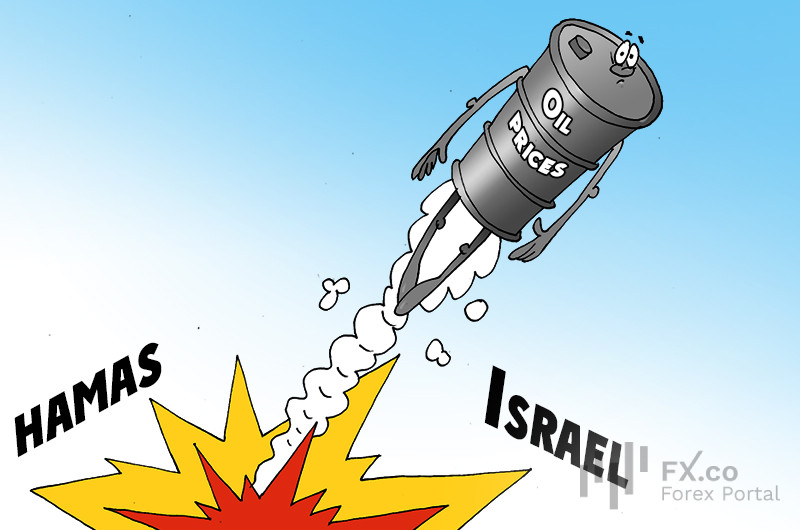

An escalation of the Israel-Hamas conflict could drive oil prices up to $157 per barrel, Bloomberg estimated, citing the World Bank’s study.

According to analysts, a wider war in the Middle East involving other regional states could lead to severe supply disruptions in the global energy market. In this case, the oil supply would shrink by 6 million to 8 million barrels per day, with the world facing a large-scale oil shock, not seen since 1973 when an Arab oil embargo was introduced. The outlook for the global economy would darken sharply under such a scenario, the World Bank warned.

The report outlines that even in case of short-term disruptions, the global energy supply would ebb by 500,000 to 2 million barrels per day. Thus, oil prices would range from $93 to $102 per barrel, adding to inflationary pressures. In a “medium disruption” scenario, the hydrocarbon market could also be affected. The global oil supply would fall by 3 million to 5 million barrels per day, which in turn would drive prices up to $121 per barrel.

Notably, the global oil crisis of 1973 erupted after the Organization of Arab Petroleum Exporting Countries (OAPEC) proclaimed an embargo of oil exports to nations supporting Israel in the so-called Yom Kippur War against Egypt and Syria. As a result, the UK, Canada, the Netherlands, the US, and Japan lost access to the Middle Eastern oil market. By the end of the embargo in March 1974, global oil prices quadrupled from $3 to $12 per barrel.

Earlier, Bloomberg analysts warned about the risks of a steep rise in commodity prices. In case of a sharper escalation of the conflict between Hamas and Israel bringing the latter into direct conflict with Iran, oil prices could soar to $150 per barrel. In this situation, global inflation would accelerate to 6.7%, thereby dampening the already weak economic performance.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: