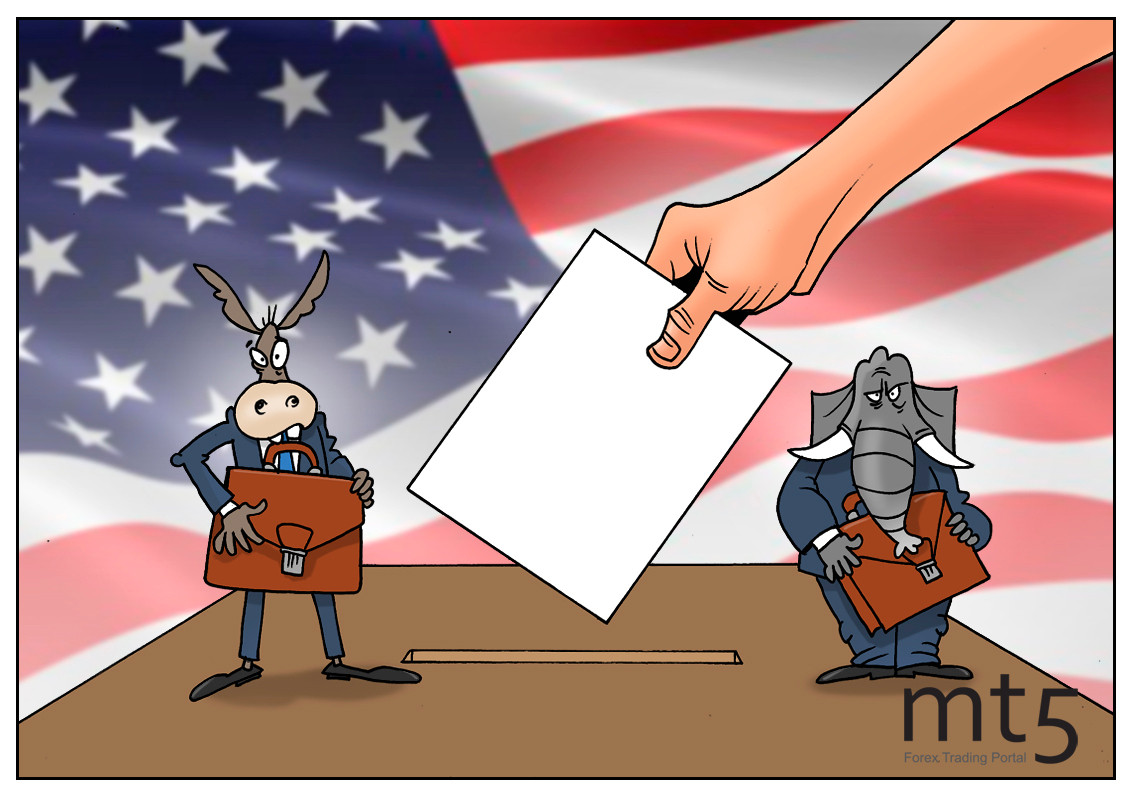

A private Swiss bank invented a smart financial tool. Julius Baer is selling structured notes with one year maturity whose yields depend on the outcome of the US presidential election in 2020. The exotic financial instrument is sure to arouse interest among investors. Logically, prospects of large US companies will hinge on that political party which will win the forthcoming election. These structured notes are pegged to two baskets of US stocks. So, yields of such structured notes are linked directly to the performance of US stocks. In other words, investors may choose the Republican-friendly portfolio if they are betting on the victory of Donald Trump or someone else from his party. Alternatively, investors are free to bet on the Democrats. Julius Baer’s Democrat basket includes companies from the energy and healthcare sectors like Ford, Walmart, McDonald's, Coca-Cola, SunPower, and Exelon. The Republican portfolio is tied mainly to hi-tech and financial stocks such as Alphabet (Google’s parent company), Amazon, Citigroup, Visa, American Express, Chevron, and ConocoPhilips. If the prediction is made right, an investor will profit from rising stocks in the appropriate portfolio.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: