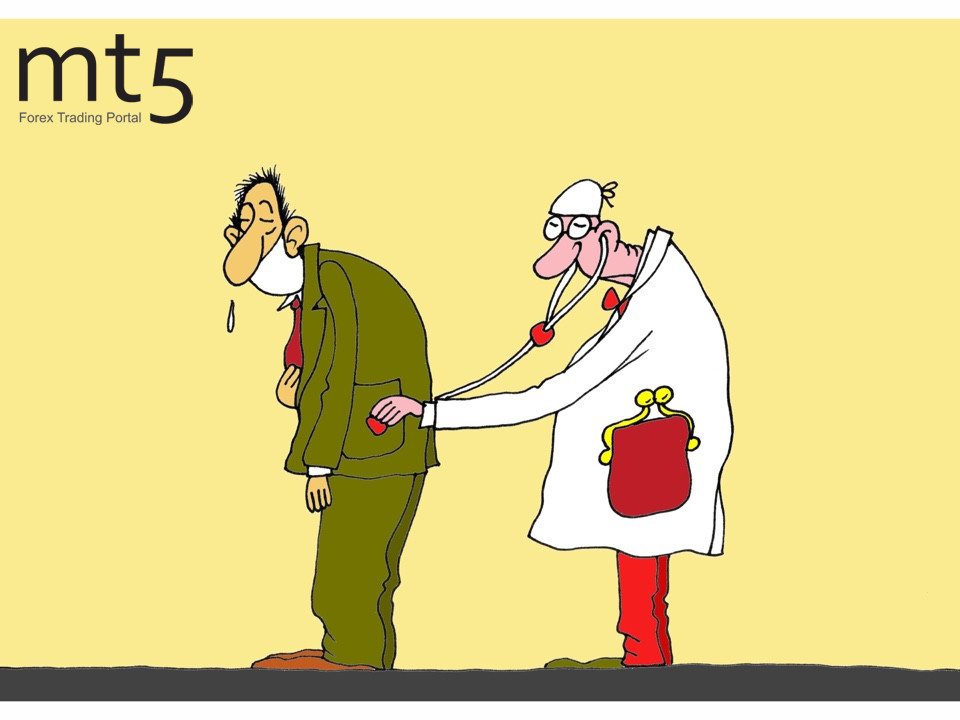

The outbreak of the coronavirus in China and its spread remain the headline news across the world. The epidemic will have a heavy impact on the Chinese economy, experts say. They expect a slowdown in China's economic growth, as well as a reduction in consumer spending.

Earlier, Chinese authorities paid particular attention to the development of the country's consumer sector. They believed that consumers were a primary engine of economic growth, but the outbreak of a new virus changed the situation. Now the authorities strongly recommend citizens refrain from visiting malls and other public places in order to avoid infection at a time when the epidemic is spreading.

In some Chinese regions, theaters, museums, and other important segments of the service sector have been shut down. Wuhan, the epicenter of the outbreak, has halted its public transport. As a result, a dozen other Chinese cities have followed suit.

According to preliminary data, the number of patients with pneumonia caused by the coronavirus exceeded 2,700 people. China's authorities are making every effort to prevent the spread of the infection.

Experts believe that the outbreak of the new virus poses a threat to the continued growth of the Chinese economy. However, China was decelerating even before the epidemic hit. The new challenge only exacerbates the situation. The country is expected to face a large-scale crisis, especially in the health sector. Preliminary estimates indicate that the current epidemic could cost China 40 billion yuan ($ 5.77 billion), shaving 1 percentage point off the country's GDP growth rate.

Analysts at Societe Generale SA estimate that if the epidemiological situation continues to deteriorate, China's first quarter GDP growth could fall below the psychologically important level of 6%.

Previously, the Chinese consumer sector took a hit when the SARS epidemic swept across the country in late 2002 and early 2003. When SARS peaked, China's growth slowed to 9.1%.

At the moment, the consumer sector is crucial for the Chinese economy and its recovery from the epidemic is likely to be challenging. Notably, in 2002-2003, the country's economy and its large-scale industrial projects were supported by public investment, but the current situation is different. The consumer sector is a driving force for China's growth, as consumption accounts for more than 50% of GDP.

The economy of Wuhan, the country's main quarantine zone, will bear the brunt of the spreading coronavirus. Experts consider Wuhan to be an economic driver in central China, so their fears seem to be well-founded.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: