The British pound and the euro continued to decline against the US dollar. Yesterday's report on manufacturing activity in the United States instilled confidence in dollar buyers, while data for the UK and the eurozone was disappointing.

The weak growth in consumer lending in the UK is a bad signal for the economy, as it indicates its likely slowdown in the 2nd quarter.

According to the Bank of England, in May of this year, the annual growth of unsecured consumer lending was 5.6%, while the net volume of unsecured lending decreased to 496 million pounds from 800 million pounds in April. All this suggests that in the spring of this year, there was a decrease in consumer spending.

The pressure on the pound was formed by a weak report on the manufacturing sector, which is also experiencing a recession, as in many developed countries. Companies continued to reduce inventory amid a general decline in orders. Uncertainty also creates a postponed exit of the UK from the EU.

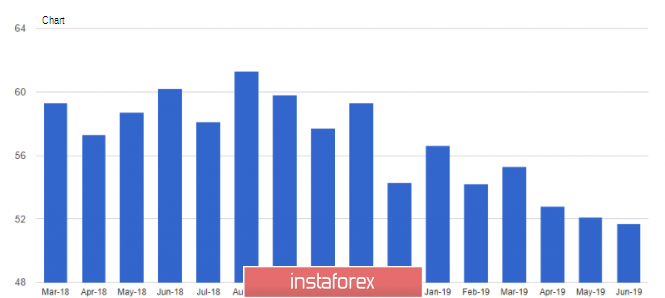

According to IHS Markit, the purchasing managers' index (PMI) for the UK manufacturing sector fell to 48.0 points in June against 49.4 points in May. Let me remind you that the values below 50.0 indicate a decrease in activity.

As for the technical picture of the GBPUSD pair, the decline will continue. A break of support at 1.2620 will increase the pressure on the pound and will lead to an update of the new monthly lows around 1.2580 and 1.2540. The upward correction will be limited by the upper boundary of the downward channel in the area of 1.2700.

As noted above, the US dollar rose against a number of world currencies after data that US manufacturing activity continued to grow at a faster pace this June against the backdrop of new orders. According to IHS Markit, the final purchasing managers' index (PMI) for the US manufacturing sector rose to 50.6 points in June from 50.5 points in May. The main limiting factor in the growth rate remains the tension in world trade. Economists had expected the index to be 51.3 points.

According to the Institute for Supply Management (ISM), purchasing managers' index (PMI) for the manufacturing sector was 51.7 points in June of this year against 52.1 points in May. Values above 50 indicate an increase in activity. Economists had forecast a drop in the index to 51.3 points. The ISM noted that interviewed respondents expressed concern over the volatile trade relations between the United States and China.

The decline in construction spending in the United States, in light of high prices and lower bookmarking of new homes, is not surprising. According to the US Department of Commerce, expenses in May of this year fell and amounted to 1.294 trillion dollars compared with the previous month. Economists had forecast an increase of 0.1%. Expenditures on private construction in May fell by 0.7%, while expenditures on the construction of single-family homes fell by 0.8%.

Yesterday, Thomas Barkin, representative of the Federal Reserve System, made a speech. The president of the Fed-Richmond said that, despite the uncertainty in trade policy, the deterioration of company sentiment and the decline in investment, the state of the American economy remains fairly stable. In this regard, in his opinion, it is still early to talk about lowering rates and easing monetary policy.

As for the technical picture of the EURUSD pair, a further decline in the pair is very likely, and an upward correction in the resistance area of 1.1310 and updating the upper limit of the new downward channel in the area of 1.1340 will be an excellent signal to continue opening short positions in the trading instrument. The aim of the sellers are lows in the area of 1.1240 and 1.1200.

Português

Português

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română