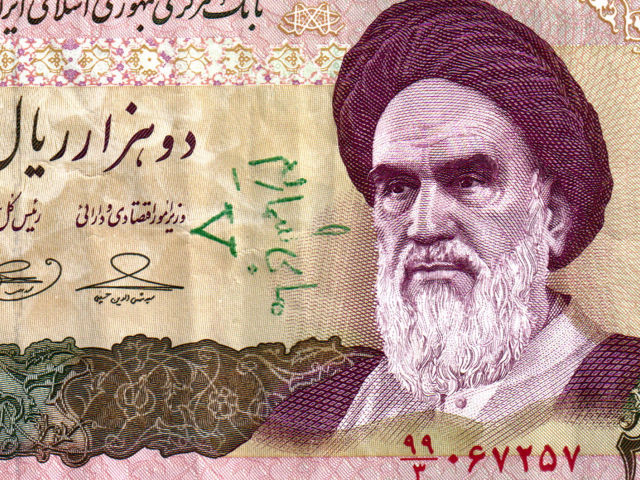

Iranian rial

The Iranian rial is the world’s weakest national currency, with $1 equalling more than 42,000 rials. Iran’s currency has been badly affected by economic sanctions imposed on the country by several foreign countries. These measures, which include limits on oil exports, severely curtailed Iranian foreign trade, negatively affecting IRR. High inflation in Iran has also undermined confidence in the national currency.

Vietnamese dong

The Vietnamese dong occupies second place on the list of the weakest currencies on the planet. Today, to buy $1, you will need to pay more than 23 thousand dong. The currency's weakness can be attributed to persistently high inflation and constantly growing trade deficit. However, last year, the Vietnamese dong was significantly undermined by another factor. The sharp rise in US interest rates in November 2022 saw VND fall to a multi-year low of 24,875 against USD.

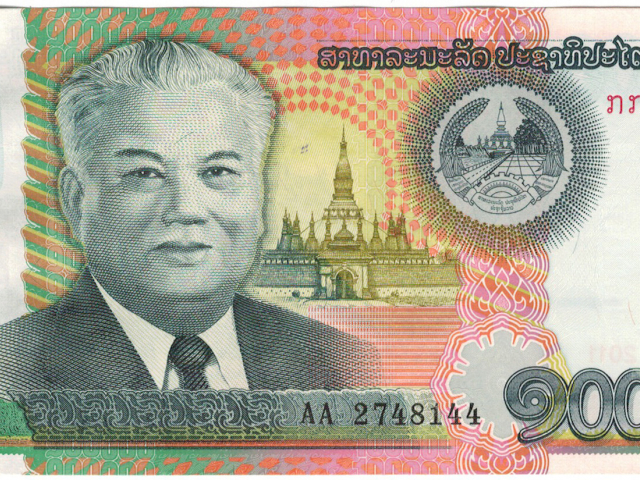

Lao kip

The Lao kip is third on the Forbes' list of weakest national currencies. 1 US dollar equals more than 19 thousand Laotian kip. The sluggish state of the country's economy, increasing external government debt, limited investment, as well as the rapid rate of inflation, has negatively impacted the national currency. Last year, Laos was among the top 20 countries with the highest inflation rate. In 2022, price growth has only gained momentum, reaching 28.6% year-over-year in June.

Sierra Leonean leone

The Sierra Leonean leone is the world’s fourth weakest currency, with $1 equalling more than 17,000 leones. The country’s currency depreciated significantly in 2023 due to high inflation, which jumped above 40%, as well as severe foreign debt and a recession. The economy of Sierra Leone was crippled by the Ebola epidemic in 2014 and has failed to fully recover since then.

Indonesian rupiah

Indonesia's national currency is 5th among the world's weakest currencies. Today, one needs to pay almost 15 thousand Indonesian rupiahs to buy $1. The current weakness of the currency is primarily due to high inflationary pressures and growing concerns about the economic slowdown in the country. Also one of the negative factors for IDR is the Indonesian economy's heavy reliance on imports. The country currently imports a large amount of goods and commodities, including oil. The huge import costs creates a trade imbalance, which has put significant pressure on the rupiah.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română