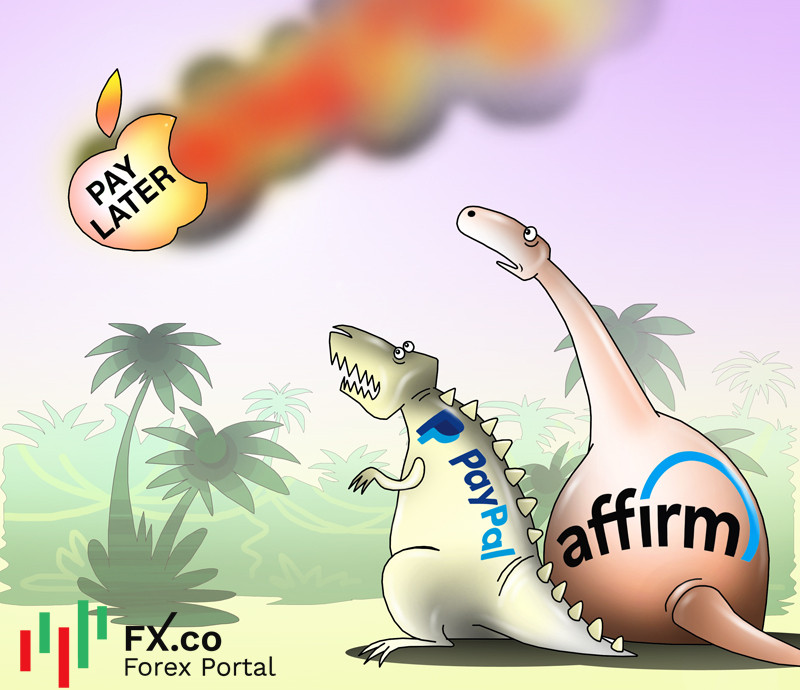

According to CNBC, Apple, the US largest smartphone manufacturer, made the life of “buy now, pay later” tech firms more complicated as they may not survive competition with this IT giant. Recently, Apple has announced its plans to launch the installment payment service that is already widely introduced in other fintech companies. Apple’s move may put the industry's future in doubt, CNBC notes. In early June, the iPhone maker presented its new service called Apple Pay Later, thus expanding the array of financial services and products which already include mobile payments and credit cards. The service will allow users to pay for products in four equal installments. In fact, this is a monthly paid loan without interest. Experts warn that Apple’s joining the Buy Now Pay Later (BNPL) market creates serious problems for such long-existing players as PayPal, Affirm, and Klarna. In the week of June 6-11, the shares of Affirm sank by 17% on the news. The BNPL market has already been showing signs of weakness amid geopolitical risks, the conflict in Ukraine, and a looming recession. The main challenges for the industry include higher interest rates, slowing economic growth, and rising inflation. Besides, many BNPL firms have faced difficulties due to rising borrowing costs. Today, many consumers worldwide cannot afford to pay for things immediately. The worsening economic situation will hit both users and providers of the BNPL services. The “buy now, pay later” business may come under pressure in developed countries in case of mass insolvency of the population. For instance, in May, Klarna had to lay off 10% of its workforce amid fears of a recession.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: