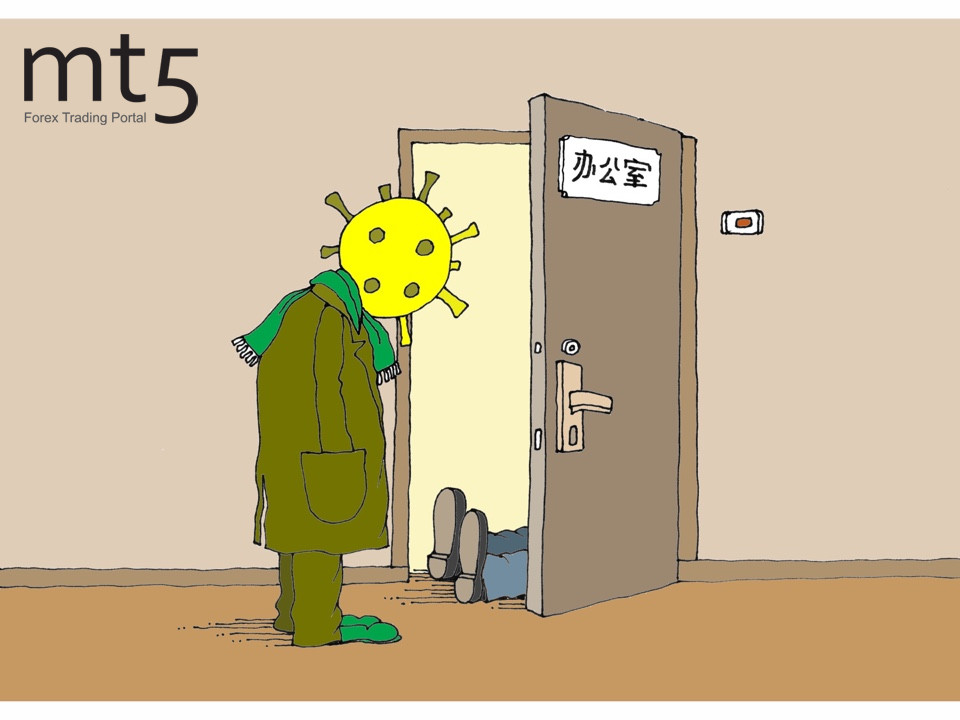

The COVID-19 outbreak had a severe impact on the Chinese economy. The country’s manufacturing and trade sectors were almost paralized. Currently, the majority of China’s industries is on an extended break while millions of firms are struggling to stay afloat.

Both small and big-sized companies were hit by the coronavirus outbreak. Thus, one of the biggest Chinese auto dealers had to close around 100 stores around the country for a month. The company is running out of money while banks are reluctant to provide loans for paying out debts.

The majority of firms across the country face serious challenges due to the virus epidemic. According to a survey conducted among representatives of small and medium-sized businesses in China, only the third part of all companies is likely to not slip into deficit in the coming month.

Experts believe that the stimulus measures introduced by the government are not going to help small and medium-sized businesses in China. Under the directive from the government, the central bank cut benchmark lending rates and encouraged commercial banks to scale up loans. At this point, the private sector, which accounts for 60% of the country’s GDP and 80% of jobs, lacks financing in order to repay loans and pay employees. According to analysts, if the government does not offer support to these companies, they are likely to be terminated in the first quarter of 2020.

However, receiving financial assistance is not so easy. Banks have a number of requirements firms should comply with in order to get a loan. Apart from that, the list of companies is limited. The restrictions are determined by local monetary authorities. In order to apply for a soft loan, a company must prove that at least 10% of its proceeds will be dedicated to combat the COVID-19.

Presently, banks grant loans only to fight the coronavirus. Industrial & Commercial Bank of China is ready to offer loans to 14 thousand companies allocating 5.4 billion yuan, or $770 million. In early February 2020, the group of Chinese banks lent 254 billion yuan to stop the spread of the coronavirus.

However, many small and medium-sized businesses were doomed even without the coronavirus outbreak. These firms were deeply affected by the trade conflict with the US as well as massive loans. As a result, China's economic growth slowed to its lowest levels in three decades in 2019.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: