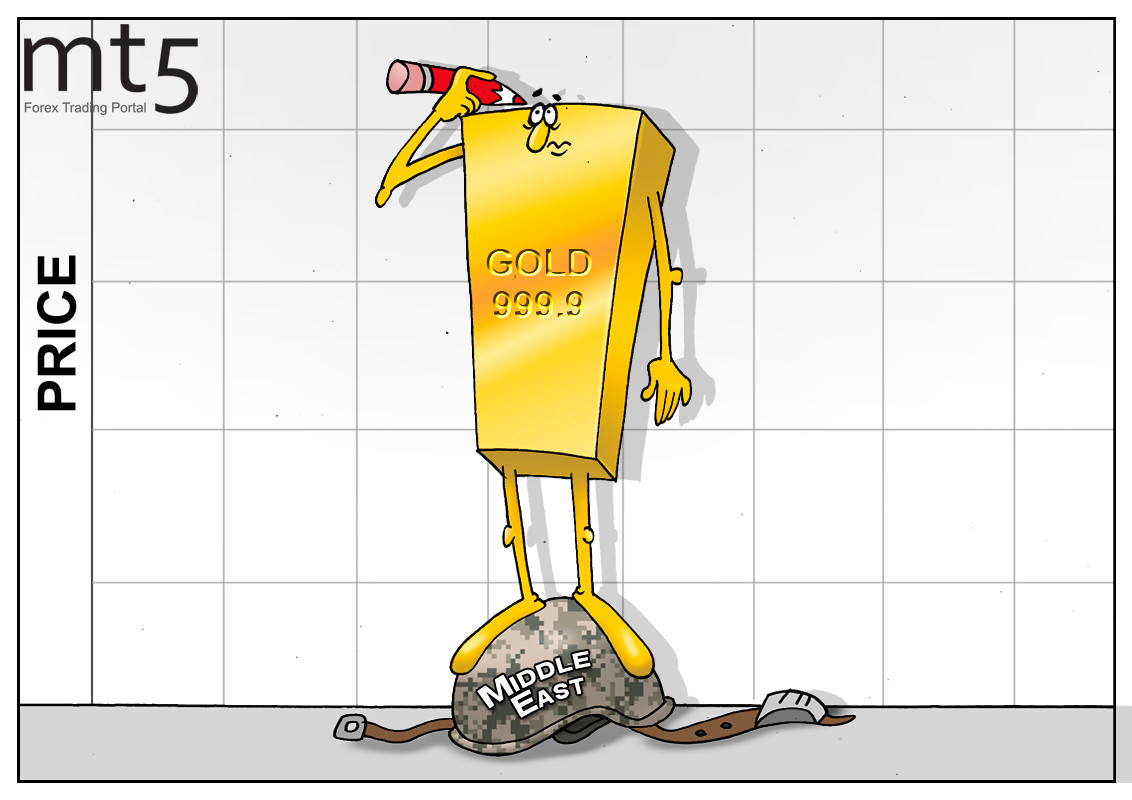

Geopolitical tensions in the Middle East boost demand for safe haven assets, gold in particular. The assassination of Iran’s top commander Qassem Suleimani, the leader of the elite Quds Force, by a US airstrike sparked off a conflict between the US and Iran. Stoking fears about an all-out war, investors revised portfolios in favor of precious metals. Gold hit a seven-year high immediately to trade at near $1,590 per troy ounce. Moreover, silver and palladium are also picking up steam. Amid risk aversion sentiment, palladium reached a record $2,030 per ounce while silver spiked to $18.5081 per ounce. The external environment indicates a further rally of safe haven assets. Indeed, jitters between the US and Iran could turn out into a full-blown military conflict beyond the region. According to Goldman Sachs, the odds are that gold is set to soar much higher than the current levels. Analysts at UBS Group AG and ABN Amro Bank NV expect the price of gold to reach as high as $1,600 in the medium term in case of escalating tensions in the region.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: