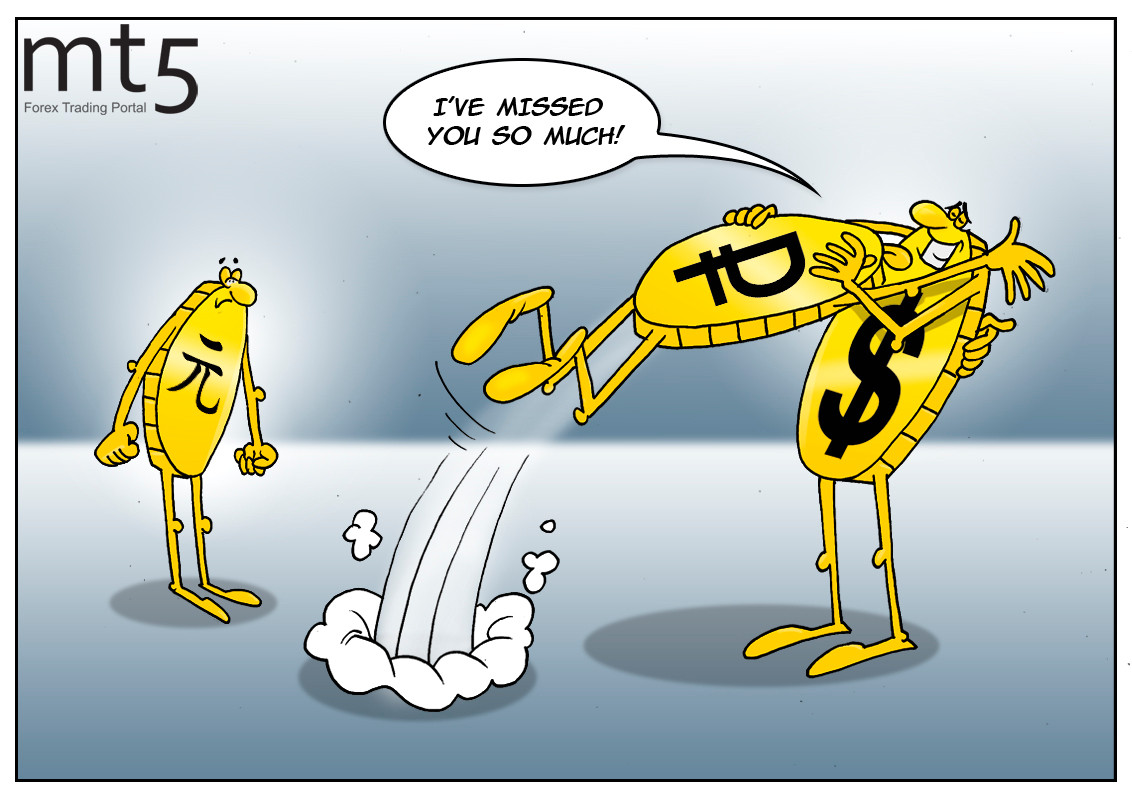

The Kremlin has been always eager to pose a challenge to the US dollar’s reign. However, these brave efforts have been in vain. In response to the imposition of economic sanctions by the US, Russia’s government unveiled the plans to abandon the US currency in international settlements. Actually, the Kremlin managed to team up with some of its allies like China, Turkey, and Iran which are also in the standoff with Washington. Besides, the Bank of Russia revised its portfolio in favor of the euro and the yuan. Dealing with China, Russia pushed ahead with the idea to give up the US dollar in invoices for consumer goods. Nevertheless, these ambitious plans did not bear fruit. According to the central bank’s estimates, Russian and Chinese companies increased the share of mutual settlements in the US dollar after a short pause. The US currency accounts for 63% in revenues of Russian exporters in Q3, 2019, up from 62.5% in Q2. Thus, the greenback was scaled up in the Russia – Sino trade relations for two quarters straight. The thing is that the full de-dollarization is out of the question. Chinese suppliers which had initially agreed to support Moscow’s proposal did not stick to the agreement for long. Nowadays, they are shifting focus back towards the US dollar. Its share in China’s exports grew 0.6% to 39.5%. As for the rest of China’s exports, Beijing prefers to issue invoices to its buyers in euros which represents 45% in China’s international trade.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: