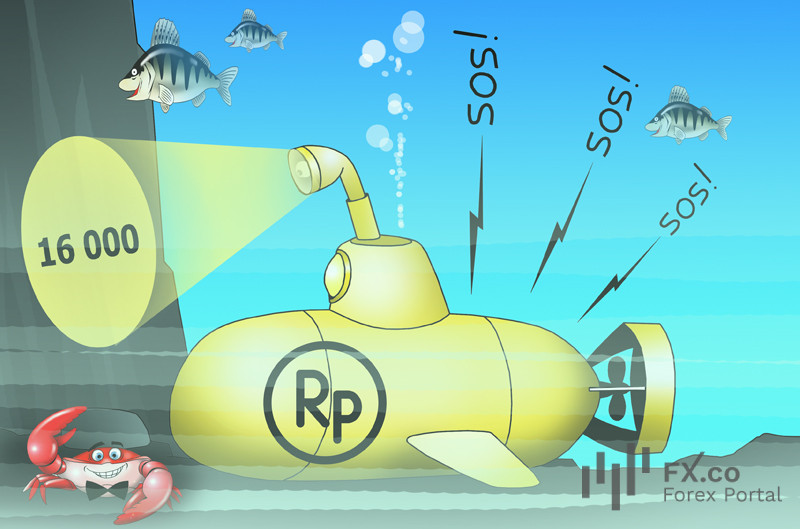

According to Bloomberg, the Indonesian rupiah showed the worst performance among Asian currencies. In October, it dropped by 3.1%, being the main loser in the financial market of the Asia-Pacific region.

Even the decision of the Indonesian central bank to raise the key rate failed to support the national currency. Analysts suppose that the rupiah’s weakness after the key rate hike reflects the magnitude of the current economic problems. Rising key rates and oil prices, as well as the financial sensitivity of the country, are among the key issues.

This month, investors have pulled $599 million out of the nation’s bonds as the spread to Treasuries sharply narrowed. This forced Bank Indonesia (BI) to raise the benchmark rate and introduce new FX securities to attract inflows.

Currently, the Indonesian national currency is trading at around 16,000 per $1. It is a psychological level for the rupiah, analysts warned. It was last recorded in April 2020 amid concerns about a jump in oil prices and bond yields.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: