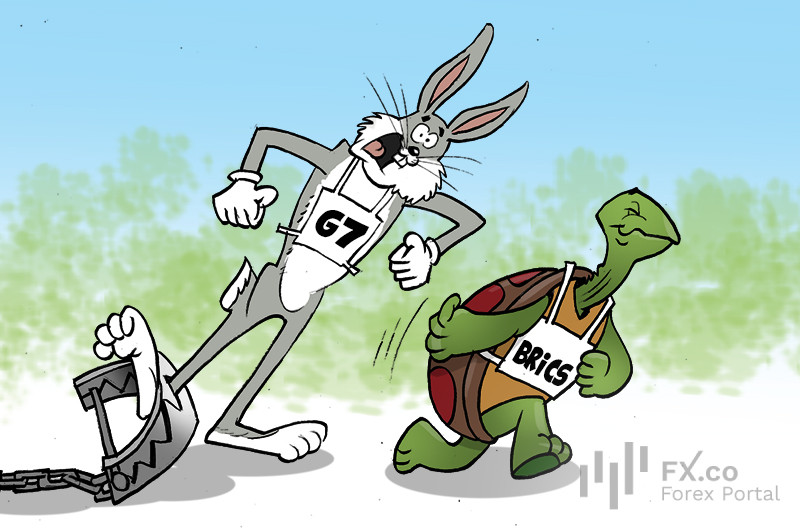

According to Bloomberg, the G7 countries are expected to cede their dominance in the global financial arena to the BRICS nations. Currently, the BRICS economies are outpacing the G7, and by 2040, this gap is projected to double. Analysts are exploring the "overwhelming power" of BRICS and the potential weaknesses of the G7 states. The BRICS bloc originated from an idea by Jim O'Neill, chief economist at Goldman Sachs. Criteria for membership included a large economy and robust growth rates. Countries like Brazil, Russia, India, and China fit this bill. In August 2023, Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE joined BRICS. Experts believe that the recent expansion of BRICS is more politically motivated than economically. The main goals are to challenge US dominance and significantly reduce the US dollar's role in the global economy. There are questions about whether BRICS will achieve its objectives without overextending itself in the global race. The expansion of BRICS has been beneficial: it surpassed the G7 bloc. In 2022, BRICS accounted for 36% of the global economy, compared to the G7's 30%. Forecasts suggest that by 2045, with increased labor resources and strong technological potential, the share of BRICS+ could rise to 45%, while the G7's share might drop to 21%. It is possible that BRICS+ and G7 might swap places in terms of economic output. However, BRICS+ faces many challenges ahead. Ambitious projects, like shifting oil trade to other currencies, could reduce the dollar's share in international trade. Economists note that weakening the American currency is a primary goal for BRICS+. Each member is contributing to this process, building a future that aligns with their vision.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română