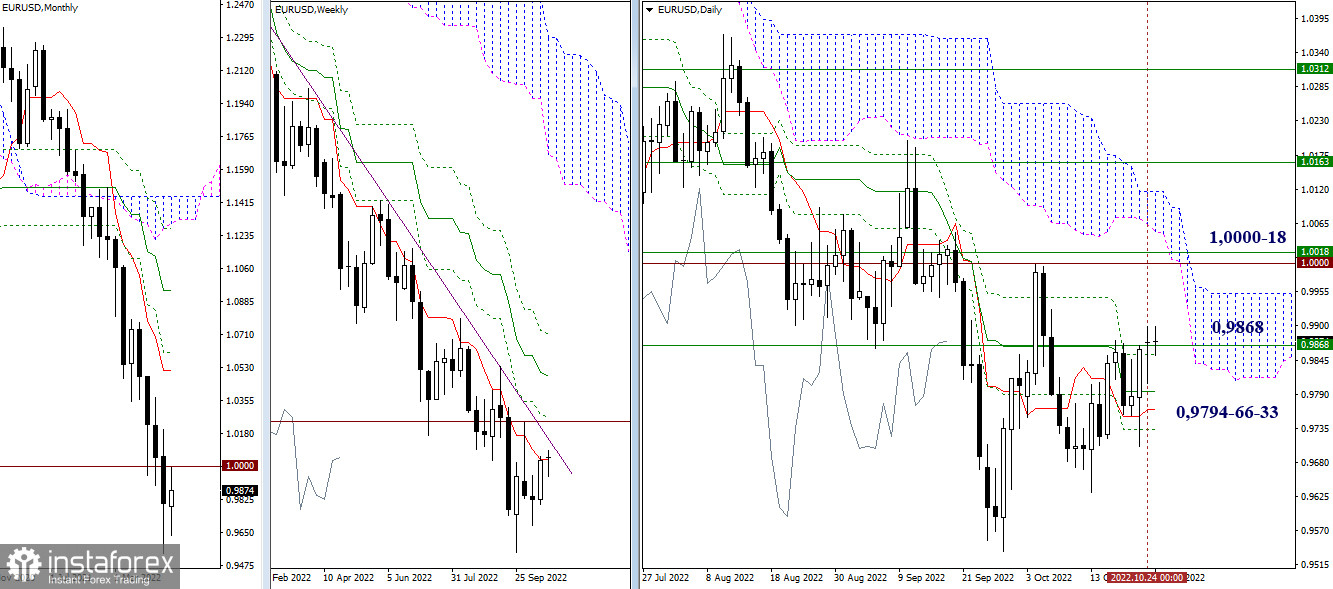

EUR/USD

Higher timeframes

The pair performed a corrective rise to the weekly short-term trend (0.9868) and the final level of the daily Ichimoku cross (0.9854). Now it is busy testing the met milestones and forming the result. Consolidation above will open the way to the daily cloud and resistances 1.0000 – 1.0018 (psychological level + weekly Fibo Kijun). The completion of the rise will return the pair to the daily support levels (0.9794 – 0.9766 – 0.9733), consolidation below can become the realization of rebound from the currently tested levels (0.9868-54). Next, the main task will be to update the lows 0.9632 – 0.9536 and restore the downward trend.

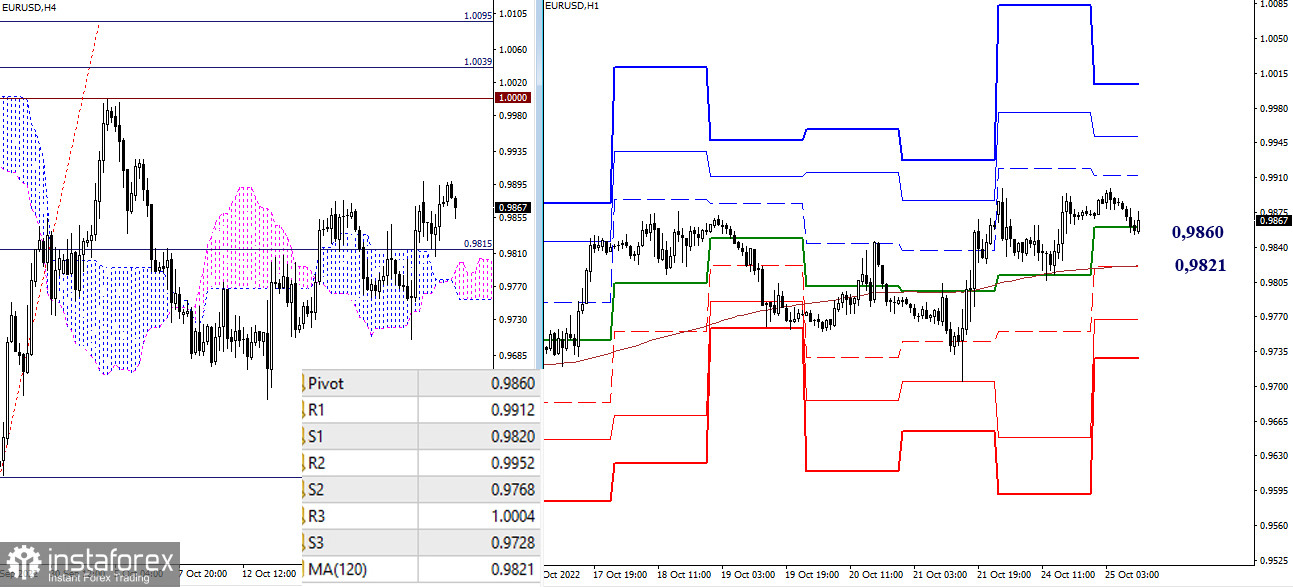

H4 – H1

The main advantage in the lower timeframes belongs to the bulls. Among the upward benchmarks within the day today, we can note 0.9912 - 0.9952 - 1.0004 (classic pivot points) and possible target levels for the breakdown of the H4 cloud (1.0039 - 1.0095). If the bears manage to take over the weekly long-term trend (0.9821) and deploy a moving average, then the current balance of power may again shift to their side, which will lead to possible uncertainty and consolidation, or the bears' new activity and performance. Additional benchmarks within the day are the support of the classic pivot points (0.9768 - 0.9728).

***

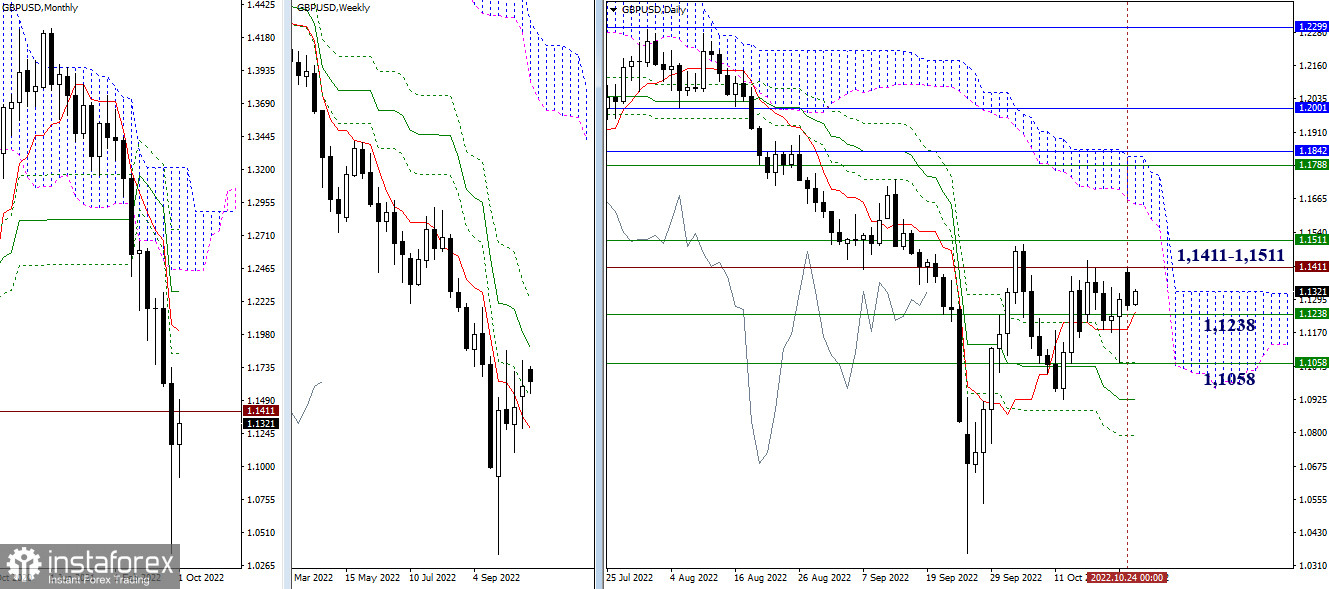

GBP/USD

Higher timeframes

The pair continues to remain in the zone of attraction and influence of the weekly level (1.1238). The next important resistance can be noted at the levels of 1.1411 - 1.1511 (historical level + weekly medium-term trend). Further, attention will be focused on the passage of the daily cloud and testing the bundle of weekly and monthly levels 1.1788 - 1.1842. For bears in the current situation, it is important to regain support for the weekly short-term trend (1.1058) and eliminate the daily golden cross (1.0925 - 1.0790).

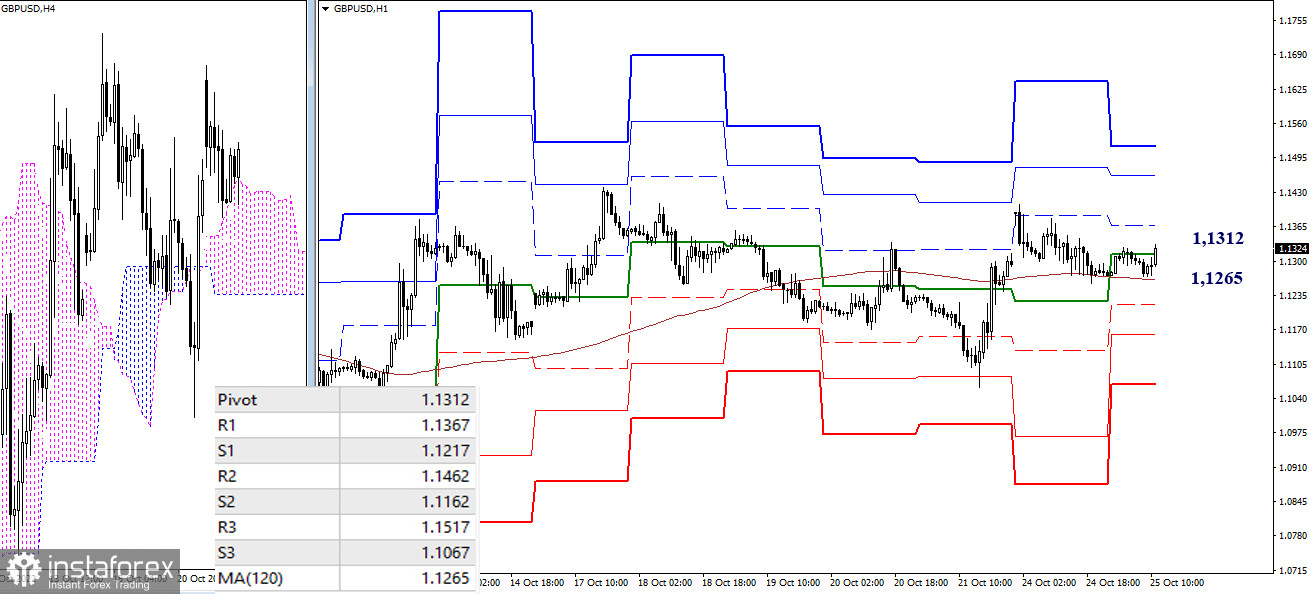

H4 – H1

As of writing, the pair is in the zone of attraction of the key levels 1.1265 - 1.1312 (weekly long-term trend + central pivot point of the day), so we can say that the market is dominated by uncertainty and the pair is in some contemplation. If the situation changes, then as intraday reference points for bulls, we can mark the resistance of the classic pivot points (1.1217 – 1.1162 – 1.1067).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

Português

Português

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română