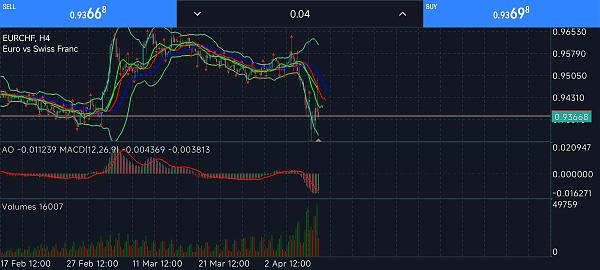

EUR/CHF (07.04.2025) Hello colleagues! Let's analyze the Euro-Swiss Franc pair for tomorrow. The pair itself is not very volatile, but it responds well to levels and technical signals. On the 4-hour timeframe, the pair is showing a descending trend, trading below the local maximum level of 0.96325, which previously acted as support. Overall, I will likely consider the situation for tomorrow and this week as defined, as the currency pair is currently testing the monthly local minimum of 0.93600. Breakouts have not been achieved yet, leading to a pullback from this level. Most likely, tomorrow the currency pair will either continue to decline in case of important news releases, or we will try to enter a consolidation phase - one of the two, as the pair is in a less liquid zone. It is probable that tomorrow the pair will enter an accumulation phase, thus extending the sideways movement. Regarding the levels, since we had a strong breakout of the sideways range, we have a key resistance level in the range of 0.9750, where the price is unlikely to reach soon. There are several other marked levels - for example, 0.9720 is considered an important resistance level for this week, as it was successfully broken, leading to a new monthly low. There is also another key resistance level, formed since March and considered a local maximum - in the range of 0.9820. This level could be decisive if the price approaches it. In terms of technical indicators, the situation is not very favorable either, as the RSI is in the oversold zone, signaling a correction. This means that tomorrow or during the week, we might see a deep correction in the bearish zone. The pair is trading in the negative zone on the MACD, and the volumes are almost exhausted, which could also signal either a local price reversal or the formation of a deep correction. Volumes in the bearish trend zone are starting to decrease - this also signals the end of the descending trend. The Bollinger Band only gives two signals for the end of the impulse in the upper part, while the lower band is still trying to hold the impulse. In general, the situation for the week is as follows: if we break the key minimum, we will likely continue the decline. If we manage to have a few pullbacks and bring the price back into the bullish zone, we might see a local trend reversal - it all depends on the background.

*L'analyse de marché présentée est de nature informative et n'est pas une incitation à effectuer une transaction