According to Mark Zandi, the chief economist at Moody’s, an increase in the debt ceiling, proposed by Republicans, could push the US into a recession.

Raising the debt limit would be the highway to a slowdown in the American economy and a recession. In this light, US GDP may drop to 1.61% by the end of 2024.

The US Congress must solve the issue as soon as possible. Otherwise, the country will slide into a recession and its financial conditions will get worse.

Earlier, Kevin McCarthy, the speaker of the House of Representatives, proposed raising the debt ceiling and cutting government spending by 8% in 2024. In addition, McCarthy’s proposal is aimed at limiting growth in spending to 1% per year.

Mark Zandi is rather skeptical about this strategy. In his view, employment will drop by 800,000 jobs if spending is decreased in 2024. The country will risk facing a surge in unemployment to an impressive 5% from the current rate of 3.5%. In addition, economic activity may shrink to 1.61%, down from 2.23%, previously projected by the GOP.

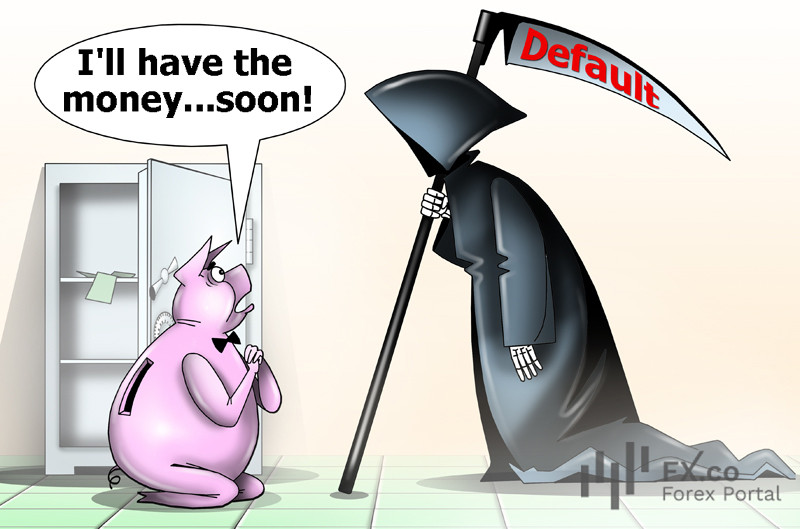

In such a case, the US Treasury will run out of cash to pay its bills by June 8, though anytime between June 1 and August 8 is also possible.

The House GOP bill will likely be blocked in the Senate, controlled by Democrats. There has not been any progress in negotiations on raising the debt ceiling so far. As of January 2023, the nation’s debt totaled $31.4 trillion.

Earlier, the White House slammed the bill that would slash federal spending while raising the debt limit. A meeting on debt ceiling negotiations between President Biden and congressional leaders is scheduled for May 12.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: