To open long positions on GBP/USD, you need:

Given the low volatility and trading volume, there were no signals to enter the market. The buyers of the pound tried to build an upward correction to the resistance area of 1.3357, but it did not lead to anything good, which returned pressure on the British pound closer to the middle of the day. In the afternoon, several American exchanges are closed due to the celebration of Thanksgiving, so the trading volume will be quite low. From a technical point of view, nothing has changed, exactly like the strategy for the American session.

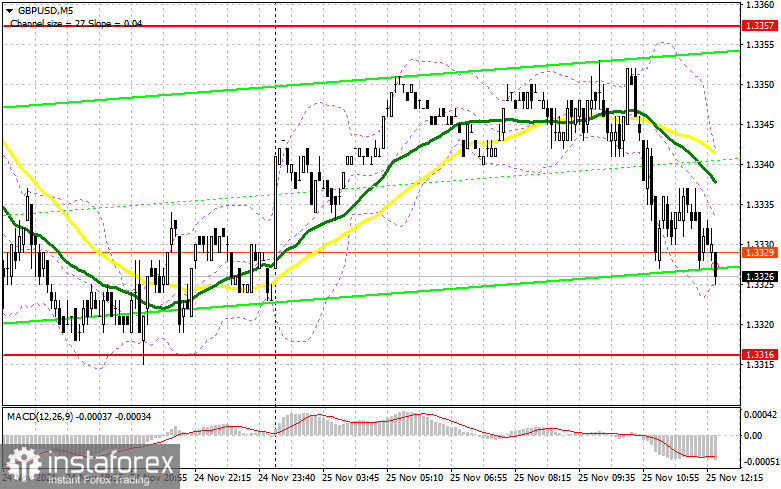

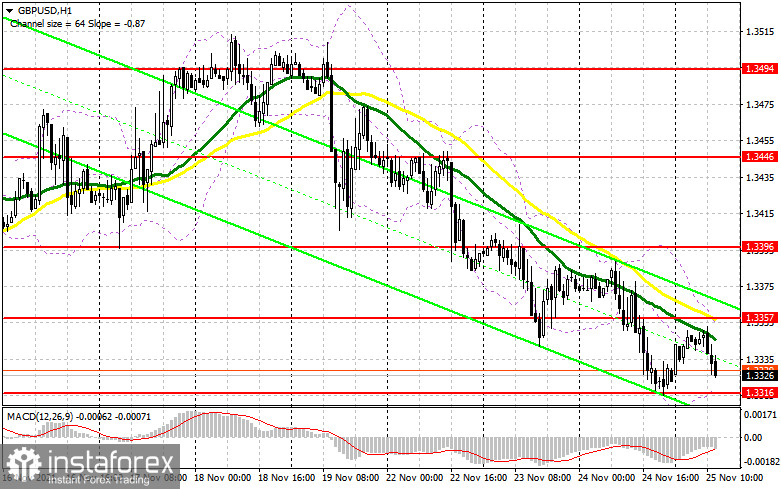

As I noted above, buyers failed to cope with the level of 1.3357, which remains their main target for the second half of the day. Only a breakthrough of this area and a top-down test will lead to the formation of a good entry point into long positions with the prospect of the pound recovering to the maximum area of 1.3396. Do not forget that during the American session, there will be an interview with the governor of the Bank of England, Andrew Bailey, which is unlikely to have a positive impact on the pair. However, in case of hints of a more active reduction of the bond purchase program, the bulls will quickly deal with 1.3396, taking the path to a maximum of 1.3446, where I recommend fixing the profits. In the scenario of a decline in the pound, buyers will have to try to protect the support of 1.3316, the test of which may take place in the near future. Only this option will stop the bearish trend. The formation of a false breakdown there against the background of low trading volume due to Thanksgiving in the USA forms an entry point into long positions for the pair. Under the scenario of a decline in GBP/USD and the absence of bull activity at 1.3316, the pressure on the pound may seriously increase. In this case, I advise you to open new long positions only after a false breakdown in the area of 1.3264. You can watch GBP/USD purchases immediately for a rebound from the minimum of 1.3227, or even lower - from the support of 1.3189, counting on a correction of 25-30 points inside the day.

To open short positions on GBP/USD, you need:

The bears are still coping with the tasks set for them perfectly, updating the lows every day - this keeps the downward trend for the pair, not allowing the bulls to offer anything in return. The best option for selling GBP/USD today in the afternoon, of course, remains the formation of a false breakdown at the level of 1.3357, which we did not reach quite a bit during morning trading. Only this will lead to the formation of a new entry point into short positions, followed by a decline to the area of the week's minimum of 1.3316. A lot depends on this level today because there the bulls will make every effort to protect it. The breakthrough of this range, together with the reverse test from the bottom up and the preservation of dovish rhetoric on the part of the Governor of the Bank of England Andrew Bailey – all this forms an additional signal to open new short positions to reduce to the lows: 1.3264 and 1.3227, where I recommend fixing the profits. A more distant target will be the 1.3189 area. However, do not forget that today is Thanksgiving Day in the United States, and volatility may be quite low due to the closure of several American exchanges. If the pair grows during the American session and sellers are weak at 1.3357, it is best to postpone sales to a larger resistance of 1.3396. I advise you to open short positions immediately for a rebound from 1.3446, or even higher - from a new maximum in the area of 1.3494, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for November 16 recorded a sharp increase in short positions and a reduction in long ones, which led to an increase in the negative delta. Good data on the recovery of the UK labor market, increased inflationary pressure, and growth in retail sales - all this saved the British pound last week and gave the bulls a chance to continue the pair's growth. However, the aggravation of the coronavirus situation in the European part of the continent and statements by representatives of the Bank of England that no one will rush to change the course of monetary policy in the current conditions - all this very quickly returned pressure on the pair by the end of the week. An important point remains the unresolved issue around the Server Ireland protocol, which the UK authorities plan to suspend in the near future. To this, the European Union is preparing to introduce certain retaliatory measures – which do not add confidence to buyers of the British pound. At the same time, in the United States of America, we are witnessing an increase in inflation and increased talk about the need for an earlier increase in interest rates next year, which provides significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the policy of the central bank. The COT report indicates that long non-commercial positions decreased from the level of 54,004 to the level of 50,443, while short non-commercial positions increased from the level of 66,097 to the level of 82,042. This led to an increase in the negative non-commercial net position: the delta was -31,599 versus -12,093 a week earlier. The weekly closing price collapsed as a result of the Bank of England's policy from 1.3563 to 1.3410.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the continuation of the downward trend.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3316 will increase the pressure on the pair. A break of the upper limit of the indicator in the area of 1.3360 will lead to the growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

Português

Português

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română