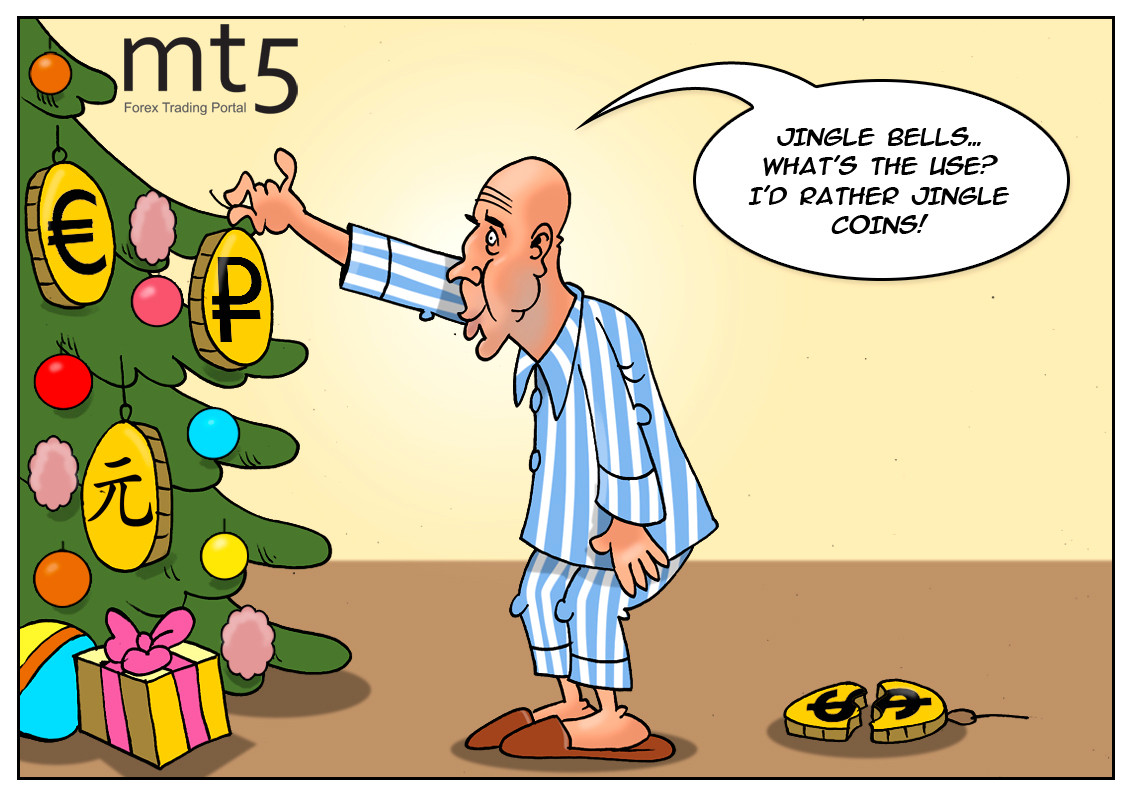

The US and the EU are not willing to lift their sanctions from Russia. Apart from the defense industry and a blacklist of companies, entrepreneurs and officials, Western sanctions also target Russia’s debt market. So, the country has been barred from international bond markets for a few years. Interestingly, Russia’s authorities say pompous words that the national economy supposedly benefits from the sanctions. Besides, domestic pundits reckon that those countries which advocate for the sanctions have already suffered heavy losses. At the same time, Russia’s finance ministry has been seeking advice from Euroclear, a Belgium-based financial company that assists in safekeeping and servicing securities. The Kremlin has not solved yet the thorny issue of borrowing. Russia is making determined efforts to re-enter the global market of debt securities, searching for a loophole to evade the sanctions. One of the options is to buy bonds denominated not in US dollars, but in other currency. If this scheme proves its efficiency, Russia will be able to resume its operation in the international credit market next year. “Russia has conducted consultations with Euroclear. The US Treasury Department confirmed its directive that Russia is prohibited from borrowing in the US currency. However, there are no restrictions on buying bonds denominated in other currencies. So, the odds are that in 2020 Russia will enter foreign markets which sell debt in other currencies,” Finance Minister Anton Siluanov unveiled the prospects of Russia’s participation in the global debt market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: