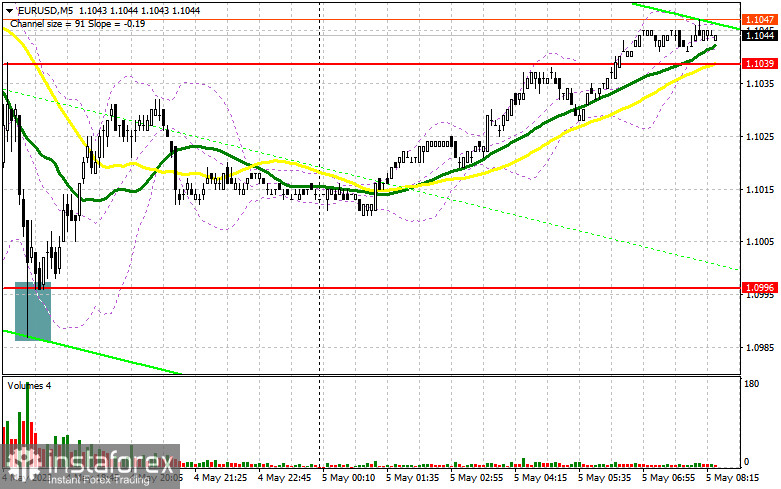

Yesterday, only one entry signal was made. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I considered entering the market at 1.1094. The euro grew at the very opening of the European session, but a false breakout at the 1.1094 level did not occur. No signals came near 1.1058 because the euro's decline amid upbeat business activity data in the eurozone looked quite strange. After the ECB's decision to raise rates, the pair fell to the area of 1.0996. A false breakout there generated an excellent buy signal, and the price advanced by more than 30 pips.

To open long positions on EURUSD, it is required:

The ECB raised interest rates by only 0.25%, which came in line with the market consensus. EUR/USD showed some weakness after the ECB's decision but the bulls then bought it out when Christine Lagarde said the ECB would keep fighting high inflation. Today, Germany's factory orders and the eurozone's retail sales for March are due in the first half of the day. If data come strong, that will be another reminder that the ECB will continue raising rates to fight inflation. The speech of the ECB's Frank Elderson will also likely draw traders' attention.

Of course, I would like to buy the euro on a correction, so I will focus on the nearest level of 1.1029, which was formed yesterday. A false breakout through it will produce a buy signal with the target at the nearest resistance level of 1.1060. In case of a breakout and a downside test of this range after the release of positive statistics in the eurozone, the upward trend will resume, creating a buy entry point with the target at the monthly high of 1.1090. The most distant target remains at around 1.1129, where I am going to take profit.

In case of a decline in EUR/USD and the absence of buyers at 1.1029 amid the release of important data on the US labor market in the second half of the day, the dollar will strengthen. A false breakout through the next support level of 1.0988 will generate a signal to buy the euro. I will open long positions on a rebound from a low of 1.0944, allowing an upward correction of 30-35 pips intraday.

To open short positions on EURUSD, it is required:

The bears failed to maintain control over the market, which they gained after the ECB's decision, and now they need to work hard not to let the pair out of the sideways channel. An important task is to protect the intermediate resistance at 1.1060, a surge to the mark may occur after the release of macro data in the eurozone. A false breakout through this level amid the publication of weak data will give a sell signal, targeting 1.1029, a new support level, formed yesterday. In case of consolidation below this range and its upside retest, the price may go to 1.0988. The most distant target will stand at a low of 1.0944, where I am going to take profit.

In case of an increase in EUR/USD during the European session and the absence of bears at 1.1060, buyers will likely try to continue yesterday's trend. In such a case, I will sell at the level of 1.1090, the upper limit of the sideways channel, but only after failed consolidation. I will open short positions on the rebound from a high of 1.1129, allowing a bearish correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, which indicates that the bulls are trying to regain control over the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Support stands at 1.1025, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

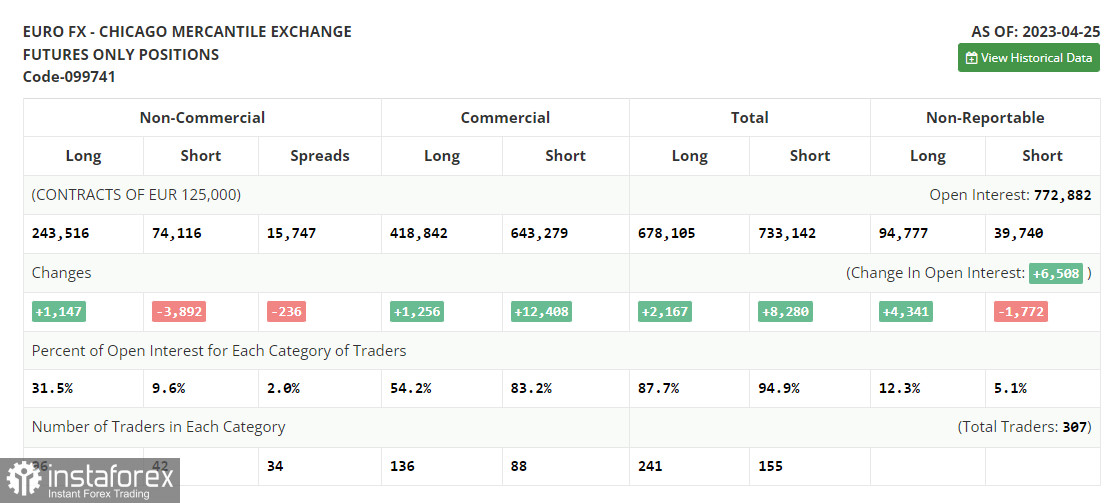

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

हिन्दी

हिन्दी

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা Čeština

Čeština Українська

Українська Română

Română