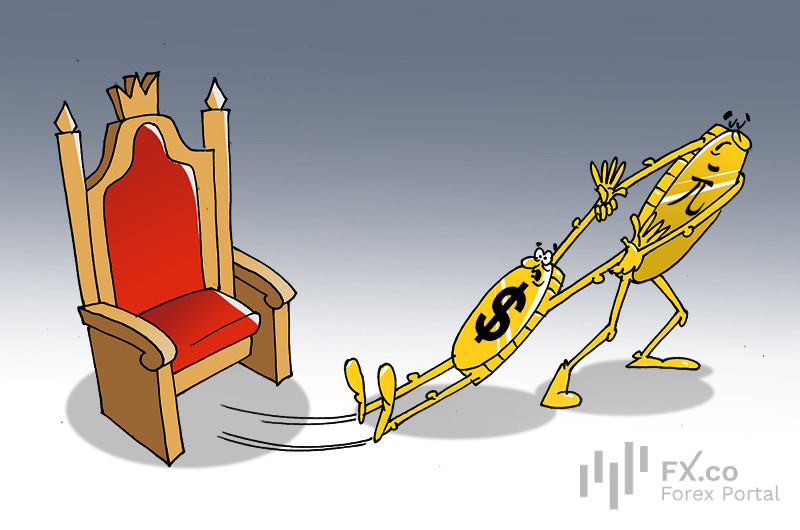

According to Reuters, a steady rise in the yuan has been driven by Chinese state-owned banks speculating in the currency market, thus pushing the national currency to the highest level in the last four months.

From November 20 to 25, the Chinese currency soared by 2% to 7.13 yuan per dollar. The rally began after China's major state-owned banks were seen exchanging yuan for dollars in the onshore swap market and selling those dollars in the spot currency market.

As a result, the yuan hit a four-month high, with large credit organizations continuing their dollar-selling activity.

Some market participants believe that state-owned banks could provoke further gains in the yuan and prompt exporters to convert more of their foreign exchange receipts into yuan. According to economic strategists at Societe Generale, it looks like they are "doing preparatory work ahead of its policy rate cut."

In August 2023, many Chinese state-owned banks tried to pursue de-dollarization. Against this background, the yuan fell against the US currency, notching a 6% loss since the beginning of the year. Earlier, China’s public lenders acted similarly when the yuan was under pressure. Now financial institutions have been active amid a broad decline in the greenback, which dipped by more than 3% in November.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: