"This year’s list is both fascinating and shocking while encouraging investors to think outside the consensus box," Chief Economist at Saxo Bank, Steen Jakobsen, said.

EU announces a debt jubilee

Italian contagion sickens Europe’s banks as the EU lurches into recession. After this contagion spreads to France, policymakers understand that the EU faces the abyss. Germany and the rest of core Europe, which refuses to let the Eurozone fall apart, have no other choice than to back monetization.

GBP/USD parity

Labor sweeps to a resounding victory and names Jeremy Corbyn as prime minister. New tax revenue streams are tapped into as Corbyn brings the UK’s first steeply progressive property tax into being to soak the wealthy and demands the Bank of England help finance a new “People’s quantitative easing”, or universal basic income. Inflation rises steeply, business investment languishes, and non-domiciled foreign residents run for cover, taking their vast wealth with them. As a result, sterling is crushed, and for the first time in history the pound sterling rate reaches $1.

New Fed head

At the December 2018 Federal Open Market Committee meeting, Federal Reserve chair Jerome Powell signs on with a slim majority of voters in favor of a rate hike - one too many and the US economy and US equities promptly drop off a cliff in Q1 2019. By the summer, with equities in a deep funk and the US yield curve having moved to outright inversion, an incensed President Trump fires Powell and appoints Minnesota Fed President Neel Kashkari in his stead who continues the policy of reducing government debt and accelerates inflation to 6 percent. Against this background, the dollar remains at risk of weakening.

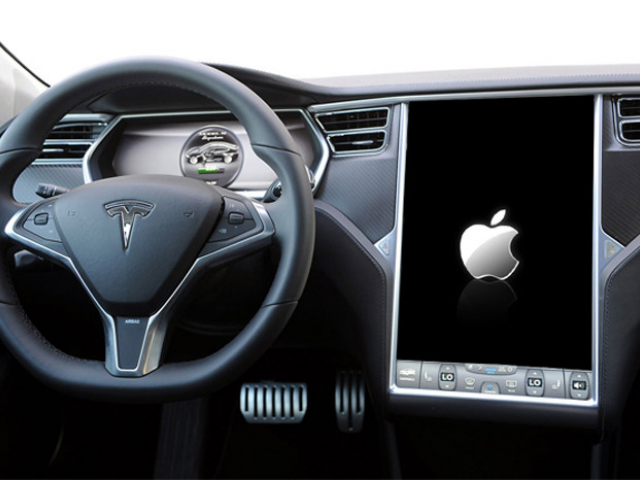

Apple takes over Tesla

Having decided to enter the automobile market, Apple acquires Tesla by securing funding for the deal at a 40% premium of $520 dollars a share. The deal allows Tesla to build several new Gigafactories and production facilities in Europe and China to stay ahead of the competition and dominate the future of the car industry.

X-class solar flare

A solar storm strikes the Western hemisphere, taking down most satellites on the wrong side of the earth at the time and unleashing untold chaos on GPS-reliant air and surface travel/logistics and electric power infrastructure. Saxo Bank noted that the damage will be estimated at around $2 trillion. Thus, in the coming year, even the Sun can turn against investors.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română