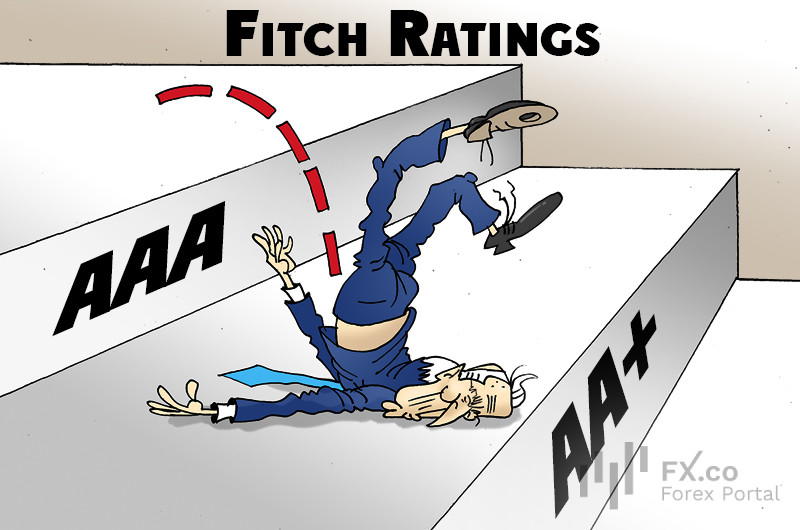

Everything happens for a reason. Stock markets around the world took a nosedive in late July as investors were pricing in changes in the US credit rating. Their premonition did not defy expectations. On August 1, Fitch Ratings lowered “the long-term foreign-currency issuer default rating” of the US from the highest AAA rank to AA+ for the first time since 1994. It goes without saying that the downgrade is a landmark event affecting global investment activity. Stock investors’ response was to withdraw their funds out of risky stocks in favor of safe-haven assets, for instance, the US dollar.

"In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025," the rating agency said in a statement. Analysts point out that the rating was revised with a stable outlook.

Fitch experts warned that the fiscal situation in the US would worsen in the next three years. Moreover, the agency expects the US federal debt to swell in the future. In June, Fitch Ratings cut its forecasts of energy prices for 2023-2024. Analysts predict that crude oil will trade $5 down in the long term. Besides, they slashed twice the expected gas prices from their previous forecast.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: