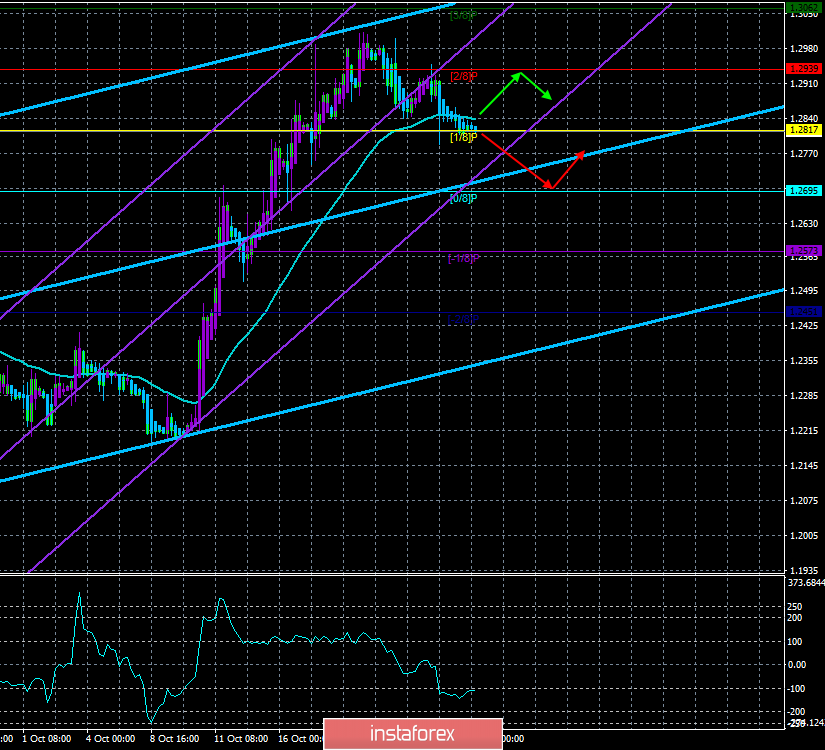

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – sideways.

CCI: -124.3468

As Brexit has been regularly pushed to a later date, we have repeatedly said that perhaps holding a second referendum is not such a bad idea. The problem with Brexit is that the decision was made only by a formal majority. Recall that in 2016, the margin of votes "for" leaving the EU was only 4%. That is, almost half of the inhabitants of the United Kingdom were against leaving the European Union. As the UK began to enter and sink into the "swamp" of negotiations with Brussels on the terms of an orderly "divorce", the whole procedure was delayed, the economic situation worsened, the country was mired in a political crisis, but no positive changes in the economy, geopolitics or living standards of citizens did not happen. The question arises: was it the right decision to express a desire to leave the Alliance at all? Now, after 3 years, what has changed for the better? Nothing. Well, if the process was on the "finish line". But no! Brexit will once again be postponed to January 31 with a 99% probability. And what are the guarantees that something will change before January 31? That the parliament and the prime minister will find a common language? Or that re-elections, if held, would give the conservatives the necessary number of votes to accept any Brexit? Nothing. It turns out that the position of the Labor Party, which is in favor of holding a second referendum, that is, can give the people the opportunity to admit their mistake and re-vote on Brexit, or at least clarify whether they are ready for a "hard" Brexit of Boris Johnson, is becoming stronger and more attractive every day. The main thing – it looks right in the current situation. According to recent opinion polls, 57% of Britons expressed regret that a referendum was held in 2016 and a decision was made to leave the EU. And only 30% of respondents believe that this decision was correct. That is, we see a sharp change in the mood of the population. And if a new Brexit vote were to be held now, we are confident that its results would leave the Kingdom in the European Union.

By the way, the topic of early elections is very interesting. Everyone understands that Boris Johnson is seeking an election with one aim – to improve the position of the conservatives in parliament so that he can achieve approval of any version of Brexit. But the parliamentarians themselves understand this. Deputies are also aware that if Johnson has the opportunity, he will implement a "hard" Brexit without hesitation. That "hard" Brexit, against the implementation of which the deputies are fighting fiercely. Accordingly, Johnson and his party should not improve their positions. Accordingly, early elections are not beneficial to the opposition. Thus, it is not a fact that they will take place at all. Recall that to make such a decision, we need the support of 2/3 of the parliament. Usually, 40 percent of deputies are in favor of Johnson's proposal. Thus, the Laborites need to wait for the official transfer of Brexit to January 31, which can be announced by the European Union today, after which they get a new trump card in their hands in negotiations with Boris Johnson. Well, if there is no re-election, then Johnson's plan will be rejected sooner or later. Will the EU go to the third stage of the "all over again" negotiations?

So far, the British pound does not show a bad mood since Brexit will again be postponed. The downward movement after taking off 800 points up is minimal. However, the technical picture still inclines us to wait for the continuation of the downward movement, as the bears managed to overcome the moving, and the Heiken Ashi indicator turns the bars blue. Fundamentally, pound/dollar traders will have nothing to pay attention to today. The calendar of macroeconomic events in the UK remains empty for more than a week. Thus, technical factors and Brexit news will remain drivers for the currency pair.

Nearest support levels:

S1 – 1.2817

S2 – 1.2695

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2939

R2 – 1.3062

R3 – 1.3184

Trading recommendations:

The GBP/USD currency pair continues its weak downward movement. Thus, traders are now advised to buy the US currency in small lots (since both channels of linear regression are directed upwards) with a target of 1.2695, if the pair remains below the moving average. It is recommended to consider buy-positions not earlier than overcoming the moving average line with the nearest target of 1.2939.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

Português

Português

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română