The financial reputation of the United States has been tarnished somewhat. International ratings agency Moody's lowered its outlook on the country's credit rating to "negative" from "stable", citing large fiscal deficits and lower debt affordability. Besides, the leading risk assessment agency affirmed the long-term issuer and senior unsecured ratings of the US at AAA.

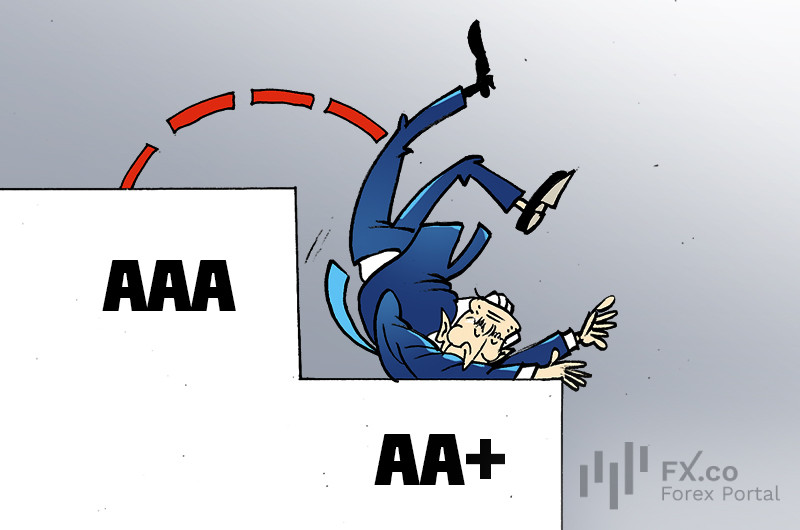

The move followed a rating downgrade by another ratings agency. On August 1, 2023, Fitch cut the United States’ long-term foreign currency issuer default rating to AA+ from AAA. The shift reflected potential fiscal deterioration over the next three years. A growing general debt burden and an erosion of governance in the United States added fuel to the fire. Besides, the credit grader cited a prolonged standoff over the US debt ceiling as well as its last-minute resolution.

Also, Moody's analysts expressed concern about continued political polarization in Congress, which "raises the risk that lawmakers will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability."

Investors echoed concerns raised by the ratings agency. Once the rating was downgraded, US stock indices tumbled. Against this background, US government bonds hit the lowest in the past 16 years.

On October 4, 2023, the US government debt reached a record high of $33.442 trillion after rising by $275 billion in a single day from the previous $33.167 trillion. Earlier, currency strategist Michael Hartnett predicted that the US public debt would add $5.2 billion daily over the next decade.

According to experts, the main factor denting the ratings agency’s outlook is a prominent risk of deteriorating fiscal sustainability in the United States. This negative aspect cannot be fully offset by the credit advantages of the country.

"Any type of significant policy response that we might be able to see to this declining fiscal strength probably wouldn't happen until 2025," William Foster, a senior vice president at Moody's, said. At the same time, the agency did not rule out another downgrade of the US rating in the medium term.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: