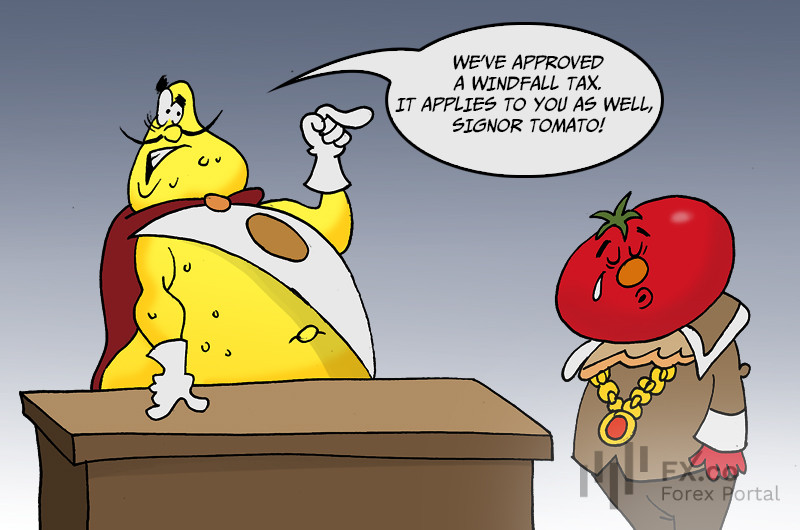

European banks have lost billions of dollars after the government decided to introduce a windfall tax, causing contradictions in Europe. In early August, Deputy Prime Minister of Italy Matteo Salvini introduced a one-off 40% windfall tax targeting banks' extra profits from higher interest rates in the EU. As a result, shares of major Italian banks tumbled on the news, losing about €10 billion in value intraday. For example, Italy’s largest banks UniCredit and Intesa Sanpaolo slid by 6.7% and 8.6% respectively. Economists project that the 40% levy will cut Italian banks' profits by 10% or €2 billion ($2.2 billion). According to the Italian government, two tax options are being considered and preference will be given to the one that will bring more money for the budget. The two options assume a 40% levy on the difference between the net interest margin in 2022 and 2021, targeting the yearly increase above thresholds set at no less than 5% for 2022 and 10% for 2023. In addition, the tax cannot exceed one-quarter of the bank's share capital.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română