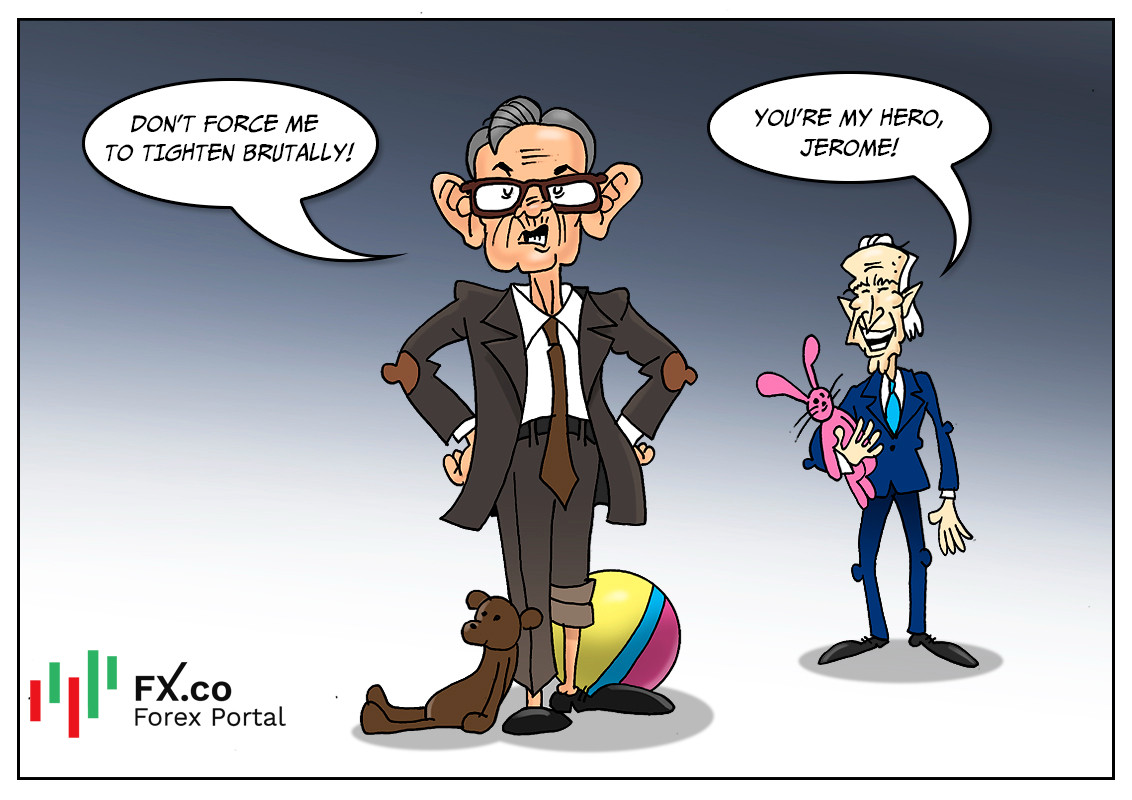

The US Fed decided to unveil its plans for the key interest rate hike. Fed Chair Jerome Powell informed the world community that the regulator would take more aggressive measures to combat surging inflation.

The aggressive stance presupposes a further rise in the benchmark rate as a part of monetary policy tightening. This news did not come as a surprise for markets. Undoubtedly, it was quite possible that the Fed might have slackened monetary policy tightening amid the Russia-Ukraine conflict. However, the US economic indicators are still favoring higher interest rates. The situation was mainly assessed through the prism of extremely high inflation. The local government is ready to take any measures to improve the situation. “What we need to see is inflation coming down in a clear and convincing way, and we're going to keep pushing until we see that," Powell said during a Wall Street Journal live event. Commenting on the matter, Jerome Powell added that if the regulator failed to reach the goal, it would take more aggressive measures, including the key interest rate hike. Notably, the US inflation has hit a 40-year high. Against the backdrop, the Fed raised the benchmark rate by 50 basis points to 0.75-1%. Curiously, President Joe Biden said that “he's not worried about recession.”

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: