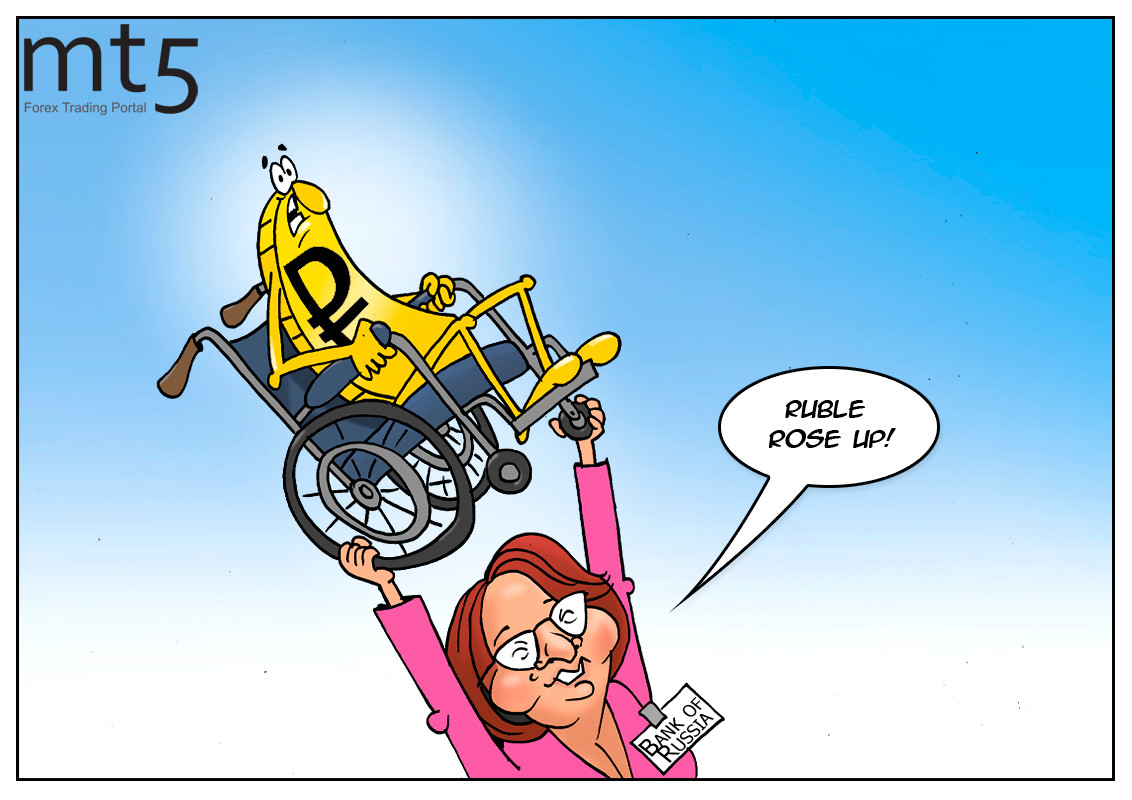

It is common knowledge that a tax filing period creates favorable conditions for reinforcement of any national currency. The Russian ruble is no exception. Traditionally, in late December the Russian currency asserts its strength provided that it is not hurt by external headwinds. The ruble is propped up by buoyant demand among domestic exporters, including energy companies. They rush to buy up the ruble to pay taxes. December is the deadline for paying a VAT, a tax on natural resources, an excise tax, and above all an income tax. Tax revenues collected during a tax filing period total almost 1.5 trillion rubles. Besides, the ruble takes advantage of the thin market as trading activity is always low on international trading floors around Christmas and New Year’s Eve. “The ruble is perking up amid the market buzz in Russia before the holiday season. Exporters are converting foreign currencies into rubles to pay taxes. Nevertheless, we do not expect an advance of the Russian ruble in the medium term,” experts at Sberbank Investment Research comment on the ruble’s strength in late 2019. Meanwhile, investors can trade the Russian currency at a profit bearing in mind that it usually develops the bullish trend at the turn of the year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: