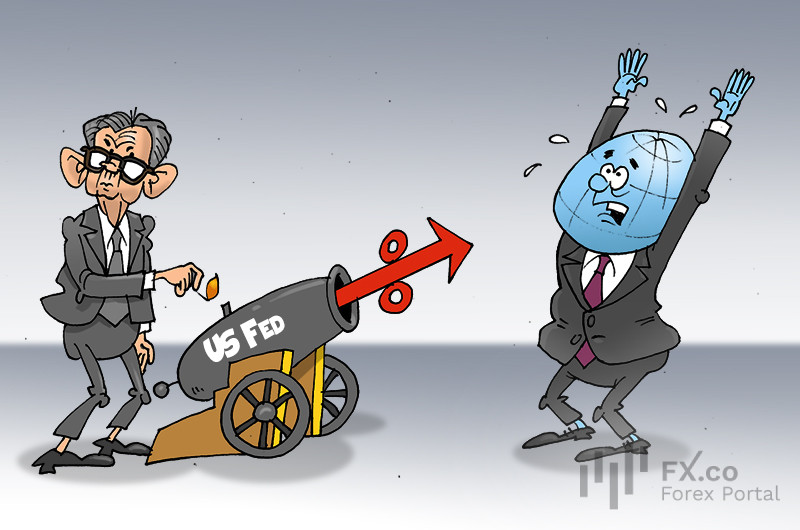

JPMorgan Chase CEO Jamie Dimon has issued a stark warning about potential risks for the US economy. According to him, the Federal Reserve’s aggressive tightening cycle may be far from over.

Dimon warns of a worst-case scenario, with benchmark interest rates hitting 7% and the economy facing stagnation. He believes tighter monetary conditions could dampen consumer spending and business investment, thus leading to a slowdown in economic growth. "I am not sure if the world is prepared for 7%," the head of the bank said, adding that there are a lot of "potential bad outcomes."

"If they are going to have lower volumes and higher rates, there will be stress in the system," the CEO of JPMorgan noted.

The difference between 5% and 7% would be more painful for the economy than a shift from 3% to 5%, Dimon cautioned. A sharp tightening in financial market conditions could heighten the risk of stagflation, which is characterized by an economic downturn, rising unemployment, and higher consumer prices.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: