At present, the global resource economy is being replaced by the technological one. Previously, IT-giants rarely fell into the top five of the world leaders in terms of capitalization, but now they have occupied it completely. It is high-tech companies that top the ranking of the most expensive public corporations in the United States.

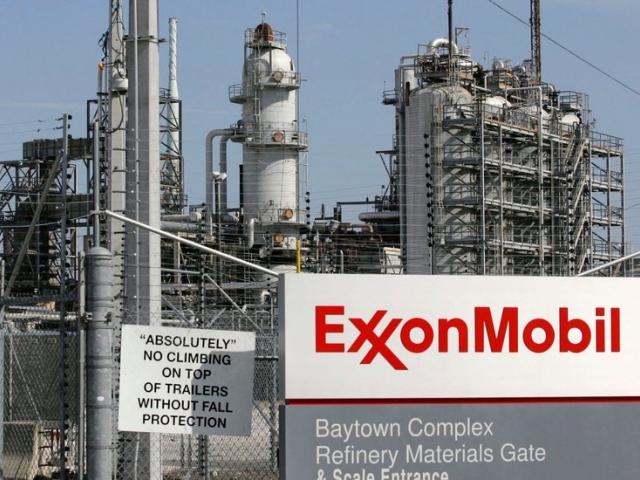

For the first time in 36 years, Exxon Mobil Corp. is not in the list of the most expensive American companies. This week the corporation was pushed aside by Amazon. Apple ($567.8 billion), Alphabet ($543.4 billion) and Microsoft ($440.9 billion) have long been the leaders in capitalization in the US market.

Bloomberg believes that the superiority of the five IT companies on capitalization is an unprecedented case. Five years ago the first two places belonged to Exxon and Shell, and Apple was considered the only high-tech company. About 10 years ago it was replaced by Microsoft, and for a long time, among the IT companies, there weren't any leaders on the market value, apart from it.

Investments in virtual technologies, according to experts, at the moment are most profitable, as they are in demand all over the world. The main resources of IT companies are the population and information, which, from the economic point of view, has infinite potential. Analysts are sure that the global demand is not affected even by the fact that information products can have marginal costs, tending to zero.

At the present time, global IT leaders have found a way to benefit from the ever-increasing Internet audience. For example, Facebook and Google are increasing their numbers through advertising. However, according to Shendorf, a Silicon Valley venture investor, you should not rest on your laurels and assume that you are fully insured against falling. He is convinced that in the next 20 years, Microsoft and Google will lose their positions.

In the late 1990s, high-tech companies came forward, overtaking the oil ones. At the moment, according to experts, the cost of a unit of raw materials produced by companies has greatly decreased. Because of this, the incomes of commodity producers fell. It was the IT companies that were the winners.

The oil and gas industry is close to the state of decline, it has no future, unlike high-tech companies, experts say.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română