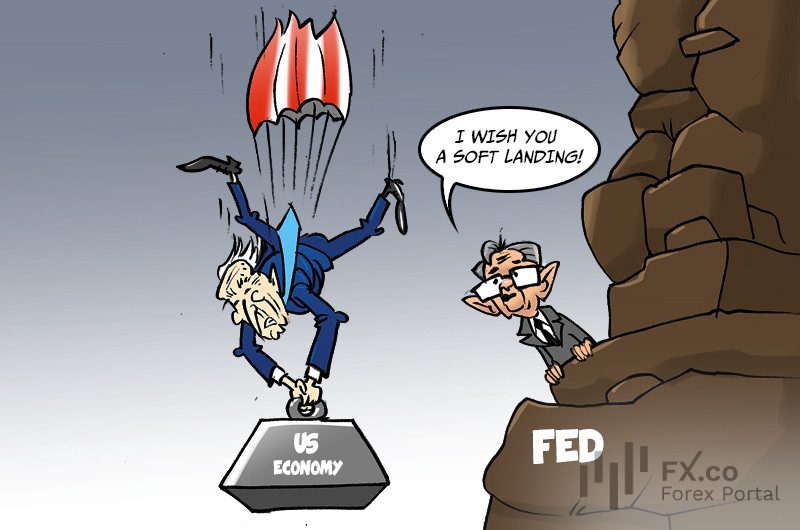

Goldman Sachs analysts project that the US Federal Reserve is unlikely to lower interest rates until the fourth quarter of 2024. Analysts believe that robust economic growth will help the United States avoid a recession. The US economy is known for its resilience as it has recovered from challenging situations so many times. Goldman Sachs analysts estimate that in 2023, the US economy will come close to achieving a “soft landing.” Contrary to the fears of experts and market participants, a recession seems to have been averted. The bank believes that the likelihood of a recession in the next 12 months remains moderate, within a 15% range. As for the US GDP, it is expected to grow by 2.1% in the coming year. Goldman Sachs' currency strategists are confident that the necessary conditions for bringing inflation back to the target of 2% have been met. "The substantial damage from tighter monetary and fiscal policies is behind us. The most challenging part of the fight against inflation has come to an end," the bank asserts. According to Goldman Sachs' forecasts, the Federal Reserve will initiate its first rate cut in the fourth quarter of 2024, when inflation falls below 2.5%. Subsequently, the central bank will reduce rates by 25 basis points every quarter until the second quarter of 2026. By then, the Fed funds rate is expected to settle within a range of 3.5% to 3.7%. Interestingly, this outlook slightly differs from the expectations of some market participants, who anticipate rate cuts to commence in mid-2024. Morgan Stanley analysts share a similar forecast. They expect the first rate cut of 25 basis points to occur in June 2024, followed by up to three additional reductions by the end of the next year. The Federal Reserve is then expected to persist with rate cuts at each subsequent meeting in 2025.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: